Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Wainø Hansen

Senior Strategist

2023 in hindsight

Following a challenging 2022 and substantial losses for risk parity strategies, investors entered 2023 with a cautious approach, anticipating an imminent US recession. However, the US economy exhibited remarkable resilience, defying the impact of extensive monetary tightening.

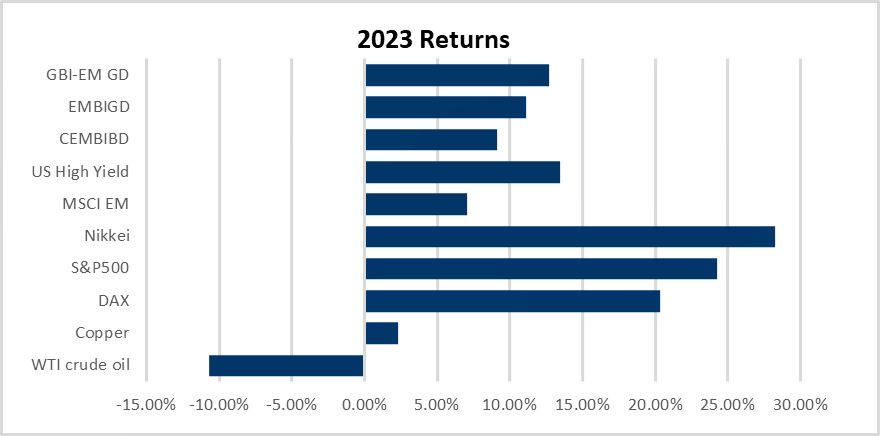

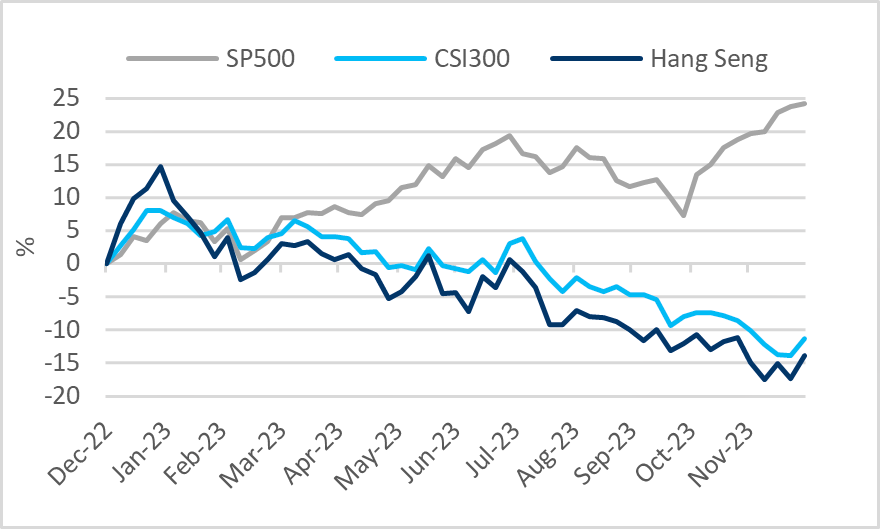

The bellwether S&P 500 Indexi experienced a notable 24% annual return in 2023, assisted by gains particularly in the latter part of the year. Three predominant drivers behind this unexpected turn of events were the resiliency of the US economy, the productivity hype surrounding Artificial Intelligence (AI) and cash-rich companies repurchasing approximately USD 900 billion worth of stocks.

The year 2023 witnessed volatility influenced by credit events and geopolitical developments. In an unexpected turn in March, the US faced a regional banking crisis, while in Europe, Swiss bank UBS absorbed Credit Suisse, resulting in significant losses for AT1 bondholders. Geopolitically, Israel experienced a Hamas-led terror assault on October 7, leading to a forceful military retaliation and causing a humanitarian crisis in Gaza. Meanwhile, the Russia-Ukraine conflict showed little progress, as Ukraine suffered waning international media attention and donor fatigue from Western countries.

The global monetary tightening cycle, initiated by Latin American central banks in 2021 due to persistent inflationary trends, reached its peak in 2023. Notably, central banks in Latin America and Central Europe (CE4), early in raising policy rates, have also been swift in reducing them.

In the realm of emerging markets, benchmarks such as EMBIGDi (sovereign hard currency), GBIEMGDi (sovereign local currency), and CEMBIBDi (hard-currency corporate debt) performed reasonably well in 2023. However, their solid full-year returns of 11%, 12.7%, and 9%, respectively, were not a straightforward journey.

Slowdown ahead

The major growth engines of the world - namely the US, EU, and China - are not firing on all cylinders.

China

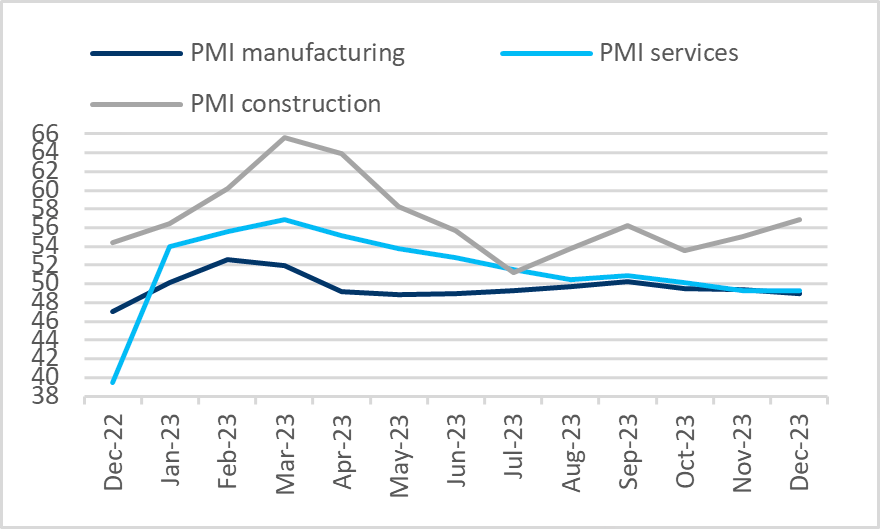

China’s manufacturing Purchasing Managers' Index (PMI) underwent a further decline, falling to 49.0 in December 2023 from 49.4 in November. Conversely, the official non-manufacturing PMI rose to 50.4 in December from 50.2 in November, driven by an increase in the construction PMI to 56.9 from 55.0, facilitated by an official initiative to expedite the completion of pre-sold homes. Moreover, the new orders sub-index for the construction sector increased to 50.6 from 48.6.

Of greater concern, within the non-manufacturing PMI, the service PMI persisted at a weak 49.3 in December, unchanged from November. This reflects a decline in consumer sentiment and spending after a brief surge in pent-up demand in Q1:23.

The Chinese real estate sector is not expected to rebound in the near future due to household reluctance toward property purchases. The prices of existing homes in top-tier cities experienced the most significant monthly decline in November 2023 since the inception of the data series in 2011.

Additionally, the floor space of sold residential buildings continues to contract substantially. This contraction extends to the value of land sales, a crucial source of revenue for local governments, which are currently grappling with the challenge of generating alternative income.

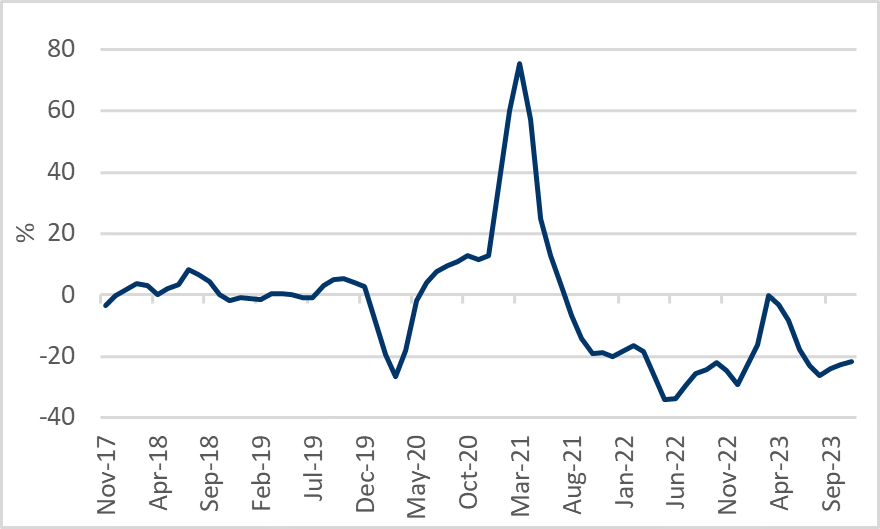

Simultaneously, foreign companies are relocating their production away from China to nations less susceptible to geopolitical conflicts. In Q3:23, foreign direct investment (FDI) in China turned negative for the first time since record-keeping commenced in 1998.

The challenges confronting the Chinese economy are evident in the divergence of stock market performance, resulting in a performance gap of approximately 35% between the CSI 300 Indexi and the US S&P 500 Indexi in 2023. Arguably, valuations are now more aligned with fundamentals.

On a structural note, China's birth rate reached a record low of 6.77 per thousand in 2022, a significant decrease from 37.88 in 1965 when the data series began. The population in 2022 fell by 850,000 from 2021 to 1.4118bn. This underscores the longer-term challenges the Chinese economy is currently grappling with.

To support the economy and achieve growth around the targeted 5%, we anticipate Chinese policymakers will enhance policy support in 2024. This may include reductions in the 1-year medium-term lending facility rate and cuts to the reserve ratio requirement for banks.

Emerging markets ex. China

The economic prospects for emerging markets (EM), excluding China, appear more promising. As foreign companies divest from China, friendlier EM countries closer to home stand to benefit.

India, in particular, has the potential to partially offset a structural slowdown in China. To begin with, India has implemented several business-friendly reforms in recent years, including with its financial markets. Although both India and China have experienced a steady decline in birth rates, India's current birth rate is 16%, and with 60% of the population under 35 years of age, India's demographic profile is considerably more favorable. In Q3:23, India's GDP growth was 7.6% year-on-year, surpassing China's growth rate of 4.90% for the same period.

Beyond Asia, Latin America is favorably positioned to spur growth by implementing a more accommodative monetary policy. In the Middle East, both Saudi Arabia and other members of the Gulf Cooperation Council have pledged substantial funds for infrastructure projects. As a noteworthy aside, Saudi Arabia has recently secured the hosting rights for the 2030 World Expo, promoted under the theme "The Era of Change."

India in GBIEMGD

India is set to gradually join JP Morgan's GBI-EM Global benchmark suite, commencing on June 28, 2024, with an anticipated weight reaching 10% by March 2025. The inclusion in the benchmark is predicted to channel capital flows amounting to USD 24 billion toward India, potentially leading to a marginal reduction in sovereign financing costs.

Looking ahead, India’s inclusion in GBI EM may prompt other benchmark providers to follow suit. India is already under consideration for inclusion in FTSE Russell's Emerging Markets Global Bond Index, and Bloomberg Barclays is considering adding India to an index as well.

It's noteworthy that India's inclusion in GBIEM will elevate the regional weight of Asia from 39.85% to 47.63%. While this may be viewed geopolitically as an undesirable increase in Asia's weight, India’s inclusion also brings diversification benefits.

Upon completion of the inclusion in GBI-EM Global Diversified, the index yield is estimated to increase by 8bps, and the index duration is expected to extend by 0.24 years. It remains to be seen whether India will exhibit characteristics of a low-beta fixed income market, akin to China, primarily influenced by domestic factors, thereby offering diversification and haven status. We suspect that India's local fixed income markets will trade more in line with global trends.

The US economy is set to cool

The US economy demonstrated exceptional resilience throughout 2023. In hindsight, it is evident that we underestimated the prolonged transmission lags associated with monetary policy caused by the timely fixed-coupon borrowing undertaken by households and companies in 2020 and 2021. Also, unintended positive wealth effects for cash-rich companies and wealthier households contributed to those lags as these entities have benefitted from the increase in the Fed funds rate and front-end yields since 2022. Additionally, the economic resilience was further supported by the Biden administration's Inflation Reduction Act (IRA) and a surge in green capital expenditures (CAPEX) prompted by uncapped tax credits, both gaining traction in 2023.

Still, there are indications of a slowdown in consumer spending as excess savings are depleted, and more households are now constrained by the resumption of student loan repayment.

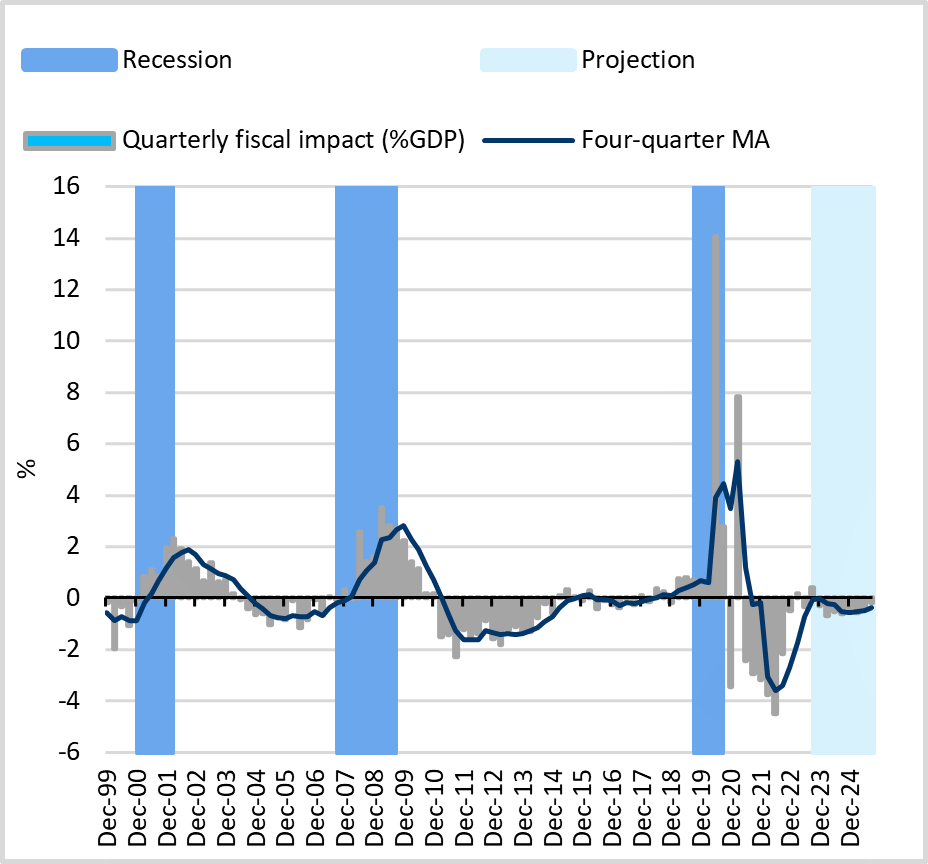

Furthermore, although a US fiscal deficit of 6% of GDP on face value is highly supportive of growth, the reality is that a moderate fiscal thrust in 2023 is expected to transform into a moderate fiscal drag in 2024.

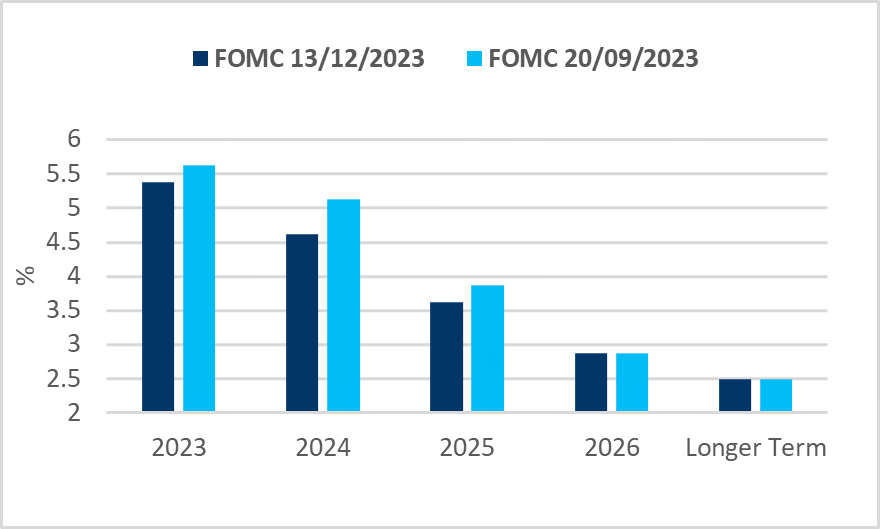

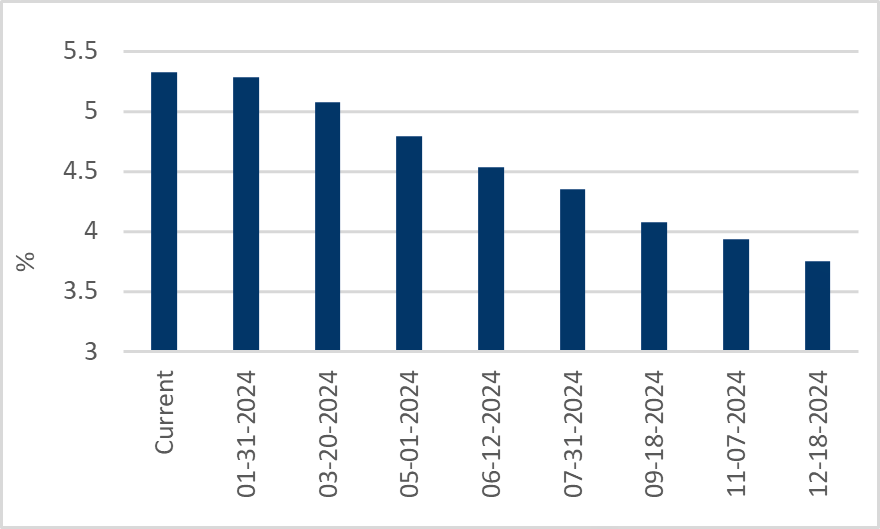

Nevertheless, we were surprised by the unexpected dovish turn in Fed Chair Powell's remarks on December 13, 2023, along with the Fed members’ modification in the median projection of Fed funds. This adjustment implied three 25-basis-point rate cuts in 2024 after no additional rate increases in 2023 as suggested in the September 20 projection.

We think the only reasonable explanation for this change in the Federal Open Market Committee's (FOMC) policy guidance and the endorsement of more accommodative financial conditions is that policymakers have grown worried about economic growth.

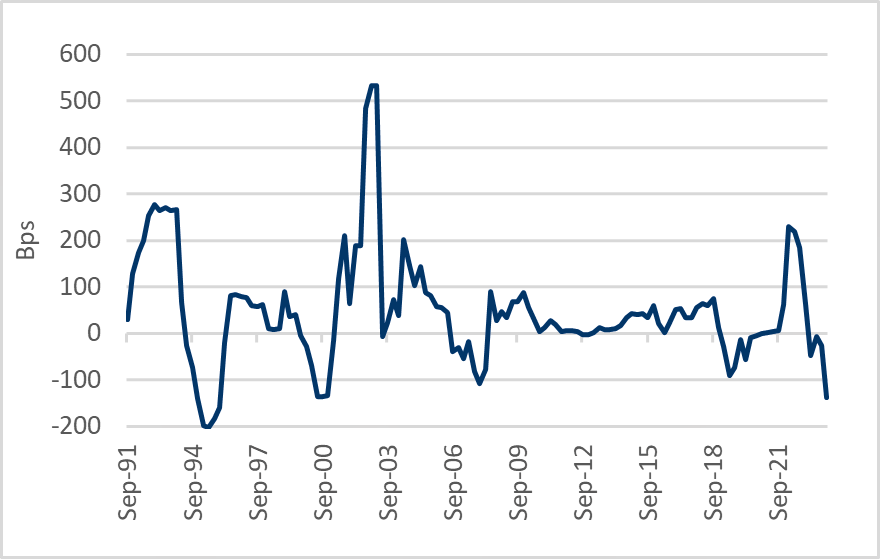

Notably, the current pricing of rate cuts over the next 12 months has resulted in the spread of the Fed funds front-month contract over the Fed funds 12-month-ahead contract reaching its widest inversion since early 2008. This level of inversion has historically been associated with recessions—specifically between February and April 2020, between December 2007 and June 2009, and between March and November 2001.

The Fed's primary focus during this tightening cycle has been on inflation. However, as inflation is now cooling more rapidly than expected, and since the Fed's November Beige Book revealed that four districts reported modest growth, two indicated conditions were flat to slightly down, and six noted slight declines in activity, the unemployment aspect of the Fed's dual mandate has come to the forefront.

Fed to start easing no later than June

After implementing 11 rate hikes amounting to a total of 525 basis points in just 16 months, we project that the Fed will execute its initial rate cut by June 2024 at the latest. If our assessment holds true and the economy decelerates to a degree that poses a risk of recession, the rate cut might be substantial, ranging from 50 to 75 basis points. Consequently, it would not be unexpected to witness the 10-year US treasury yield decreasing to approximately 3.25% before concluding the year at around 3.50%.

ECB is living on another planet

Despite the Eurozone economy operating at a sluggish pace, the European Central Bank (ECB) board seems to be in denial. The ECB’s current policy settings are already quite restrictive, and fiscal policies in Eurozone member states are offering less support. In the case of Germany, the largest economy in the Eurozone, the government has announced a return to the standard VAT rate of 19% for restaurants and catering services effective January 1, 2024 following a temporary reduction to 7% implemented in July 2020. Fiscal support is set to be further constrained following a constitutional court ruling that went against the government's plan to invest EUR 60bn in green energy and infrastructure using leftover funds from pandemic-related fiscal reserves.

In a typical economic cycle, one would anticipate more lenient fiscal and monetary policies, which contrast with the current situation. We expect that the ECB board will make a U-turn and reduce policy rates in Q2:24.

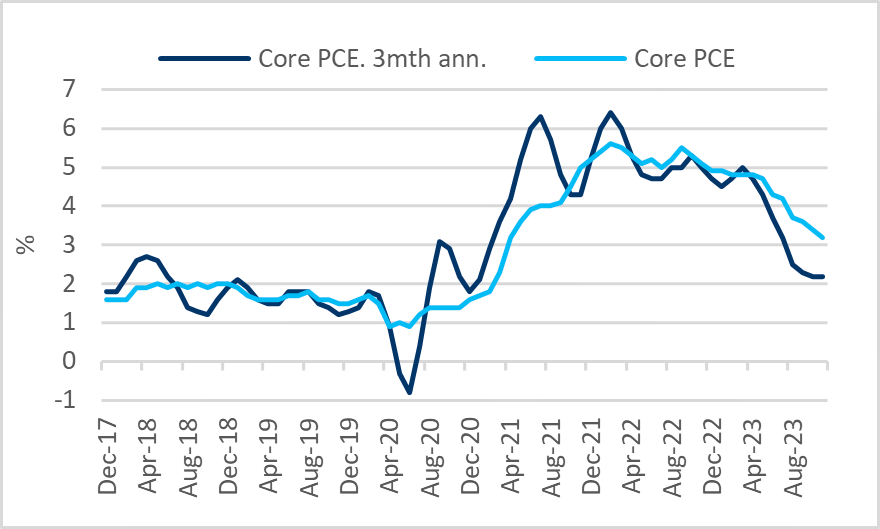

Global disinflation well underway

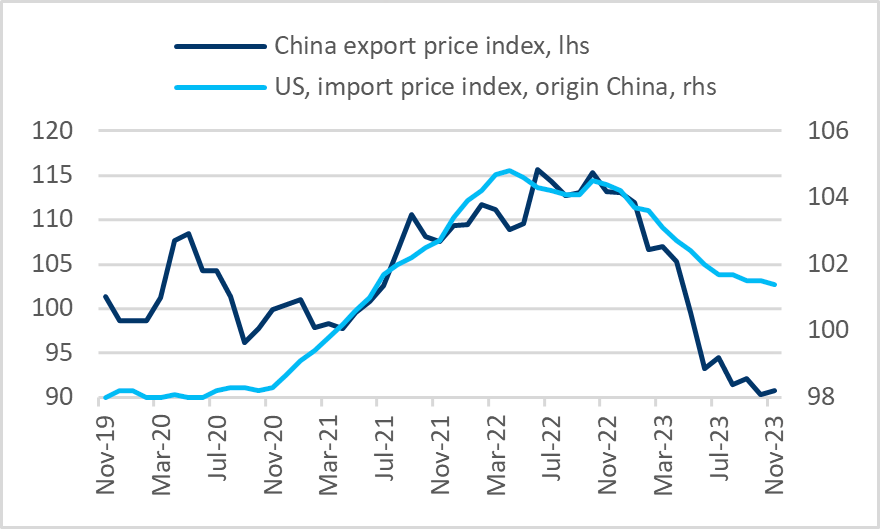

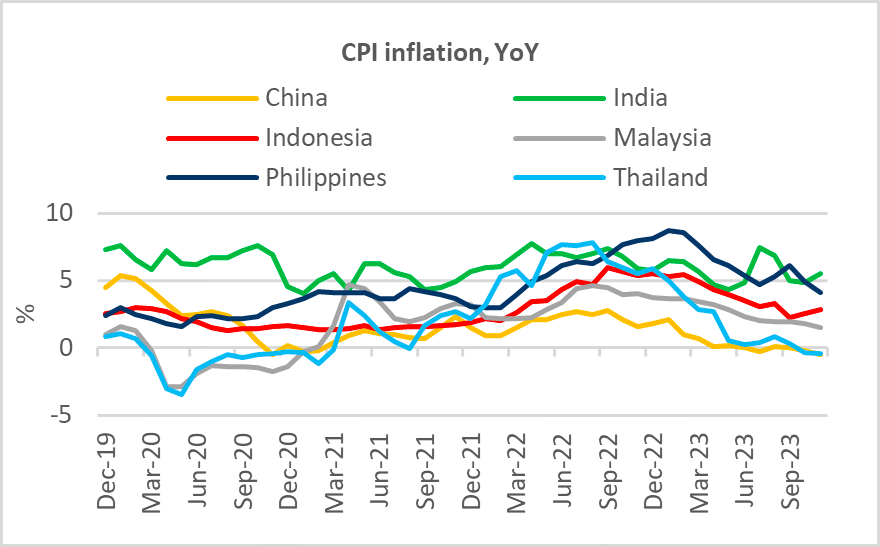

Globally, disinflation appears to be well underway, aided by subdued energy inflation, stabilized supply chains, and China’s exporting of disinflation.

We anticipate that this trend will persist in 2024. Although central bank inflation targets in the US and the UK might not be met, the ECB could see CPI inflation fall below the 2% target by the summer of 2024.

In EM, the disinflation process involves price pressures in countries like Turkey and Argentina (which are not represented in the CPI charts covering EMEA and LatAm below).

What could go wrong

In early 2023, the consensus forecasts widely missed the mark by wrongly predicting an imminent US recession. This suggests that, following unprecedented monetary and fiscal easing in the preceding two years, most forecasters failed to identify the somewhat unconventional factors driving US growth.

Looking ahead, there is a possibility that our base case for a mild US recession could be inaccurate, and the market may be mistaken in pricing in aggressive rate cuts in response to faster-than-expected disinflation. Inflation might prove to be persistently sticky, especially as both the Biden administration and the EU push for a green energy transition that involves onshoring.

China, which has been the world's preferred manufacturing hub for two decades, is now perceived as an unsafe destination for FDI from a geopolitical standpoint. Onshoring to higher-cost areas in the US and the EU could result in structurally higher inflation.

More recently, geopolitical tensions and climate disruptions have led to longer lead times and higher freight prices. Hostilities in the Red Sea have made ship passages through the Red Sea and the Suez Canal unsafe, and there are restrictions in passage through the Panama Canal due to severe drought.

AI and WFH to the rescue?

Certainly, concerns about structural inflation may be dispelled by the swift adoption of artificial intelligence (AI), resulting in increased productivity and the shift toward remote work, which reduces office space costs and allows the workforce to engage with the economy more flexibly. However, there is also the question of whether the AI excitement will end in disappointment as the bubble bursts, or if AI will reveal unforeseen and escalating, costly consequences related to cyber warfare and corporate espionage, outweighing the prospects of broader economic prosperity.

As a byproduct, the adoption of work-from-home arrangements and hybrid work weeks has left office spaces vacant in urban areas throughout the US and the EU. Commercial real estate could prove to be a vulnerable area in 2024.

Nevertheless, while these concerns involve a high degree of speculation and are challenging to navigate in trading, we believe that advanced economies are particularly exposed to these uncertainties. In our view, this serves as an argument for diversifying investments and risk strategies in favor of emerging economies.

Emerging markets - Key drivers in 2024

Looking ahead, the trajectory of US inflation, US growth, and the US presidential election, will shape the tone in global financial markets. The performance of EM’s foreign exchange (FX) will be heavily influenced by US monetary policy settings and the fate of the US dollar. However, we remain optimistic that even in a scenario of continued robust US growth (which is not our base case), the EM growth premium is likely to expand. This expansion is expected as disinflation persists across emerging economies, allowing central banks to ease monetary policy to support growth. This, in turn, sets the stage for a virtuous cycle where FDI and portfolio flows support local currency performance.

If the ECB initiates an easing cycle before the US Fed, it could result in a weaker EUR/USD, with adverse implications for EM FX performance. Nonetheless, any weakness in EUR/USD from mid-year onward should reverse as the Fed begins its easing cycle in response to sluggish growth.

In Latin America and selected Central and Eastern European (CEE) countries, local carry appears appealing. Latin American central banks took early action in the hiking cycle and have also demonstrated an early commitment to the easing cycle.

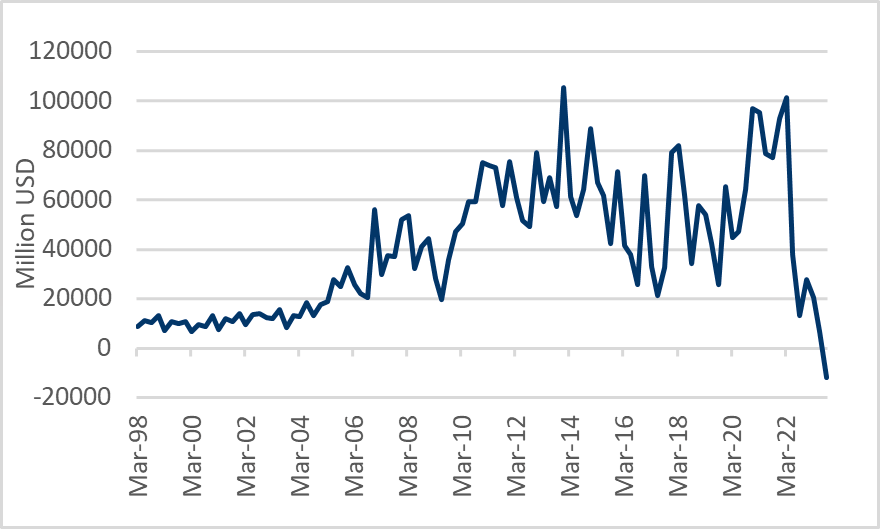

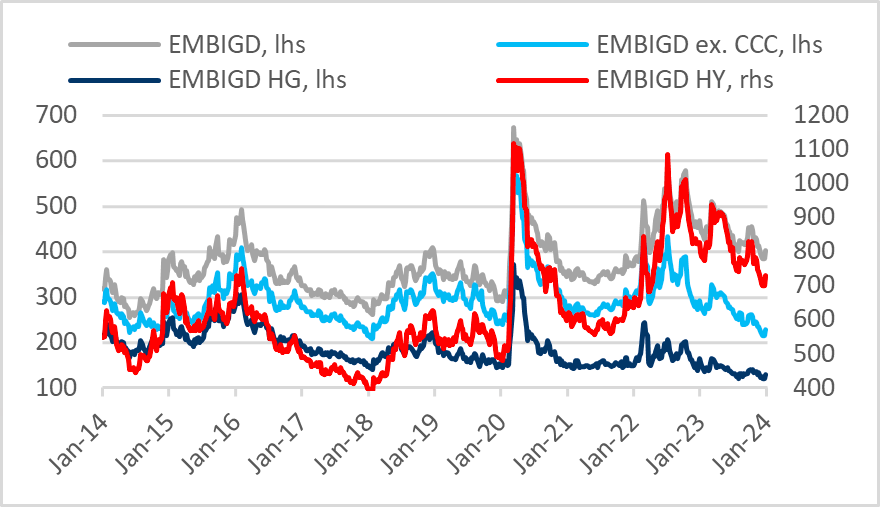

Shifting focus to hard currency debt, it is noteworthy that the benchmark EMBIGD spread in 2023 contracted by 68bps to 384bps, following a spike to 510bps in March. This is significant, considering the extensive monetary tightening by the Fed.

The overall EMBIGD spread of 384bps as of December 29 2023 is close to the 10yr average of 375bps, but if the CCC-segment is excluded from the index, spreads are 215bps, well below the 10-yr average of 294bps.

The primary source of spread volatility and year-end 2023 contraction has been the high yield/high risk segment, typically rated CCC and below. These credit spreads are often driven by idiosyncratic news.

EMBIGD HY spreads contracted by 122bps to 700bps in 2023 with the CCC segment contracting 786bps to 2838bps.

EMBIGD HG spreads contracted by a modest 18bps in 2023 to 120bps.

As we enter 2024, EM sovereign spreads appear relatively expensive, and we do not anticipate significant compression in spreads over the next 12 months. In fact, we foresee a modest widening of spreads as US treasury yields decrease in response to weakened growth and monetary easing.

Moving ahead, we believe that returns in 2024 will primarily be driven by carry. We identify opportunities among distressed credits, with the peak in sovereign defaults likely behind us. However, Ethiopia (as of our current assessment), Pakistan, and Bolivia are potential candidates for default in 2024.

While some progress has been made in the restructuring talks under the common framework over the past quarters (with Sri Lanka, Zambia, and Ghana) contributing to improved sentiment and compressed spreads, we anticipate that debt restructuring negotiations will remain intricate and prolonged, especially in cases involving China.

In the high-grade segment, spreads are narrow compared to historical levels, but technical factors appear supportive. If our forecast for lower US treasury yields proves accurate, HG duration is expected to perform well.

Manageable supply in hard currency debt

We believe the supply calendar for 2024 is manageable and investor demand is low, following two years of outflows reflecting concerns regarding the maturity wall in 2024 and 2025 and the refinancing of maturing dollar debt at higher funding rates. However, with core yields having decreased from their peak in 2023 and credit spreads now tighter than a year ago, these concerns are likely to diminish.

While a few frontier credits are currently excluded from the primary market, most EM sovereigns are encountering financing conditions that are more favorable compared to the end of 2022. Consequently, while challenges persist, particularly concerning deteriorating EM debt metrics and interest-to-revenue ratios, we do not anticipate a new wave of sovereign defaults in 2024.

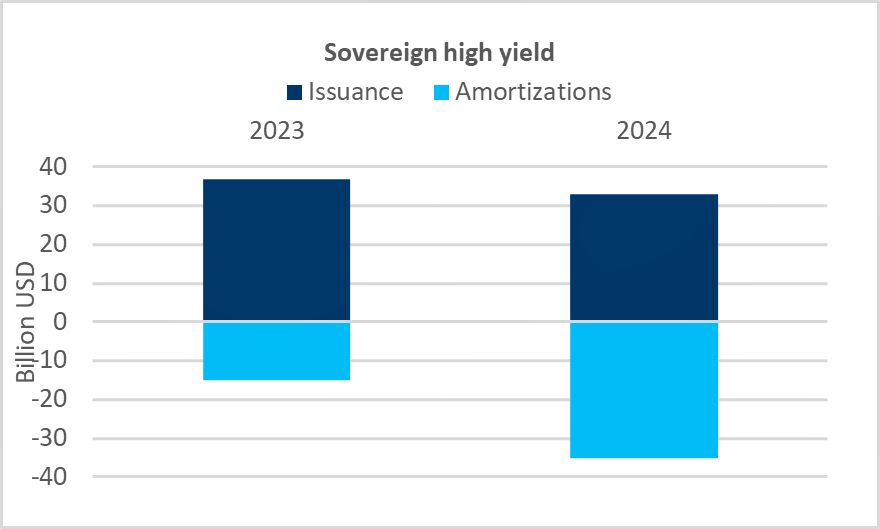

In the HY segment, investors will be closely monitoring timely payments, as outlined below.

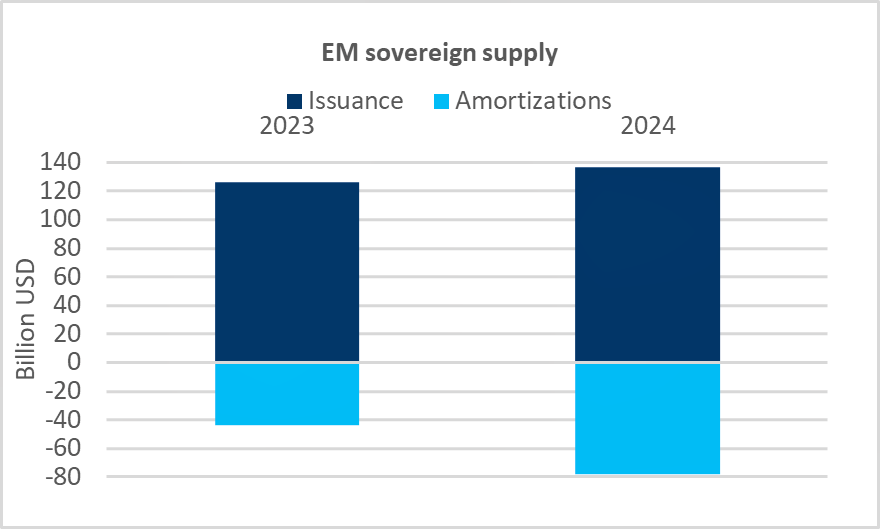

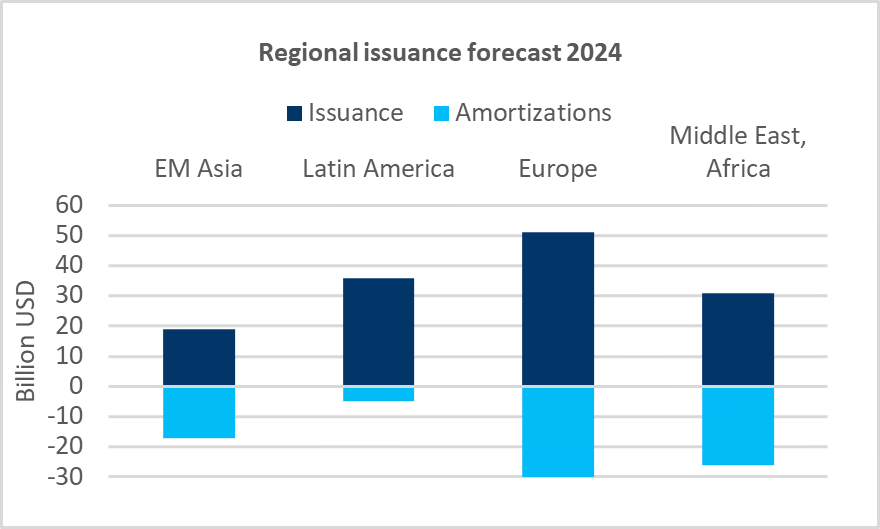

After facing exceptionally challenging market conditions in 2022, primary market activity for EM sovereigns rebounded in 2023. Gross issuance in 2023 amounted to USD 126bn, with net issuance at USD 82bn.

Looking ahead to 2024, gross issuance is anticipated to rise to USD 137bn. However, due to an increase in amortizations to USD 78bn, net issuance is expected to decrease to USD 59bn. In the HY segment, there is a possibility of negative net financing as amortizations are projected to double in 2024 compared to 2023.

Net local bond issuance in EM (excluding China) is anticipated to rise by approximately 30% compared to 2023, reaching around USD 610bn in 2024. If international fund flows do not become more supportive, domestic bond investors will need to take a larger share of this supply.

Turning point in fund flows

The structural economic reform agenda across EM has failed to impress in recent years and is unlikely to serve as the primary driver of inflows to EM in 2024.

However, a few countries stand out. In Latin America, Colombia is noteworthy for its efforts to implement reforms in the healthcare, pension sector, and labor market. Additionally, Uruguay adopted a monetary policy rate in 2020, replacing monetary aggregate targeting, significantly enhancing the monetary framework. In 2024, Argentina is worth monitoring under President Milei’s reform agenda.

Based on fund flow data from Emerging Portfolio Fund Research (EPFR) and other fund flow providers, EM credits and local fixed income have been neglected by investors since early 2022. Over this period, EPFR has reported a combined outflow totaling USD 115bn, while EM equity-dedicated strategies have received almost USD 150bn in inflows.

It is tempting to assert that EM credits and local fixed income are under-owned asset classes in international bond portfolios, a claim that is supported by a decline in foreign ownership in 14 local markets averaging 4.5 percentage points since December 2021, currently standing at 21.5% on average, according to our data.

After enduring two years of continuous outflows from both hard currency debt and local currency debt, we anticipate that flows will turn positive once the Fed initiates its easing cycle.

Tactical considerations

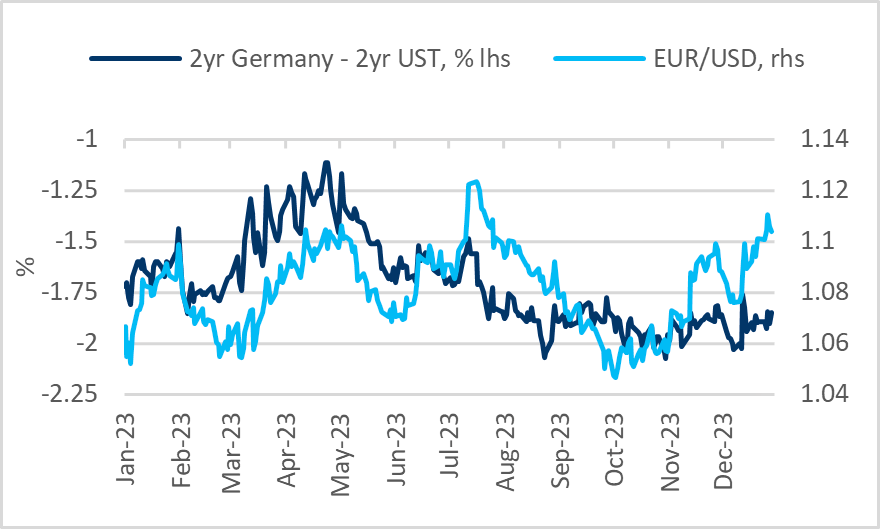

From a tactical perspective, after a substantial year-end risk rally that commenced in October 2023, the market may have advanced too far as we step into January 2024. We would like to caution that EUR/USD, priced at 1.10 and above, has deviated from fundamentals in the Eurozone and the 185bps spread of 2-year US treasury notes over 2-year German OBLs.

Regarding US treasury bonds, 10-year yields have declined from 5% to 3.90% since mid-October 2023. The Bloomberg Global Aggregate Bond Indexi has experienced an almost 10% increase over November and December 2023, marking the best performance over a two-month period since the index was launched in 1990.

This situation provides limited space for persistent inflation or unexpected positive outcomes in US non-farm payrolls.

Moreover, concerns about the diminishing structural demand for US treasury bonds may resurface if the Bank of Japan (BOJ) chooses to exit its yield curve control. This potential development could occur in spring 2024, once the BOJ has more information on wage negotiations.

Elections, geopolitics and global disorder

As we step into 2024, a packed elections calendar and geopolitics are arguably interconnected. Indeed, political left tails seem more pronounced than usual, but we are prepared to navigate these challenges confidently. We believe that our hands-on investment strategy, focused beyond benchmarks, will surpass the performance of passive benchmark-tracking strategies.

To highlight the most evident concerns, geopolitical risks persist in Eastern Europe, where Russia appears to have gained the upper hand. Meanwhile, Ukraine's President Zelinsky is grappling to secure ongoing donor support amid increasing domestic political criticism over his handling of the war and martial law. Both Ukraine and Russia are scheduled to have presidential elections in March. However, in the case of Ukraine, elections are already temporarily suspended under martial law, while Russia's presidential election is expected to be straightforward, ensuring Putin remains in power until at least 2030.

In the Middle East, Israel's continued crackdown on Hamas has resulted in a humanitarian tragedy and the destruction of residential areas in Gaza. This has sparked strong criticism from traditionally Israel-friendly Western countries, some of which have elevated their terror threat alert in response.

In other regions, the presidential election in Taiwan on January 13 will shape the trajectory of future relations with China. Notably, high-ranking Chinese officials have intensified efforts to influence the Taiwanese election. Vice President Lai Ching-te of the ruling Democratic Progressive Party (DPP) currently leads in the polls, surpassing contenders from the China-friendly Kuomintang and Taiwan’s People’s Party. A victory for the DPP could escalate tensions not only between Taiwan and China but also between the US and China. China has starkly framed the presidential election in Taiwan as a choice between "peace and war, prosperity and decline."

Moving on, North Korea remains a geopolitical wildcard. On December 18, 2023, North Korea launched its most advanced long-range missile, just days after the US warned that a nuclear attack by North Korea would lead to the end of Kim Jong Un’s regime.

In the EU, elections for the European Parliament are slated for June 6-9. The composition of the new parliament could be crucial for future support to Ukraine, especially as Hungary takes over the presidency from Belgium in H2:24. Hungary's Prime Minister Orban is known for his ties to Russia's President Putin and his disapproval of the EU's financial assistance to Ukraine.

The US presidential election will hold significant consequences not only for the US economy and trade policy but also for future US support to Ukraine, involvement in the Middle East and Asia, and commitment to NATO. A Trump victory in the US presidential election would once again reshape the relationship with Europe. If future US funding for Ukraine diminishes or comes with conditions, EU member states may struggle to find common ground on foreign policy toward Russia and Ukraine and military spending agreed upon under the NATO umbrella.

If Trump secures victory, it wouldn't be surprising if the "deal maker's" top foreign policy priority is brokering a truce between Russia and Ukraine.

General elections in India, Indonesia, South Africa, and Mexico are worth monitoring, if not for geopolitical reasons, then for economic considerations. In Mexico, incumbent President Andrés Manuel Lopez Obrador (AMLO) is ineligible for re-election. Two female candidates, Claudia Sheinbaum and Xóchitll Gálvez, are vying for the presidency. The outcome will hold significance for Mexico’s support to the state-owned oil company PEMEX, which AMLO has backed with a total of USD 77bn since 2019, posing a notable fiscal burden in the federal budget. Gálvez supports partial privatization of PEMEX, while Sheinbaum pledges to ensure Mexico’s energy sovereignty, aligning more with AMLO. For Mexico and its border with the US, the outcome of the US presidential election remains a "known unknown."

In Indonesia, incumbent President Joko Widodo's attempt to secure an extra-constitutional third term was thwarted by the old guard of political elites. Despite this, the old guard continues to influence the race. In October 2023, the Constitutional Court, led by Widodo's brother-in-law, allowed Widodo's 36-year-old son, Gibran Rakabuming Raka, to run as a vice-presidential candidate alongside former special forces general and current defense minister Prabowo Subianto, even though Raka does not meet the minimum age requirement of 40 for presidential and vice-presidential candidates. Opinion polls indicate around 40% support for the Prabowo/Gibran ticket, with the closest contenders polling at around 20%.

Turning to India, Prime Minister Modi's Bharatiya Janata Party (BJP) recently emerged victorious in local elections in three key states—Madhya Pradesh, Rajasthan, and Chhattisgarh—defeating its main rival, the Indian National Congress (INC), and underscoring Modi’s widespread appeal.

2024 marks the largest election year in history, with over 2 billion voters in 50 countries heading to the polls.

Our strategies

Global Evolution offers a range of actively managed investment strategies in UCITS format and possesses substantial expertise in segregated mandates, where investors exercise influence on the formulation of guidelines for country selection, creditworthiness, and duration.

Our core expertise lies in the frontier universe. Since 2010, we have navigated the frontier universe through various economic cycles in both hard and local currencies. The experience gained over the years also benefits investors in our more traditional emerging markets strategies, where there is often a touch of "off-benchmark" exposure to frontier markets, permitted by investment guidelines.

Our blended strategy is the obvious choice for investors who prefer not to make decisions on fluctuating valuations in local debt issued in local currencies and dollar-denominated debt traded in the international capital market.

Additionally, we have recently launched a high conviction strategy that, apart from exposure to local currencies and dollar debt, incorporates emerging markets corporate debt managed by our dedicated corporate teams in London and Singapore.

IMPORTANT

There will be significant differences between a client portfolio’s investments and the index. Indices may or may not reflect the reinvestment of dividends; interest or capital gains and the indices are not subject to any of the incentive allocation, management fees or expenses to which a client portfolio may be subject. It should not be assumed that the client portfolio will invest in any specific securities that comprise the index, nor should it be understood to mean that there is a correlation between a client portfolio’s returns and the indices. Nor can one assume that correlations to the indices based on historical returns will persist in the future. The Index is included for informational purposes only.

Disclaimer & Important Disclosures

Global Evolution Fondsmæglerselskab A/S (“Global Evolution DK”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). Global Evolution DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

Global Evolution DK has a United Kingdom branch (“Global Evolution Fondsmæglerselskab A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under the Firm Reference Number 954331.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), an SEC registered investment advisor. Registration with the SEC does not infer any specific qualifications Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is an wholly-owned subsidiary of Global Evolution Fondsmæglerselskab A/S (“Global Evolution DK”). Global Evolution DK is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Global Evolution is affiliated with Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker dealer, Conning Asset Management Limited, Conning Asia Pacific Limited and Octagon Credit Investors, LLC are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has offices in Boston, Cologne, Hartford, Hong Kong, London, New York, and Tokyo.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. Conning, Inc. is also registered with the National Futures Association and Korea’s Financial Services Commission. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316), Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this website constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2023, J.P. Morgan Chase & Co. All rights reserved.

This communication may contain Index data from Standard & Poors or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but Standard & Poors does not warrant its completeness or accuracy.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2025 Global Evolution - All rights reserved