Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Witold Bahrke

Senior Macro and Allocation Strategist

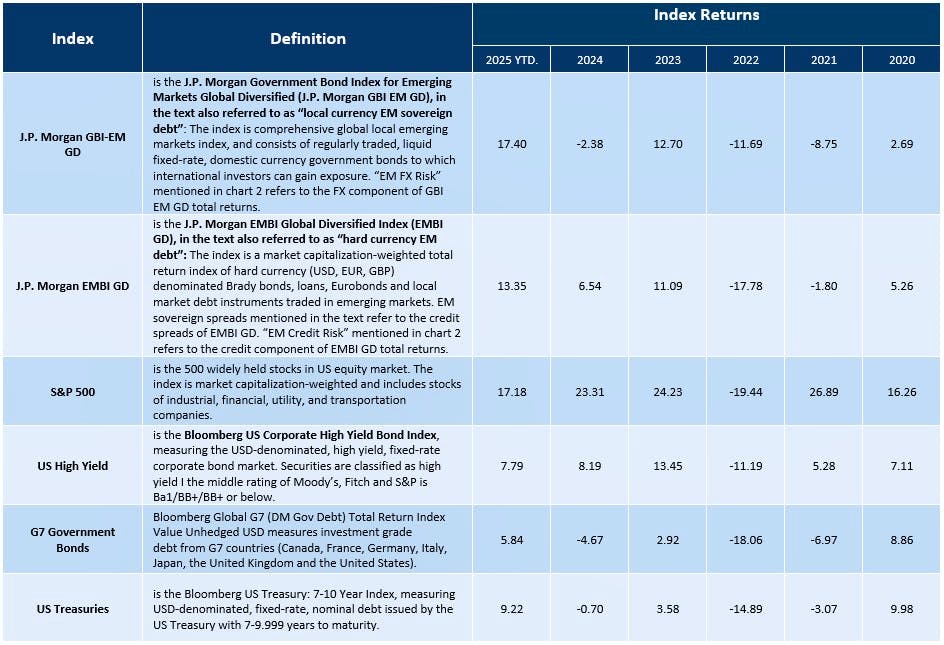

EM debt (EMD) has been among the best-performing asset classes year-to-date, beating developed market (DM) peers such as US high yield. A powerful mix of declining trade policy uncertainty, fiscal expansion, monetary policy, as well the AI investment boom creates a fertile ground for EMD returns as we head into 2026. Notwithstanding lingering growth concerns, the global business cycle is in a better place than meets the eye. Rather than extrapolating recent US labour market weakness into a recessionary spiral, job growth might be as weak as it gets as the economy exits a mid-cycle soft patch (check out our latest outlook here). At the same time, China is expected to revamp its fiscal stimulus efforts in 2026. Over in the Euro Area, the fiscal expansion in Germany is beginning to fuel growth positively next year.

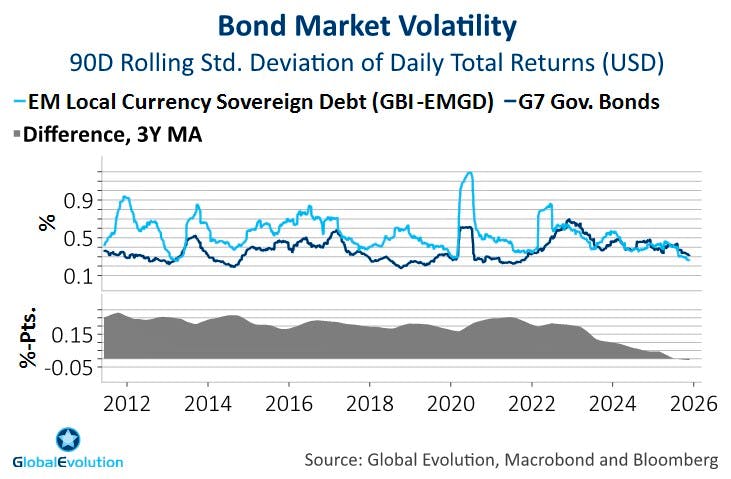

To be sure, uncertainty remains elevated as the world is undergoing several structural shifts: Inflation, geopolitical risks and fiscal leverage have experienced level shifts higher in the developed market sphere and are set to change the global macro landscape profoundly. However, as these regime shifts are driven out of DM, the EM universe does not stand first in line when it comes to the negative ramifications (for details, see here). Somewhat counterintuitive to many, the upshot is that the risk-reward in EM debt relative to DM debt has improved as, because of higher uncertainty – not despite of it. Currencies should be among the main beneficiaries of EM’s outperformance within fields of inflation, geopolitics and fiscal policy. From a medium-to long-term asset allocation perspective, local currency EM sovereign debt therefore is our favourite way to express such improving risk-reward in EMD relative to DM bonds, as bond market volatility has increased in DM, not so much in EM (chart 1).

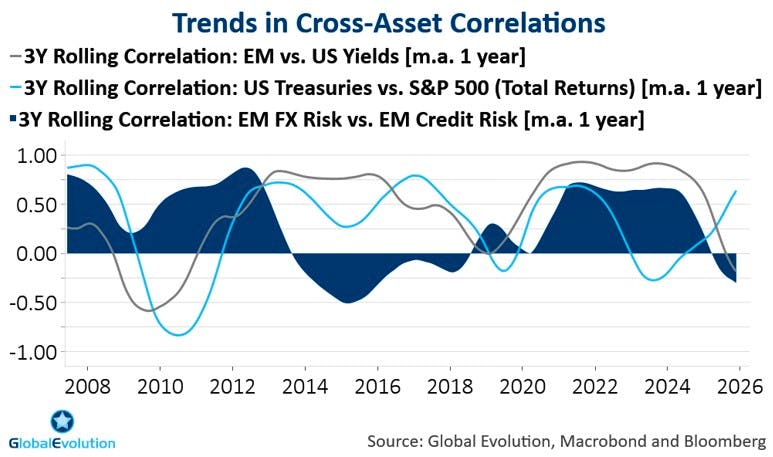

An important aspect of these regime shifts is that market cycles are becoming shorter[1]. Firstly, the flip side of frequent spikes in geopolitical risks is an increase in market drawdown risks. Secondly, higher trend inflation in DM has removed central bank’s structural easing biases, constraining their ability to smooth macro and market fluctuations. Shorter market cycles and bouts of volatility highlight the importance of an active asset allocation approach within EMD. In blended EMD strategies, such an approach enables investors to harness the return potential resulting from declining correlations between the main EM risk premiums. At the same time, it creates new diversification opportunities (chart 2) as the classic DM bond-equity portfolio split fails to deliver on that front.

The flip-side of a strong year-to-date run in EMD that took most investors by surprise is that valuations look less attractive than 12 months ago. EM sovereign spreads are tight and market sentiment is vulnerable, spurring volatility in the short-term. Within hard currency EM debt, carry should therefore be in the driver's seat when it comes to overall returns. On the other hand, we expect relatively little return contribution from spread compression. Optimizing the trade-off between carry and credit risk implies a preference for issuers that are candidates to become ‘rising stars’ i.e. higher-rated countries within the high yield segment en route for an upgrade to investment grade, such as Paraguay, Serbia and Morocco. Also, quasi-sovereign bonds can offer attractive carry, while limiting credit risk in the portfolio.

[1] We define a market cycle as the time span between 10% drawdowns following new all-time highs in global equities.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“Global Evolution DK”) is incorporated in Denmark and authorized and regulated by the Danish FSA (Finanstilsynet). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

Global Evolution DK has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under the Firm Reference Number 954331.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), an SEC registered investment advisor. Registration with the SEC does not infer any specific qualifications Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is an wholly-owned subsidiary of Global Evolution Asset Management A/S (“Global Evolution DK”). Global Evolution DK is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Global Evolution is affiliated with Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker dealer, Conning Asset Management Limited, Conning Asia Pacific Limited and Octagon Credit Investors, LLC are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has offices in Boston, Cologne, Hartford, Hong Kong, London, New York, and Tokyo.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. Conning, Inc. is also registered with the National Futures Association and Korea’s Financial Services Commission. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316), Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this website constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2025, J.P. Morgan Chase & Co. All rights reserved.

This communication may contain aggregate peer analysis data has been obtained from eVestment Alliance LLC and its affiliated entities (collectively, "eVestment"). eVestment reserves all rights, including to ownership and distribution. eVestment collects information directly from investment management firms and other sources believed to be reliable; however, eVestment does not guarantee or warrant the accuracy, timeliness, or completeness of the information provided and is not responsible for any errors or omissions. Performance results may be provided with additional disclosures available on eVestment’s systems and other important considerations such as fees that may be applicable. Not for general distribution. * All categories not necessarily included; Totals may not equal 100%. Copyright 2013‐2025 eVestment Alliance, LLC. Returns less than a year are not annualized.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

Legal Disclaimer ©2025 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved