Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Wainø Hansen

Senior Strategist

Tariff madness

Trump’s so-called "Liberation Day" on April 2 proved disruptive for China’s exports to the U.S., as the existing tariffs was raised with a 34% reciprocal tariff, bringing the total tariff on Chinese goods imported into the U.S. to approximately 65%.

China’s response was swift. On April 4, Chinese authorities surprised most observers with a resolute 34% tariff increase on U.S. goods, raising the total effective Chinese tariff on American imports to 54%. At the same time, China accused the latest round of U.S. tariffs of being a serious violation of WTO rules.

Trump, who has long been critical of the rules-based international order established after World War II, responded by threatening China with an additional 50% tariff unless Chinese authorities withdrew their 34% tariff by April 8, which China did not.

By this point, the U.S.–China trade war had devolved into a negative feedback loop. On April 9, as 30-year U.S. Treasury yields briefly approached 5%, President Donald Trump announced a 90-day pause on the higher reciprocal tariffs that had affected dozens of trade partners after midnight. However, he simultaneously increased tariffs on Chinese goods to 125%. The White House later clarified that tariff on Chinese imports—including the 20% levy on fentanyl—had now risen to 145%.

On April 11, China announced it would raise tariffs on all U.S. goods from 84% to 125%, effective April 12. Beijing also stated that it would disregard any further tariff hikes from Washington, declaring that the Trump administration's actions had become a “joke.” Clearly, Beijing intended to present itself as the more mature actor while implicitly arguing that further tariff increases were senseless, as bilateral trade would already be nearing a standstill under the existing measures.

Confusion was widespread when the Trump administration announced on Saturday, April 12, that imports of smartphones, tablets, computers, flat screens, and microchips would not be subject to the newly announced retaliatory tariffs. However, this was quickly contradicted by a tweet from Donald Trump the following Sunday, stating that Saturday’s announcement was only a temporary measure and that a different tariff would soon be applied to the sector. “NOBODY is getting ‘off the hook,’” he wrote.

The Current Situation

As things stand, the United States and China are engaged in a power struggle that threatens to push the U.S. into a recession and drive Chinese growth significantly below the official target of 5%.

If the Chinese remain as unyielding as they have been so far, our assessment is that public pressure on Trump will, in the end, grow stronger than the pressure on China’s President Xi since Xi does not have to face voters in a midterm election in November 2026. Moreover, the Chinese population for generations has been accustomed to authoritarian top-down governance and, from time to time, collective hardship. Most recently, large parts of the population were essentially locked down throughout the pandemic until sanctions were lifted in late 2022, followed by economic recovery in the first half of 2023. It is likely that the Chinese people will once again fall in line and face economic setback resulting from a trade war with the U.S. with resilience.

In the U.S., consumer confidence and the White House administration’s approval ratings are already taking a hit due to tariff concerns, while Treasury Secretary Scott Bessent's ambitious "3-3-3" economic plan—aiming for 3% GDP growth, a 3% budget deficit, and an additional 3 million barrels of daily oil production—remains a far cry amid the current economic turbulence. This helps explain both the 90-day reciprocal tariff pause and the unexpected tariff exemption announced on April 12, which can be seen as a strategic shift to mitigate further economic strain.

Furthermore, in a continued move toward de-escalation, Secretary Scott Bessent stated on April 22 that the ongoing tariff standoff is unsustainable. Meanwhile, President Trump, in a significant reversal following a meeting with CEOs from Walmart, Target, and Home Depot, predicted that the final tariff facing China would fall well below the 145% level he had set.

The three factors influencing Trump

In our view, it’s becoming increasingly clear that the Trump administration’s approach to tariffs will likely be influenced by these key factors:

The U.S. Treasury market, where 10-year yields above 4.50% represent a pain threshold

Pressure from corporate America, which is lobbying hard to highlight the complexities of global supply chains and the potential damage caused by aggressive tariff policies on U.S.-manufactured goods and imported consumer goods

Already fragile consumer sentiment and Trump’s approval rating

What economy is more vulnerable?

In response to Donald Trump’s punitive tariffs on Chinese goods, China has also introduced new export restrictions on seven additional rare earth elements giving it leverage in trade negotiations. The affected elements—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium—are vital to a broad array of technologies, including electric vehicles, semiconductors, and military applications such as missiles and drones.

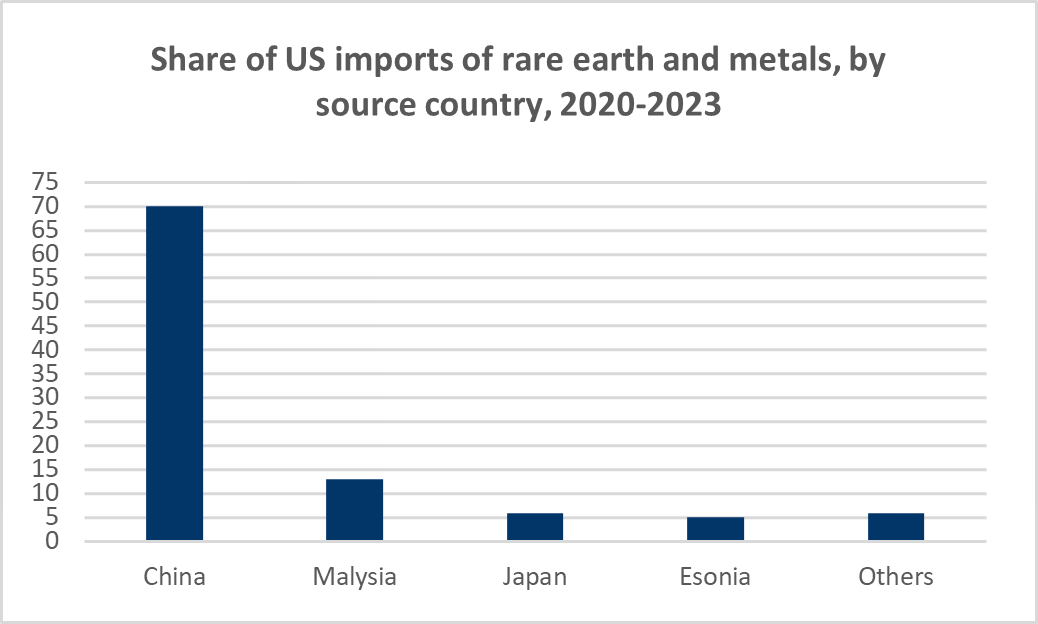

The United States currently has no domestic capacity for refining these materials and remains heavily dependent on Chinese imports. Between 2020 and 2023, China supplied approximately 70% of U.S. rare earth imports and in 2024, the U.S. sourced 100% of its scandium and yttrium imports exclusively from China. Not only does China dominate rare earth mining, but it also controls the vast majority of global refining capacity.

In the short term, we believe the U.S. will find it difficult to replace many Chinese products, which will increase inflationary pressure and increase the risk of a U.S. recession should Donald Trump stand firm on reciprocal tariffs on Chinese goods. This is presumably also what Donald Trump has had to acknowledge, when on April 11 he suddenly announced exemptions from tariffs on a range of electronics.

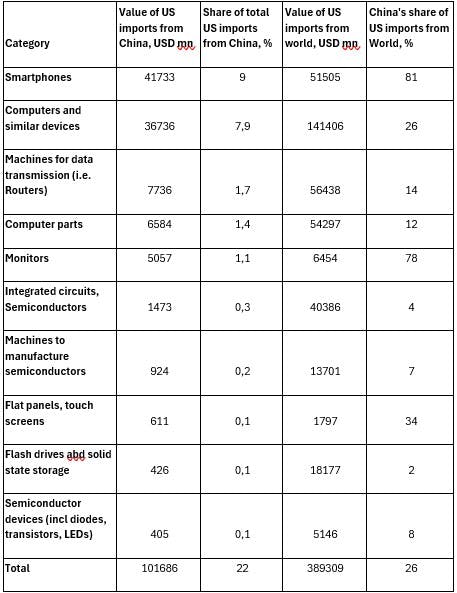

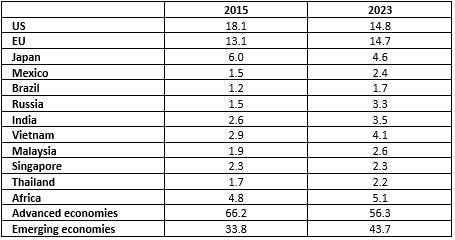

As shown in the table below, the list of products exempted from reciprocal tariffs accounts for a total of 22% of the U.S.'s overall imports from China and as much as 26% of U.S. imports from the rest of the world, with smartphones, computers, and screens being the most significant product categories.

Services trade a new front

Should the stand-off between China and the U.S. intensify, services trade could represent a potential new front in the trade war.

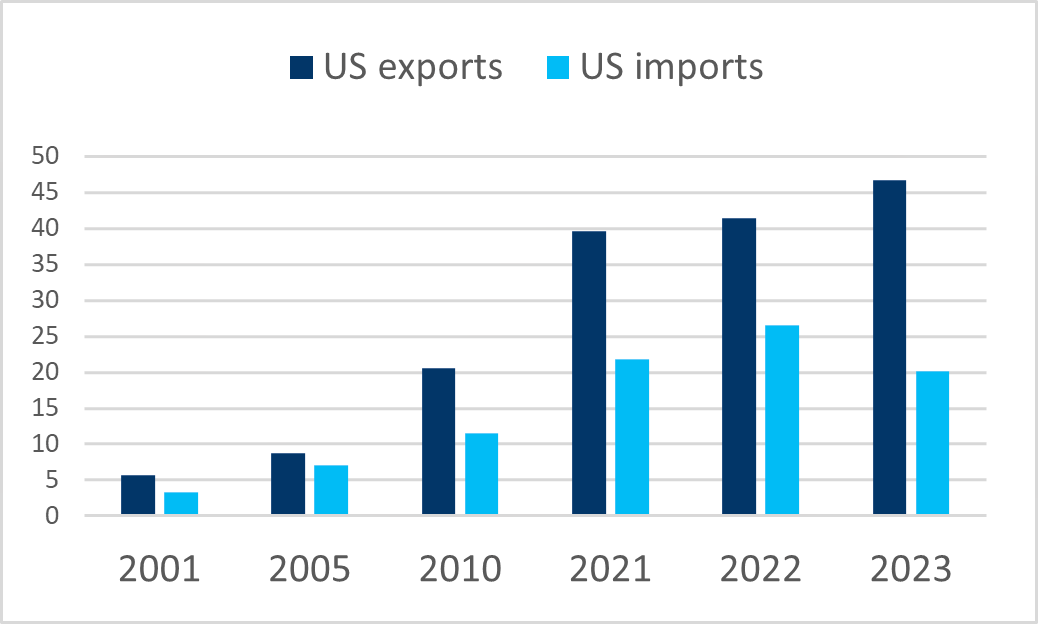

What is often overlooked in U.S. criticism of China’s goods trade surplus (USD 295 billion in 2024) is that China remains the largest contributor to the U.S. surplus in services trade, accounting for approximately 9.5% of the total.

What is China facing and what can Beijing do

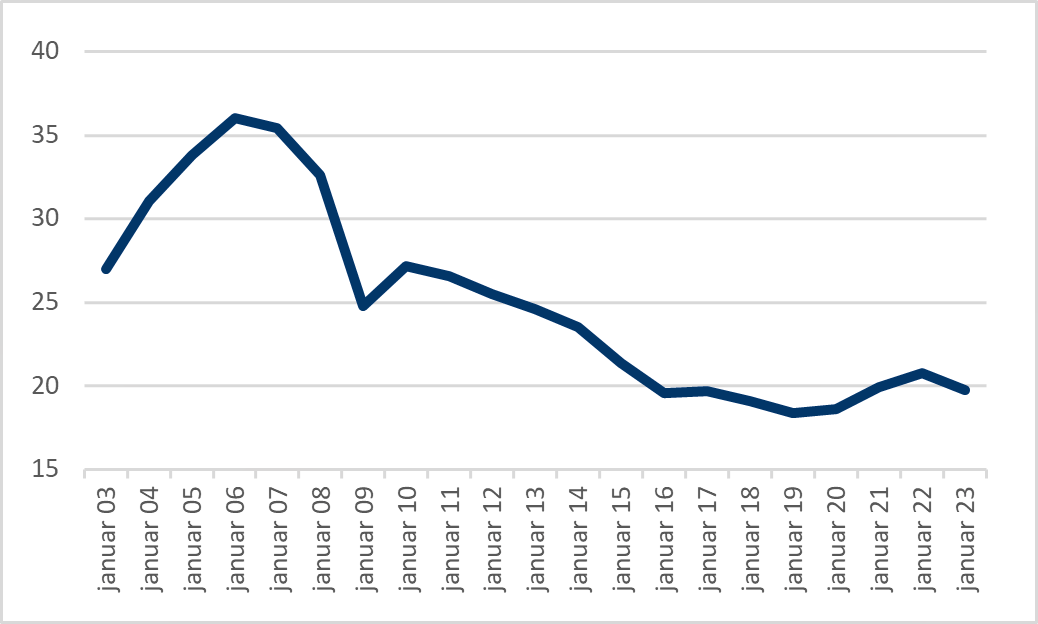

What the tariffs will do to the Chinese economy is another matter. The Chinese economy is highly dependent on exports. Although its importance has been in decline since the commodity booming 2000s and the era of outsourcing of labor-intensive manufacturing, exports still account for around 20% of GDP in 2023 and contributes around 1.5 percentage point GDP growth (in 2024).

China’s exports to the U.S. are significant. Official data does show that Chinese exports to the U.S. have been declining as a percentage of China’s total exports since Trump’s first term in office, but this data is likely obscured by Chinese 're-routing' of exports through countries such as Vietnam, Thailand, and Mexico.

Indeed, by some estimates, the U.S. share of China’s total exports was still a hefty 20% in 2024 including rerouting. This stands in stark contrast to the official number closer to 15%. However, going forward re-routing will be much more difficult as the Trump administration plug “loopholes” with reciprocal tariffs as high as 46% in the case of Vietnam and as Vietnam has pledged to crack down on Chinese goods shipped to the U.S. via its territory to ease these tariffs.

To further limit Chinese exports, the Trump administration has, in its proposal for tariff negotiations with third countries, suggested that these countries must reduce their trade with China in return for concessions on U.S. reciprocal tariffs. Unsurprisingly, the Chinese authorities have rejected this kind of coercion and have strongly urged third countries not to enter into such an agreement with the U.S. if they wish to avoid Chinese retaliation.

Watch Asia’s April export data

As of this writing, early data from South Korea’s 20-day export figures for April suggest that Asia’s exports could face a broad-based setback in the coming months, following a frontloading of shipments in Q1:25. By country, South Korea’s exports to the U.S. saw the sharpest decline, falling 14.3% year-over-year after a 2.9% increase in March. China’s April trade data, scheduled for release on May 9, will shed further light on the extent of the impact on its exports to the U.S. Additional trade reports from South Korea (May 1), Vietnam (May 6), India (May 16), and Japan (May 21) will offer valuable insight into broader U.S. trade dynamics ahead of the U.S. advance goods trade balance release on May 30.

How to unlock China’s consumer potential?

With its 1.4 billion people, China has a massive domestic market that could relieve some of the pressure on exporters hit by tariffs.

However, persistent weakness in China’s real estate sector and a sluggish job market remains significant hurdles to the government's efforts to revive consumption as a key growth driver. The ongoing trade tensions with the U.S. only add to the challenge. Exports play a critical role in supporting employment, with an estimated 120 million jobs in manufacturing and related service industries tied to export activity in 2023, according to a report from China Galaxy Securities.

Reviving household consumption in China remains challenging without a more optimistic employment outlook. Therefore, in light of the broad U.S. tariffs, we expect Chinese leaders to step up efforts to offset the impact of as a minimum a partial loss of a market that absorbed USD438 billion worth of Chinese goods in 2024, according to the Office of the U.S. Trade Representative.

Chinese authorities have pledged to accelerate fiscal spending through initiatives such as trade-in programs, childcare subsidies, wage increases, and improved paid leave to boost consumer demand. We also expect the PBoC to lower the reserve requirement ratio (RRR) and policy rates, while maintaining its support for the Chinese stock market through funding to state banks.

To support growth, China is also likely to redirect its exports toward the domestic market and non-U.S. markets, often at discounted prices. Domestically, this could help offset upward price pressures caused by Chinese tariffs on U.S. goods and a potential depreciation of the Renminbi against the CFETS currency basket (discussed further below). In broader Asia and Europe, the influx of discounted Chinese exports could help contain inflation, giving central banks more room to ease monetary policy.

China is diversifying imports away from the US

Regarding China’s imports of U.S. goods subject to tariffs and the broader shift toward a future that may challenge the U.S.-led global order Beijing has been preparing since the Trump administration first imposed tariffs on China in 2018. Since then, China has invested billions in foreign trade and foreign infrastructure initiatives to strengthen ties with the so-called Global South. As a result, American farmers have seen their share of China’s soybean imports drop by half to 20%, as Beijing has boosted domestic soybean production and increasingly turned to Brazil, now China’s largest soybean supplier.

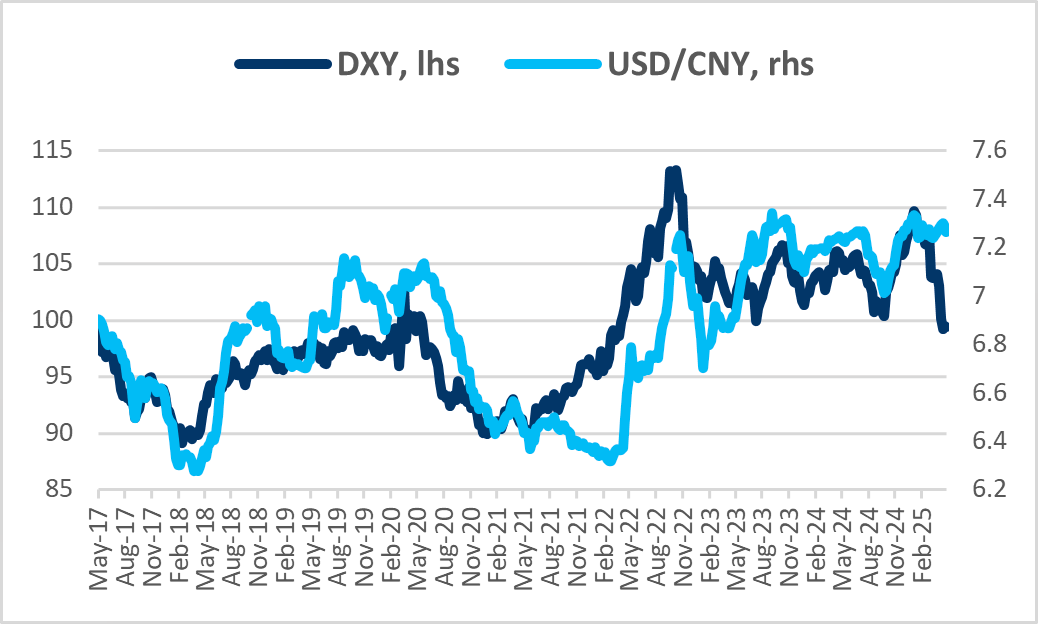

The Chinese Renminbi and foreign FDI

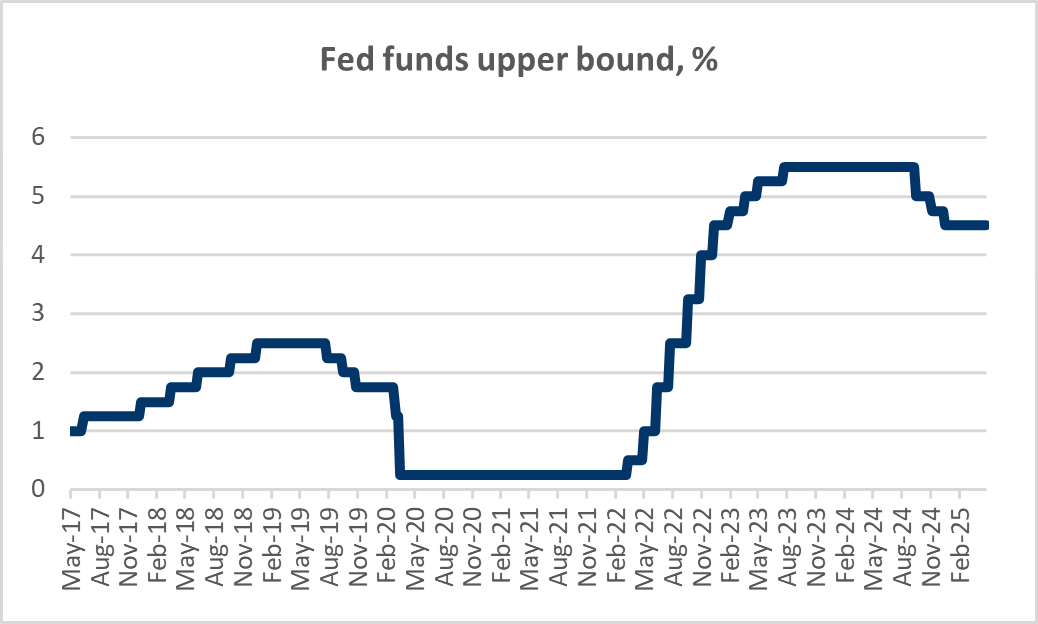

We believe that the Chinese authorities will avoid a major devaluation of the Renminbi against the CFETS basket, as it would undermine confidence in the CNY as an alternative reserve currency, encourage capital flight, and weaken the flow of inbound foreign direct investment. Against the U.S. dollar, the Renminbi appears well-positioned to hold its value given that the ongoing trade conflict is occurring in an environment of overall dollar softness and a Federal Reserve inclined toward monetary easing—unlike the previous trade war during Donald Trump’s first term, when the dollar benefited from a tightening Fed.

In relation to inbound foreign direct investments, it is worth noting that China’s National Development and Reform Commission is planning to ease its list of specific industries where foreign investors are either restricted in accessing investments or outright prohibited. Preliminary reports indicate that the number of industries on the list will be reduced from 117 to 106, which, according to the Commission, will stimulate market vitality. The easing measures will particularly apply to areas such as TV production, telecommunications services, online information services, pharmaceutical and medical services, radioactive units in the healthcare sector, and the import of forest seeds. At the same time, local governments are being encouraged to loosen access for foreign strategic investors in sectors like transportation, logistics, and car rental services.

Unlike the trade war during Trump’s first term, the incentive for foreign companies to shift their supply chains away from Chinese production to other countries is less obvious, as – this time - many of the alternative destinations are also affected by reciprocal tariffs. Additionally, many foreign companies have come to realize that replicating the same level of infrastructure, scale and access to skilled labor in other countries can be challenging. That said, according to news reports, an increasing number of Chinese companies have begun scaling back production and furloughing employees in response to a decline in new orders from U.S. clients.

Economic outlook

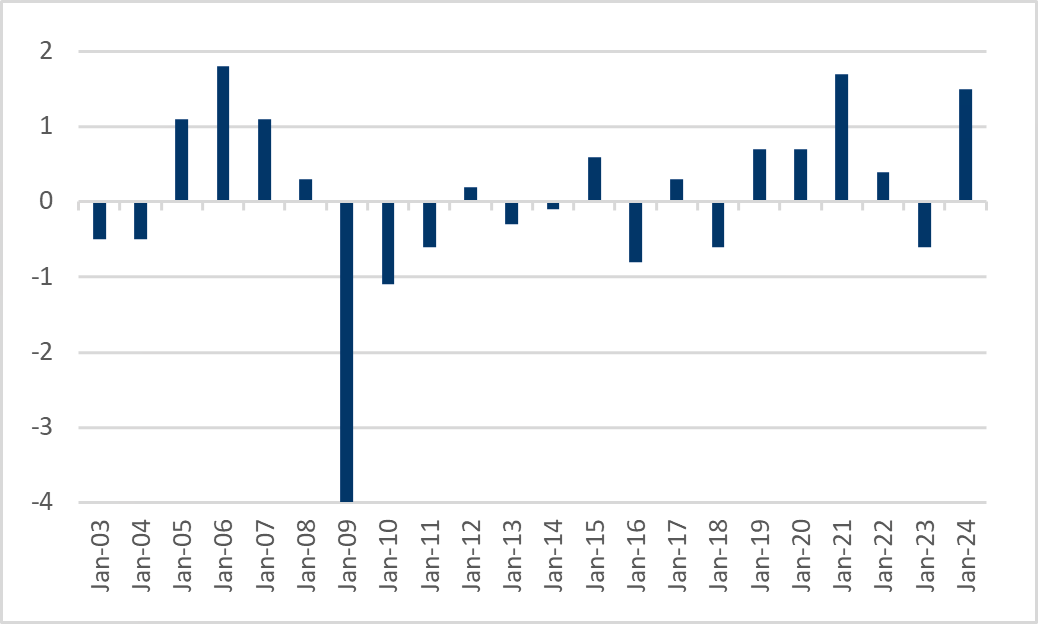

China’s GDP growth outperformed expectations in Q1 2025, rising 5.4% year-on-year, supported by stronger net exports due to stockpiling and resilient retail sales driven by consumer subsidies. However, despite the mitigating measures outlined above, the U.S. tariffs on Chinese goods—and China’s retaliatory tariffs on U.S. imports—remain a drag on growth that could reduce China’s 2025 GDP growth by up to 1.0 percentage point, we believe, putting pressure on the official 5% target.

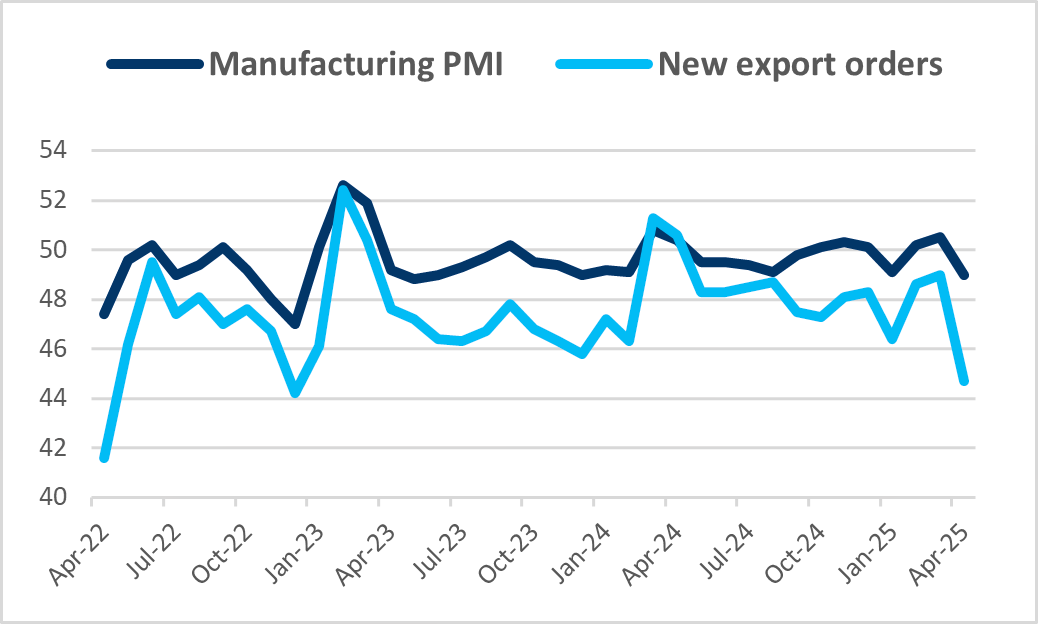

Even if U.S. tariffs on Chinese goods are reduced from the current 145% to a range of 50–100%, China’s export growth would still face considerable headwinds. Signaling the effects of tariffs and foreshadowing significant headwinds for Q2 GDP growth, China's official manufacturing PMI fell to 49.0 in April from 50.5 in March. The drop was driven primarily by a decline in the new export orders sub-index, which plummeted to 44.7 - its lowest reading since December 2022, when China, as last major country to do so, ended its zero-Covid policy.

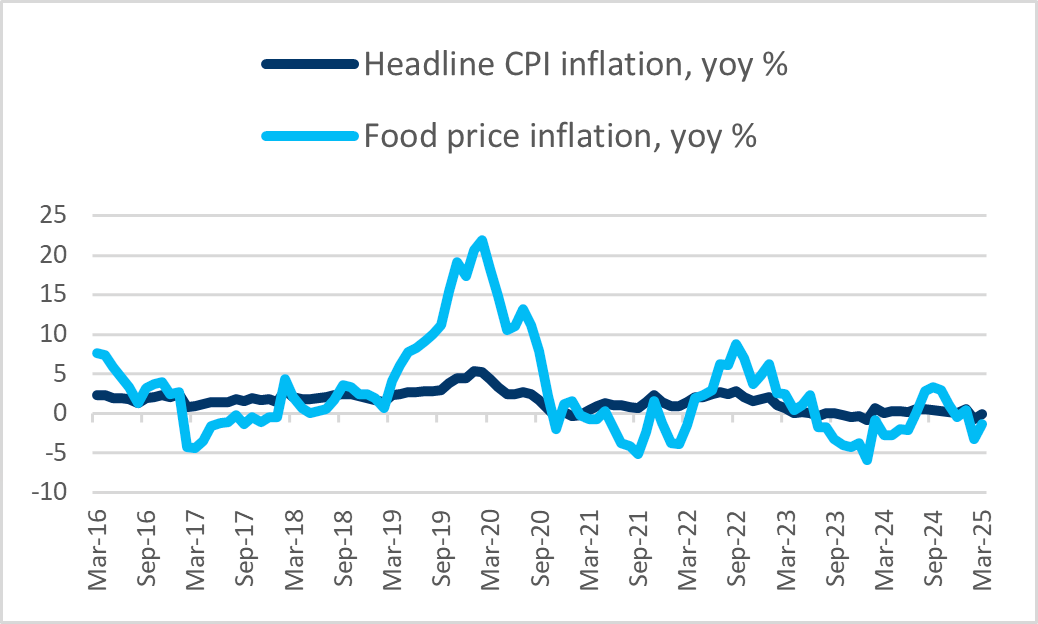

CPI inflation in China is expected to come under downward pressure due to excess domestic supply as exports are redirected to local consumers. In contrast, China’s retaliatory tariffs will exert upward pressure on inflation.

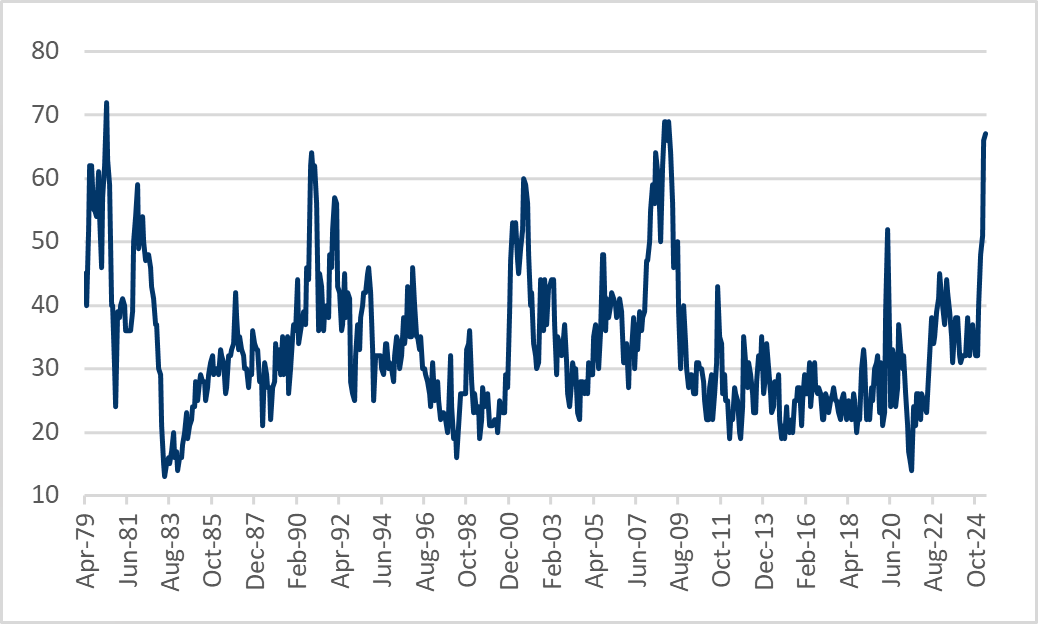

When it comes to food prices, only 8–10% of China’s total grain consumption is met through imports, and the country’s significant pivot to non-U.S. suppliers should help cushion the impact of these tariffs, resulting in only moderate direct pressure on food prices. As a result, we expect food price inflation to remain subdued compared to the 2018–2019 trade war. With oil prices currently near the lower end of their four-year range, overall CPI inflation in China is likely to stay slightly below zero in 2025 as deflationary pressures intensify.

To summarize

In our opinion, we believe that China will come out on top in a prolonged trade war between the U.S. and China. Unlike U.S. President Trump, China's President Xi does not have to answer to the public in a midterm election in 2026, and the Chinese population is accustomed to complying without major protests.

We believe that Trump's upcoming moves regarding tariffs will be influenced by the 10-year interest rate, lobbying from Corporate America - including recent warnings from retail chains about empty store shelves and finally, opinion polls and consumer confidence. This has already begun to play out.

Trade between China and the U.S. is substantial, and neither country can do without the other or find substitutes for each other’s production and demand when it comes to scale.

Even if current tariffs are reduced, trade between the U.S. and China will decline significantly, with negative implications for growth. While the U.S. flirts with a recession, China will likely be able to maintain growth of 3.5–4.0% in 2025, supported by increased monetary and fiscal stimulus.

As a result of slowing growth, idle production capacity, and a larger supply of goods in the domestic Chinese market, we expect Chinese inflation in 2025 to be negative, in the range of -0.5% to 0.0%.

Nevertheless, we believe the Chinese Renminbi will maintain its level against the U.S. dollar, but the Chinese authorities will avoid a major weakening of the Renminbi against its CFETS currency basket, as this would compromise the goal of promoting the Renminbi as an alternative reserve and payment currency and discourage FDI and portfolio outflows.

For the broader emerging Asia, the situation could be much worse. The oil price has come down, which to some extent will offset the trade balance impact of weakened exports. Additionally, the deflationary pressure from China, along with a relatively stable Chinese exchange rate policy, will make it easier for central banks to support economic growth through interest rate cuts without having to worry too much about the risk of an undesirable weakening of their respective currencies and inflation.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Danish FSA (Finanstilsynet). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Management A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Legal Disclaimer ©2025 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved