Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Yulia Kosiw

Client Portfolio Manager

Alia Yousuf

Head of EM Corporate Debt Strategy

Edward Soekamto

Senior Portfolio Manager

In this episode of our podcast ‘Emerging Insights’, Alia Yousuf, our Head of EM Corporate Debt, and Edward Soekamto, our Senior Portfolio Manager, talks about the challenges and opportunities in investing in EM Corporate debt.

Below you can download the transcript

INVESTING IN EM CORPORATE DEBT: CHALLENGES AND OPPORTUNITIES

YK: Hello and welcome back to Emerging Insights, a podcast by Global Evolution. My guests today are Alia Yousuf, our Head of EM Corporate Debt and Ed Soekamto, Senior Portfolio Manager, responsible for our Emerging Markets Corporate and Short Duration Strategies. Welcome.

AY: Hi.

ES: Hi Yulia.

YK: First, let me congratulate you on reaching a three-year milestone for the corporate EMD hard currency strategy and masterfully navigating a market that's been quite challenging to say the least. Alia, maybe we can start with you on the overall corporate market. Can you share some of the attributes of the asset class that are often overlooked and talk about how emerging market corporate bonds can enhance a fixed income portfolio?

AY: Thanks, Yulia. Yes, global fixed income market has been rather unpredictable over the past few years and that is even more so why I'm so proud of the team for the performance that they have delivered since inception.

So now moving on to the asset class, EM corporate debt sometimes can be a little bit of a misunderstood asset class. It's a hugely diversified subgroup of the EM debt and provides quite a distinct investment opportunity that can be sometimes overshadowed by its more, popular older sibling, the EM sovereign debt.

What we've seen is that after a series of downgrades in the sovereign space in the recent years, we see that EM Corporate has actually started to decouple from the sovereign credit space and one of the main reasons for that is that historically EM Corporate had offered some quite defensive characteristics.

For example, like drawdown in the corporate debt space were relatively moderate than the other EM debt segments during major risk off episodes, like a taper tantrum or the pandemic or, the Russian invasion of Ukraine. So, it's a much newer asset class, but it continues to evolve with very strong fundamentals and technicals also play quite a good role and a positive for its performance.

It's an asset class that has a much lower volatility with the spread pickup from their sovereign counterparts, offering a much better risk adjusted return as a whole for a global fixed income investor.

YK: And how about the risks? What should investors keep an eye out for when investing in EM corporate debt?

AY: I think investors should be conscious of credit risk.

The massive class has had a pretty challenging last few years with Fed hikes, China slowdown, volatile geopolitical backgrounds. So all of these have led to, spike in corporate default rate, as you would imagine. Although most of it was concentrated in the Chinese and the Russian high yield space, it still led to a much higher default rate than you would see on, the last 10 year average.

During this period, however, what was really interesting about this asset class is that when you had, something going on in China high yield, for example, contagion in other regions, example, Eastern Europe or LATAM were actually minimal. And in fact, the couple of years where we had a lot of volatility in the Chinese EM corporate space, the LATAM high yields were one of the, the best performers.

So despite such a weak backdrop of, Obviously, global macro backdrop, also EM sovereign macro backdrop, corporate has really maintained a very strong fundamentals, which has been reflected in the performance in the bond market. And that's why at Global Evolution we believe that it's a perfect asset class for active bottom up investors like ourselves.

ES: And if I could add one point, I think one unappreciated reason why EM Corporates did so well over the last two, three years, which obviously is very challenging, is that EM Corporates were able to fund themselves locally now. So, if you look at the more established EM countries like Brazil or Mexico a lot of these corporates that were able to get funding through the local banking system for their CapEx or working capital needs.

So unlike in previous years 10, 15 years ago, where banking sector wasn't as developed and the EM corporates were forced basically to, to borrow offshore through dollar, that's not the case anymore. So that gives us another extra, or that gives the corporates an extra funding source and minimized default or refinancing risk.

AY: That's absolutely correct. And that's also something that is quite interesting in the sense that we are now seeing a lot of EM corporates issuing a local currency as well. So, it's not just a hard currency asset class. So yes, that's right. I guess in terms of risk, another thing that you know, investors should or usually care about when you invest in EM is a liquidity risk.

But I think a lot of people don't really realize that EM hard currency corporate asset class is now sizable enough at two and a half trillion U. S. Dollar. And as the market and the investor base has matured, so has trading volumes and liquidity in the bonds. For example, according to EMTA, which is Emerging Market Trader Trading Association hard currency corporate daily turnover is currently around 250 billion per day in dollars.

So, which is relatively sizable. And then on top of that, you have trading platforms like Market Access and TradeWeb, which provides a, quite a nicely diversified pool of liquidity as well, which, which helps trading volumes and liquidity in the EM Corporate asset class.

YK: It's great to hear that while challenges still exist, the asset class is showing some promising developments in terms of market maturity and trading infrastructure.

How do emerging market corporates stack up against more familiar fixed income options like U. S. high yield and the global aggregate? And what are investors potentially missing out on by not allocating to EM corporate debt?

AY: Yes, I think investors are definitely missing out by not allocating to EM corporate debt, and there are many reasons for it. The obvious one is the immense diversification, and the risk adjusted return benefit. But, maybe the less obvious one is that EM corporate asset class is actually larger than the U. S. high yield asset class or the EM sovereign hard currency asset class. And given that the index's average rating is investment grade and has very strong healthy fundamentals, the asset class still managed to generate much higher 10 year rolling annualized return than most of the other major fixed income asset classes.

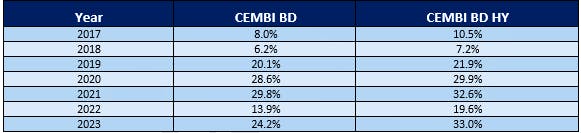

For example, the CEMBI index, which is the hard currency corporate index has returned over the last 10 years in a rolling annualized basis of 5. 6%, with a very low annualized volatility of about 3.16% Which, if you look at against the USIG, which has returned about 4.5%, but with a much higher volatility of 5.4%. During the same period CEMBI high yield, which is just the high yield portion of the corporate index, has returned about 7.2% with a very low vol of 4.4%.

While if you compare it with the US high yield, the return has been smaller than CEMBI high yield at 6. 9, but with a much higher volatility of 5. 4%. There are many reasons why we think EM Corporate is not just a stuff substitute for U. S. high yield, but actually it's a complementary asset class to both US IG and U. S. high yield.

YK: As we consider the performance and characteristics of this asset class as a whole, it's important to remember that emerging markets are far from homogenous. The fortunes of EM corporates can be influenced by economic trends in key countries within the emerging market sphere.

And this brings us to my next question, which focuses on one of the most influential players in the EM space. China is a major EM player and trading partner for other emerging market countries. And what we're seeing now is a slowdown in Chinese growth. Has this slump affected EM corporates?

AY: Yeah, look, China is a, 18 trillion dollar economy. It's about 17 percent of global economy. So any growth slowdown or any kind of domestic or international issues that, that has China in it will not only be felt with EM, but it's also being globally felt in DM too. In fact only last week the EU was actually deciding to put EV tariff, which they eventually did go ahead and do, but they decided to put EV tariff against China and it was actually the EU car manufacturing lobby that was pleading with the government not to do so because the tariff would ultimately result in their input from China being a lot more expensive. To think that China is just a, the EM issue I think is misguided. I think China is a global issue and it impacts EM and DM. And what we've seen is that, as the country has grown in dominance and obviously it's, trying to push it's you know, it's geopolitical pressure on rest of the world what we've seen and also combined with the pandemic that countries around the world have been trying to diversify their supply chain and their manufacturing capabilities away from China.

So, to be honest, there's a couple of ways you can look at it. One, it's actually quite difficult to do economics of scale outside of China. And two, in this whole diversifying process, a lot of Asian EM countries have actually quite substantially benefited, for example, India, Vietnam, Malaysia, and Thailand.

In India and Malaysia, most of the supply chain shift has been concentrated in electronics and semiconductors. In Vietnam, it's a mix of electronics and automobiles. While in Thailand, it's mostly the automobile sector that has benefited. So, what is quite interesting, actually, what we see is that essentially the Chinese companies themselves are the biggest source of investment in these supply chain reconfigurations.

So, it's actually, So I don't think it's that straightforward to assume that market moving away from China will necessarily be negative for EM. As we've seen in quite a lot of these Asian countries is actually been quite beneficial.

YK: Thanks, Alia. That was very informative.

Ed, maybe we can turn to Global Evolution and how your team identifies and captures market opportunities. Can you tell us how EM Corporate Strategy is designed and what market inefficiencies you are looking to exploit?

ES: Of course, Yulia. So, our EM Corporate Debt Strategy offers an interesting diversified income stream across the entire rating spectrum from investment grade and high yields.

So, by combining price appreciation and high carry returns while also maintaining low volatility profile and minimizing downside risk during volatile times as well. At the same time we also try to see beyond market beta and adopt an approach where we look to exploit valuation and price dislocation across the market site, which always occurs in our asset class.

That is due to the inefficient and headlight driven asset class. So what do we mean with inefficient asset class? So, despite the growing asset Class which improved over the last 10, 15 years, it improved and diversification improved as well. It still remains a significantly under invested under researched and also under appreciated asset class with only a few dedicated investors and also mainly driven by, by local investors.

So, to us, this makes the class an inefficient market and on the flip side, it offers an abundant opportunities for active managers like us at Global Evolution. In fact, here at Global Evolution our team we like to describe the asset class as the bottom up paradise for active managers.

So, what does active investing mean in corporates? So, at Global Evolution, our general approach is to invest in corporates by a thorough bottom-up credit analysis. But at the same time, it's also important to consider bigger macro-economic trends country specific issues and trends, which we believe is critical to identify interesting investment opportunities across the cycle.

YK: And when you're analyzing the credit worthiness of emerging market corporate bond issuers, what critical factors do you consider?

ES: Strong fundamentals are key in our approach. So, when we analyze the credit worthiness of an issuer, we like to take a holistic approach.

So, we combine the financial analysis with country risk assessment. So, we have a strong team which help us with the country assessment. And then we have a sector expert as well. So, we look at the industry outlook, the sector outlook, and we also scrutinize governance related issues as well. And the second point is the interplay between local economic conditions.

The issue is financial health and the ability external macro shocks while incorporating broader ESG factors as well. And this of all provides a comprehensive picture of the risk and opportunities in EM corporate debt. But investing in EM corporate goes beyond just looking at the financial indicators, looking at the balance sheet or financial statements, the ability to build trust and have a long-standing relationship with issuers and management is a key factor in our assessment as well. And if you look at our team, we've been around for a very long time. We have an average experience of like 10 to 15 years. We know the asset class very well.

YK: Ed, so you mentioned ESG. We know that ESG factors are quite important when it comes to sovereign EM debt, especially factors related to governance and human capital formation. How do you think about ESG in the context of EM corporates?

ES: So, when we look at ESG, we take a more holistic approach. So our ESG framework promotes a broad set of social and environmental characteristics. It's not It's not focused just on few indicators since sustainability is a broader issue, especially in our space where we have different companies in different countries operating in different sectors as well.

So, you need to take a more holistic approach in practical terms, it means E, S and G integrated in various ways. So, we monitor different factors and discuss them within the team. So, we have different industry experts, which also helps to assess ESG factors more appropriately. And we also have the help of our research Quant Team to monitor the progress and to risk factors over time.

YK: And as my last question, I'd like to talk about the current environment. Where do you see opportunities going forward? Are there specific regions or sectors that look particularly promising?

ES: As always, there are plenty of opportunities in the EM corporate. So, if you look at some of the established EM countries with proven regulatory frameworks, such as Brazil or Mexico.

Yeah, for compelling investment opportunities in regards to Brazil, for example. Yes, there are a lot of political uncertainties, but Brazil offers a promising range of investments. So, Brazil is very diverse economy also from a Investment point of view, you have a lot of different issues in different sectors.

We have a good diversification in that sub sector. And we think in particular, the energy and commodity space can benefit short to medium term. Especially corporate issues in the agriculture and infrastructure space are well positioned to benefit from the government's pursuits to of personal and economic reforms.

And if you look at Mexico as Mexico is a key player in the North American supply chain. So, we think that Mexico should continue to benefit from a near shoring and from the proximity to, to the US. So, there are a lot of opportunities, especially in the manufacturing, automotive and telecommunication sectors.

And if you look more from a sector point of view our asset class has a very diverse range of sectors. And at the moment we prefer, or we really like the commodity sector, which is at the moment very interesting. As global demand for key resources such as copper, iron, or lithium, sort of green commodities increases because of the energy transition, we think that even corporates, especially in the mining industry can benefit a lot.

So, countries like Chile, Peru, and LATAM. Also, of the African countries in South Africa or Zambia should benefit medium to long term. And also, in regard to the energy transition, there's a big shift towards renewable energy and the EM space is well positioned for that. So, if you look at Latin America, Asia, there are a lot of renewable projects going on at the moment and also gaining momentum.

There's a lot of capital going into that sector. And so corporate issuers in solar wind or hydro energy offer a great growth prospects with interesting yields at the moment as well.

AY: I think that's, I think something that is quite interesting. And I don't think a lot of people do realize that, that, it's going to be very difficult to do energy transition in a sustainable and meaningful way without investing in EM corporates because a lot of these companies, some of them are, the best in class companies in some of the larger EM countries.

They are the innovators. They are the ones. who are actually, doing quite a lot of investments in this renewable energy. And so, it will be quite difficult to not have your corporate as one of the, the main asset class that that it doesn't take part in the, this whole energy transition.

YK: Fascinating. Thank you both so much. I look forward to seeing how these trends play out. It's been so great chatting with you.

We hope you found this discussion informative and welcome your feedback and questions. You can reach us via our website at www.globalevolution.com or by emailing marketing@globalevolution.com. We hope you join us next time.

Disclaimer:

This podcast is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Global Evolution for investment advisory services. This discussion may include predictions, estimates, or other information that might be considered forward-looking. While this content represents our current judgment on what the future may hold, it is not a guarantee and the investment market is subject to risks and uncertainties that could cause actual results to differ materially. You are cautioned not to place undue reliance on the content of this podcast, which reflects our opinions only as of the date of this presentation. Nothing contained herein is meant to be investment advice.

NOTE: There will be significant differences between a client portfolio’s investments and the index Indices may or may not reflect the reinvestment of dividends interest or capital gains and the indices are not subject to any of the incentive allocation, management fees or expenses to which a client portfolio may be subject It should not be assumed that the client portfolio will invest in any specific securities that comprise the index, nor should it be understood to mean that there is a correlation between a client portfolio’s returns and the indices Nor can one assume that correlations to the indices based on historical returns will persist in the future The Index is included for informational purposes only.

©2024 Global Evolution. This podcast and the software described within are copyrighted with all rights reserved. No part of this podcast may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution. Global Evolution does not make any warranties, express or implied, in this podcast. In no event shall Global Evolution be liable for damages of any kind arising out of the use of this podcast or the information contained within it. This podcast is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this podcast is subject to change at any time without notice.

Copyright © 2026 Global Evolution - All rights reserved