Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Peter Marber

Managing Director

For many of Wall Street, the first six months of 2025 has felt like a lifetime.

Many investors planning for a simple pro-business orientation for Donald Trump’s second administration have been forced to digest dozens of surprises - both economic and geopolitical - including higher-than-expected tariffs, the U.S. bombing of Iran, attempts to oust the independent Fed president, changing stances on the Russian/Ukraine invasion, among several others.

With that said, the markets have tried to shake off the headlines with a wait-and-see attitude rooted in “TACO” – a belief that Trump Always Chickens Out when coming to final actions.

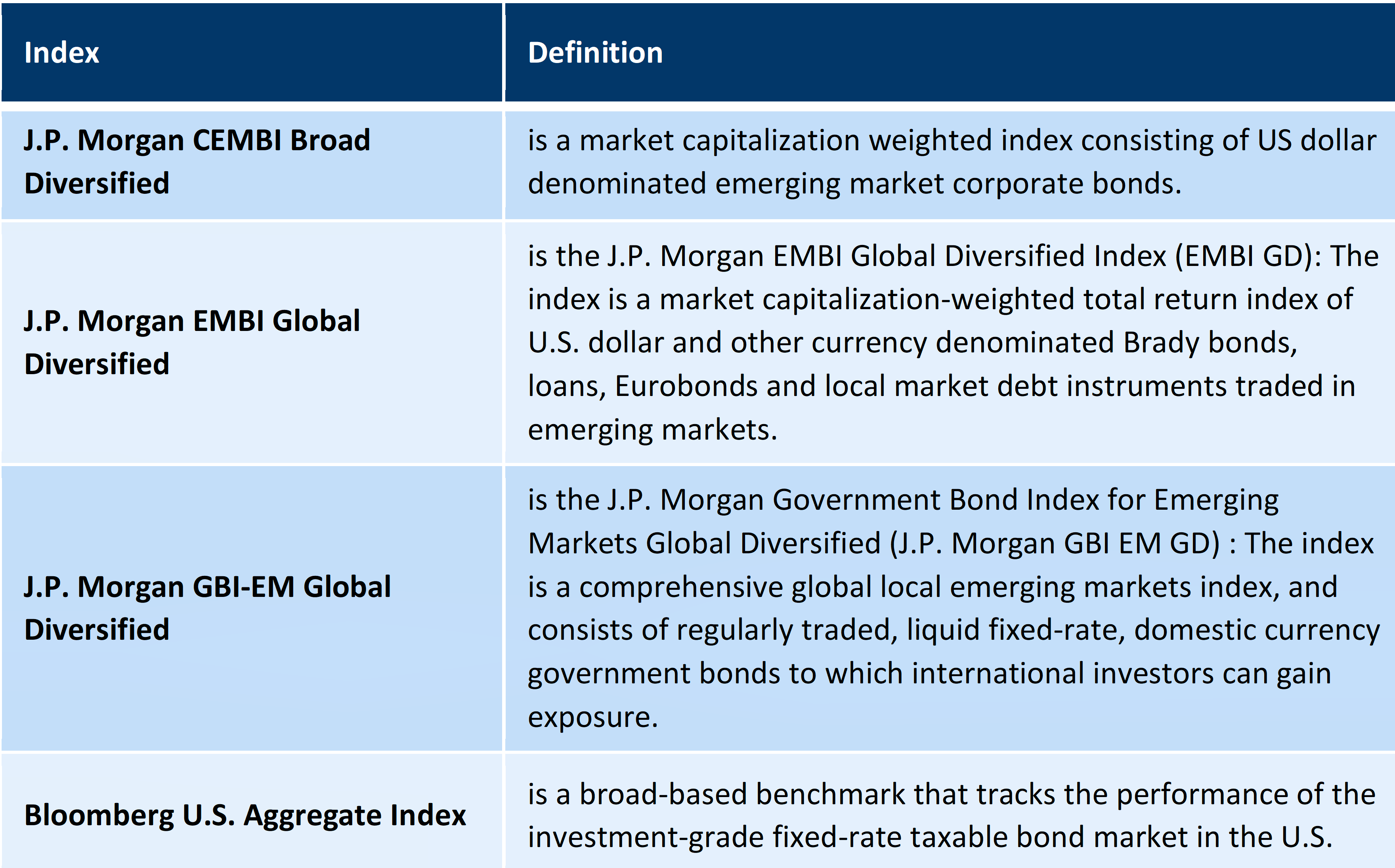

Amid the noise, Emerging Markets Debt has proven resilient with all key benchmarks posting impressive returns through the first half. In hard currency, JP Morgan’s Emerging Markets sovereign benchmark (EMBI GD) surged by +5.91%, while the diversified corporate index (CEMBI GD) rose +4.04%, well ahead of the Bloomberg U.S. Aggregate which advanced around 2%. Sovereign spreads narrowed by 10 bps to close at +314 bps above Treasuries (mostly in the high yield space), while corporate spreads widened by 2 bps to end at T +208 bps.

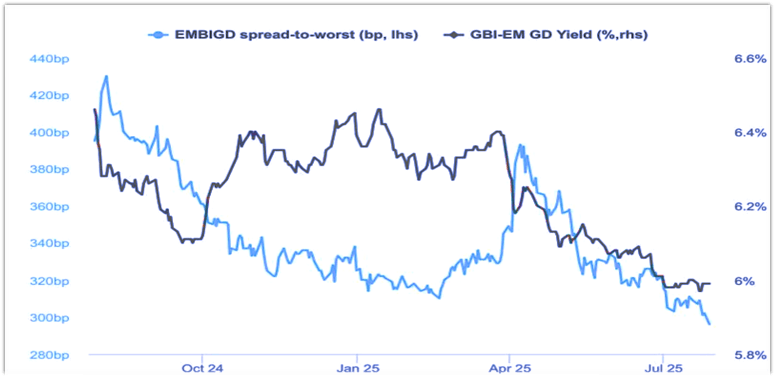

But the telling story is the roller-coaster chart below, highlighting the initial fear over the tariffs pushing-up EMD credit spreads 80+ bps. after “Liberation Day” in early April only to fall to a record low for 2025 by July with local EM currency yields dropping around 40 bps. to a 52-week low.

The U.S. Dollar’s Decline

The bigger surprise has been the broad weakening of the U.S. dollar, which has propelled the EM local currency index +12.73% through June. One fascinating chart that may catch investors’ eyes comes from the Institute for International Finance (“IFF”) regarding EM FX regimes and the U.S. dollar.

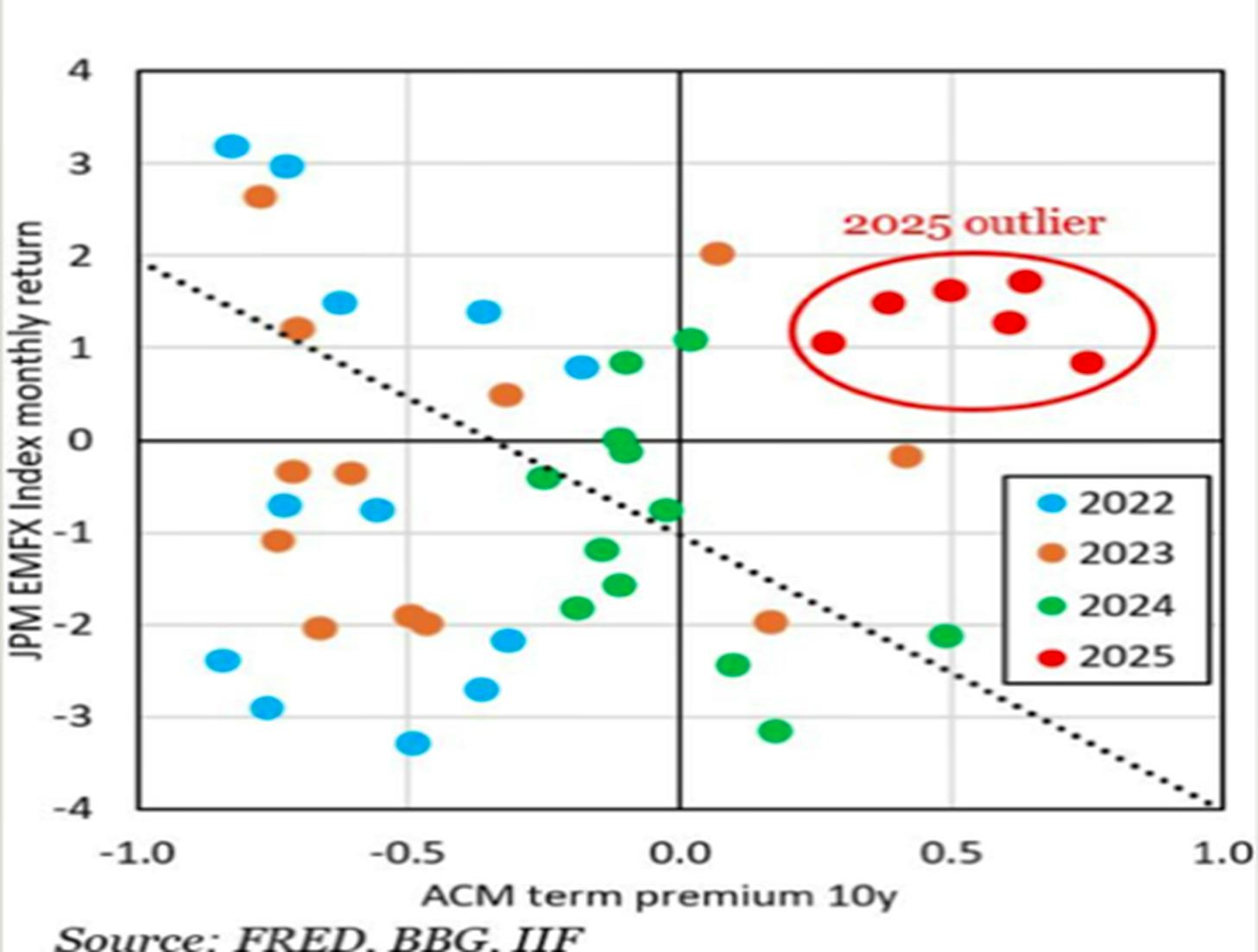

The above chart plots EMFX returns vs. U.S. term premia, something that suggests a significant investor regime shift. In 2025, Emerging Market currencies have been rallying in the face of rising U.S. yields. Compared to history, that shouldn’t happen. For the last two decades, what we’ve seen is the higher U.S. yields, the weaker EMFX returns – and vice versa.

Amid the tariff turmoil, firm U.S. rates, and general uncertainties, the U.S. dollar should be rallying - but it isn’t. Perhaps Emerging Market countries are no longer passive price takers of the global U.S. dollar cycle. With stronger institutions, better macro frameworks, and reduced FX mismatches, we believe investors may be recognizing the significant policy improvements in Emerging Markets over the years.

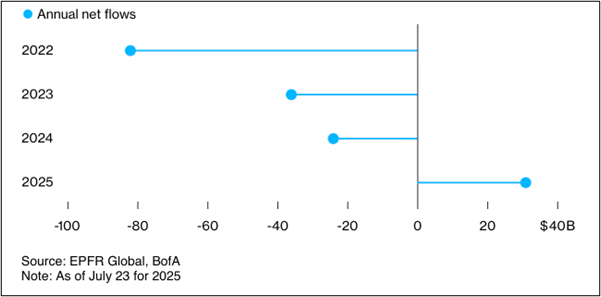

As the IFF note mentioned, over time this regime shift may lead to EMD being less of a macro call and more about picking winning and losing assets in a Trump-led America. Some countries may find it easier to negotiate more favorable Trump’s tariffs, and many are not that impacted by them at all. And investors seem to be taking notice, as evidenced by positive net flows into EMD after three years of net withdrawals which fueling the regime shift:

With over 75 countries represented in EM bond indices, many markets remain under the radar of global turbulence. For EMD investors, they present a trending opportunity with healthy carry and credit spreads. Strengthening currencies also help ease financial conditions, fueling further growth. With some signs that U.S. growth is slowing, there may also be some tailwinds with eventual Fed rate cuts sometime in the second half of 2025 which we believe could propel EMD returns even further.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. ©2025, J.P. Morgan Chase & Co. All rights reserved.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

Legal Disclaimer ©2025 Global Evolution.

Copyright © 2026 Global Evolution - All rights reserved