Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Wainø Hansen

Senior Strategist

The U.S. trade strategy toward the BRICS countries has generated significant uncertainty, particularly with respect to India. Despite previously cordial relations with the Trump administration, India has faced elevated tariffs and criticism for its purchases of Russian oil. These actions have fostered distrust and may prompt a reevaluation of India’s geopolitical alignments. The Trump administration’s hardline approach has reinforced cohesion among BRICS nations. It is therefore strategically significant that Indian Prime Minister Modi is undertaking his first visit to China in seven years. Strengthening ties between India and China could complicate U.S. efforts to manage China’s regional and global ambitions, potentially altering the balance of influence in the Indo-Pacific and beyond.

Trump is going tough on India

The White House trade policy directed toward the so-called BRIC countries has made headlines and caused puzzlement. While President Trump has been relatively patient with Russia and its warfare in Ukraine and relatively restrained with tariffs aimed at China after China resolutely retaliated against Trump’s Liberation Day tariffs with tariffs in kind, Brazil’s President Lula and South Africa’s President Ramaphosa have felt the rough edge. Brazil has felt Trump’s tariffs because of the country’s legal case against former President Bolsonaro, while South Africa has been the target of Trump’s anger and unsubstantiated accusations of executions of white South African farmers. However, what has really surprised is Trump’s treatment of India.

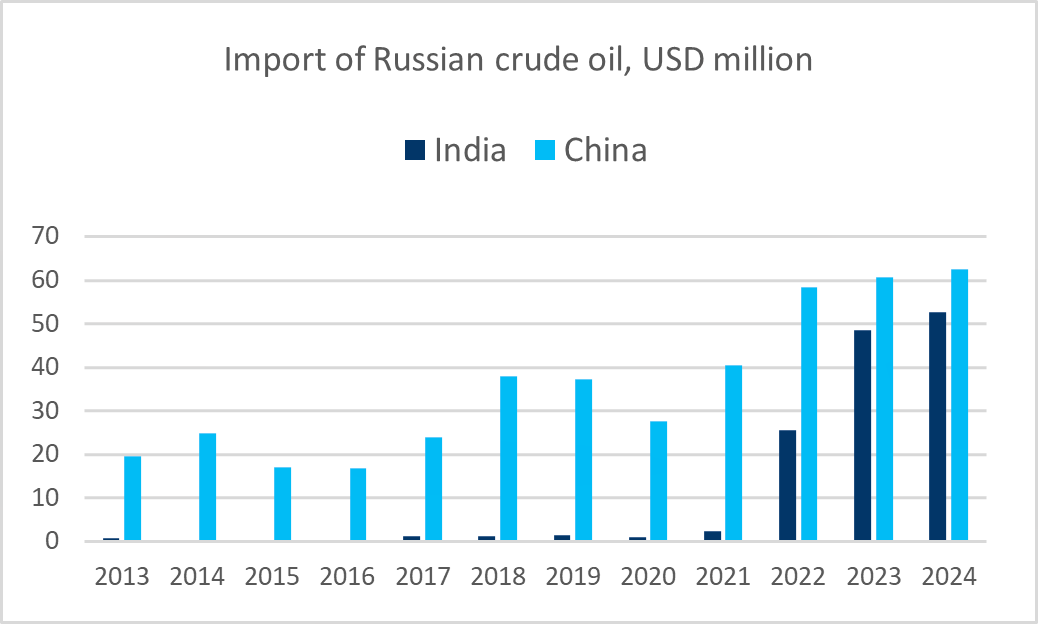

India’s Prime Minister Modi, who had already developed a friendship with Trump during Trump’s first term, was the first foreign head of state to visit Trump after his inauguration in the White House on January 20, 2025. The meeting took place in a friendly tone as expected and included agreements on increased sales of US military equipment, including F-35 fighter jets, and increased Indian imports of American oil and gas. However, on April 2, the tone changed when Trump announced a surprisingly high reciprocal tariff of 25% on goods imported from India. What is more, India has since been singled out as a scapegoat for the country’s purchase of Russian oil, with an additional tariff of 25% taking effect on August 27. This despite the fact that China imports more Russian oil than India does.

Tariffs are unfair

From the Indian side, the message is clear. The tariffs are considered unfair, and they also point out that the country’s purchase of Russian oil was initially - when the global oil market was “tight” at the start of 2025 and oil prices were high - met with the tacit acceptance of the Trump administration. Had India at that time refrained from buying Russian oil, prices could have risen, which would have been directly contrary to the wishes of the White House. Moreover, what has really frustrated the Indian government and created mistrust toward the Trump administration is Trump’s overtly friendly overtures toward Pakistan, including his hosting of Pakistan’s army chief, Asim Munir, in June.

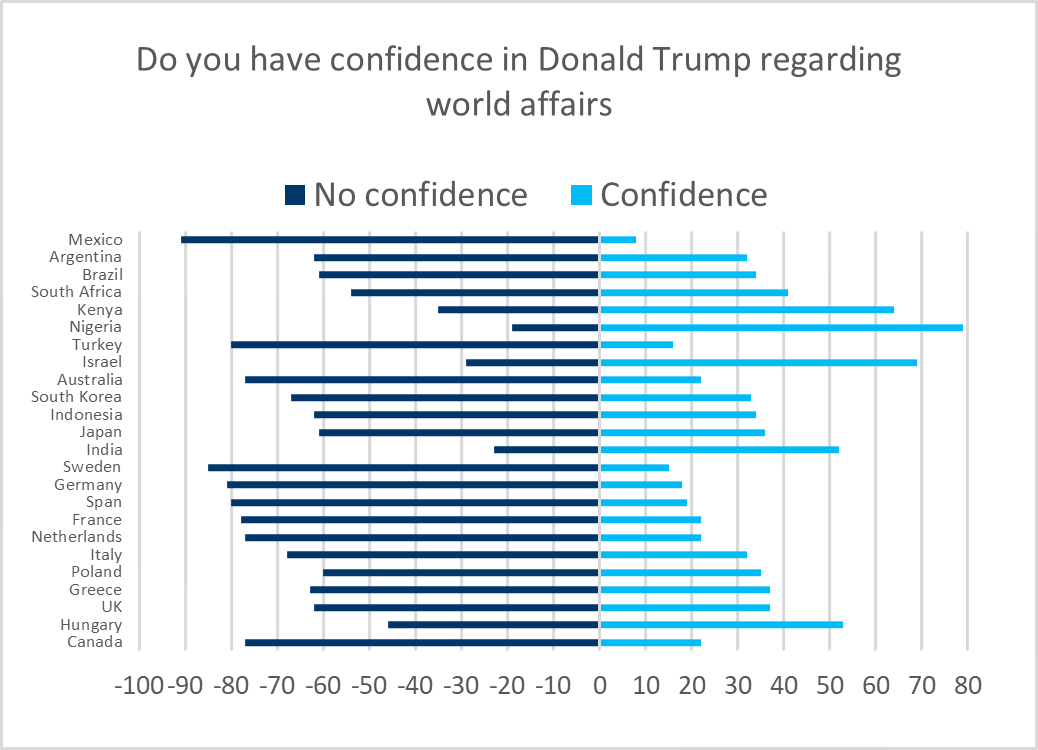

For India, this may mark the beginning of a seismic shift in its geopolitical alignments. Just three months ago, a survey done by Pew Research Center revealed that India was among the few nations where the United States still enjoyed positive favorability, and one of only five where a majority expressed confidence in President Trump. Those times are now over.

Why differentiate

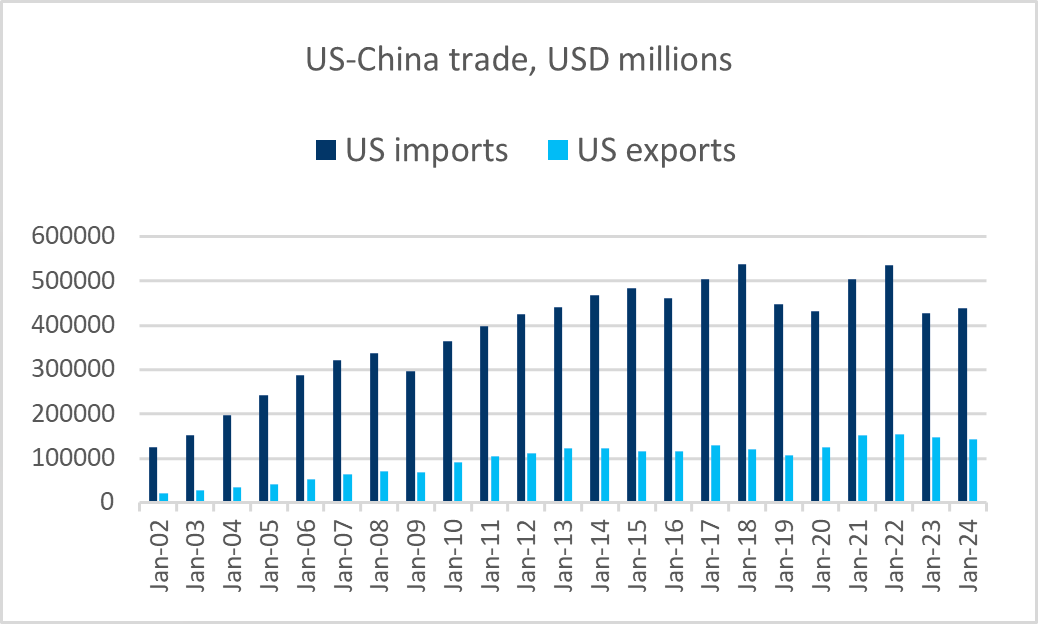

Back to oil related tariffs, we believe that the reason for the U.S. differential treatment of India and China is twofold. On the one hand, the threat of oil-related tariffs directed at India—and the possibility that India might turn to alternative oil suppliers—can be used as leverage against Russia in the negotiations for peace in Ukraine. On the other hand, Chinese exports to the US are substantial, and higher tariffs on Chinese goods could therefore backfire as they are passed through to US consumers. Also, China has already demonstrated its willingness to retaliate immediately with tariffs in kind and to halt the export of rare earth elements to the United States.

Much is at stake

The United States and the West have much at stake. The big question is whether India and Prime Minister Modi see the current conflict as a breach of friendship and an end to many years of efforts to forge closer ties between India and the West including a shared vision for the Indo-Pacific region—and therefore an incentive for India to seek or strengthen other partnerships.

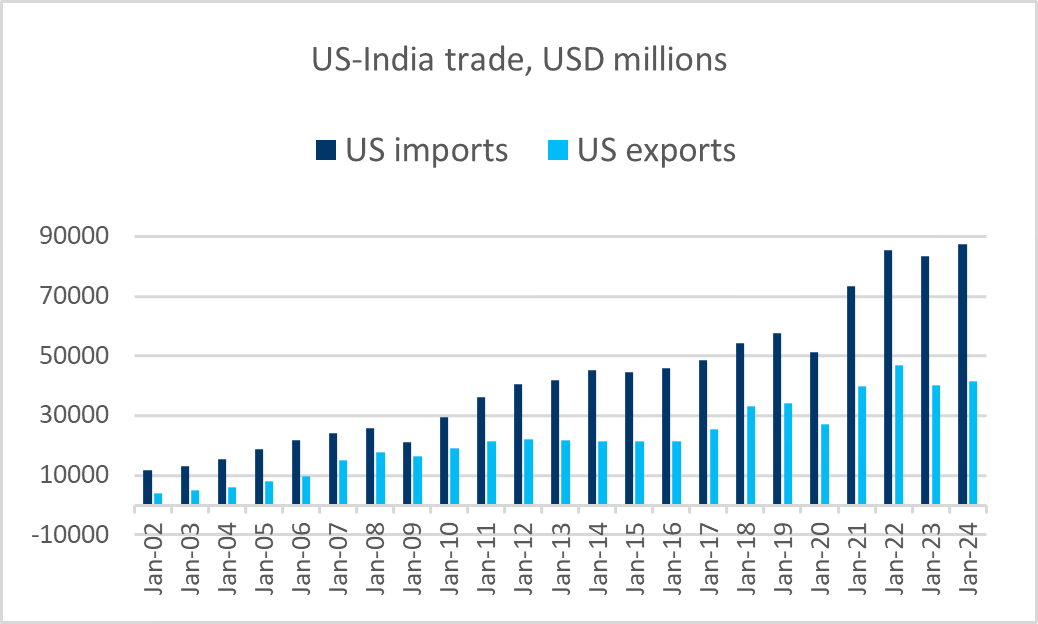

For now, Prime Minister Modi has vowed to take the necessary steps to protect India’s national interests, including promising not to compromise the welfare of Indian farmers and fishermen. In fact, Modi has declared that he is willing to “pay a high price” personally, but this is a balancing act since the U.S. is India’s single most important export market, accounting for 20% of India’s total exports.

Bilateral relations are vulnerable

Without a resolution to the trade conflict, India’s GDP growth will inevitably be affected. The U.S. tariffs impact roughly 55% of India’s total exports to the United States, and if American importers shift to alternative suppliers in Vietnam and Bangladesh—both of which face lower tariffs than India—it will hurt. Some estimates suggest that GDP growth could be reduced by 0.5 percentage points.

A potential meeting with President Trump, when Prime Minister Modi is scheduled to attend the United Nations General Assembly in New York on September 23, could become a turning point—one that might ease trade tensions and restore relations between India and the U.S. Without a resolution, bilateral relations will suffer—perhaps permanently—and China would in that case gain a strategic advantage at the expense of the United States.

Trump, BRICS, and the SCO

President Trump has made no secret of the fact that he considers BRICS to be an unfriendly organization. However, through the U.S.’s discriminatory treatment of India and China, along with general American sanctions and trade tariffs, Trump has effectively given the BRICS countries a new argument for closing ranks and increasing trade among themselves (the first incentive came when the U.S. and the EU froze Russia’s currency reserves in the wake of its invasion of Ukraine).

We do not believe it is a coincidence that Indian Prime Minister Modi will attend the Shanghai Cooperation Organization (SCO)[2] summit in Tianjin, taking place at the end of August. For Modi, this marks his first visit to China in seven years, and beyond sending a signal to the United States, it is also a sign that relations between the two populous nuclear powers and economic heavyweights have improved significantly since the deadly border clashes in 2020, when relations between the two countries cooled substantially.

India and China

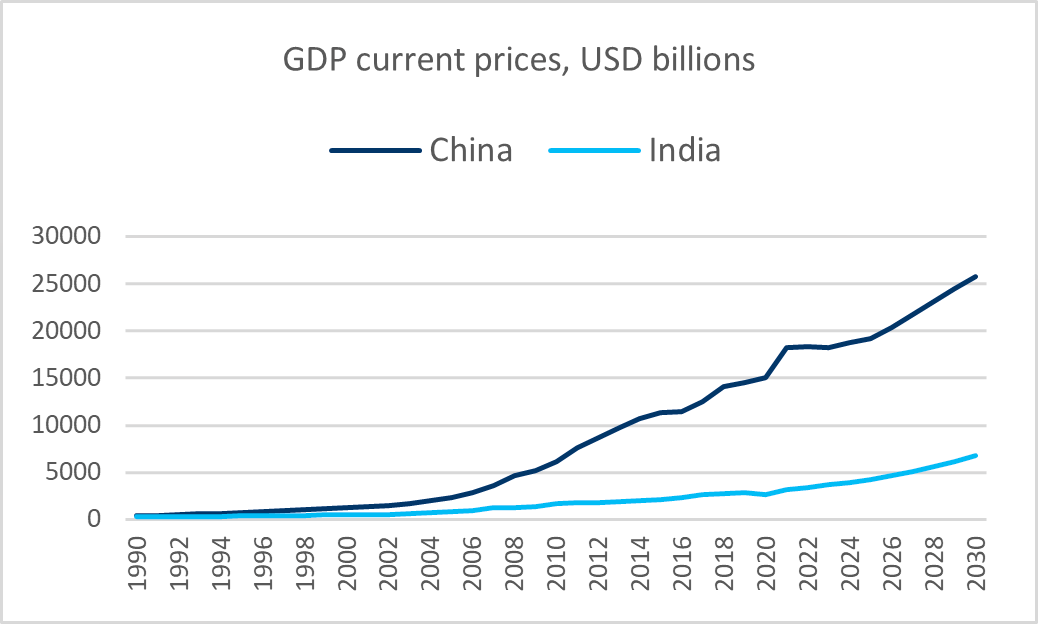

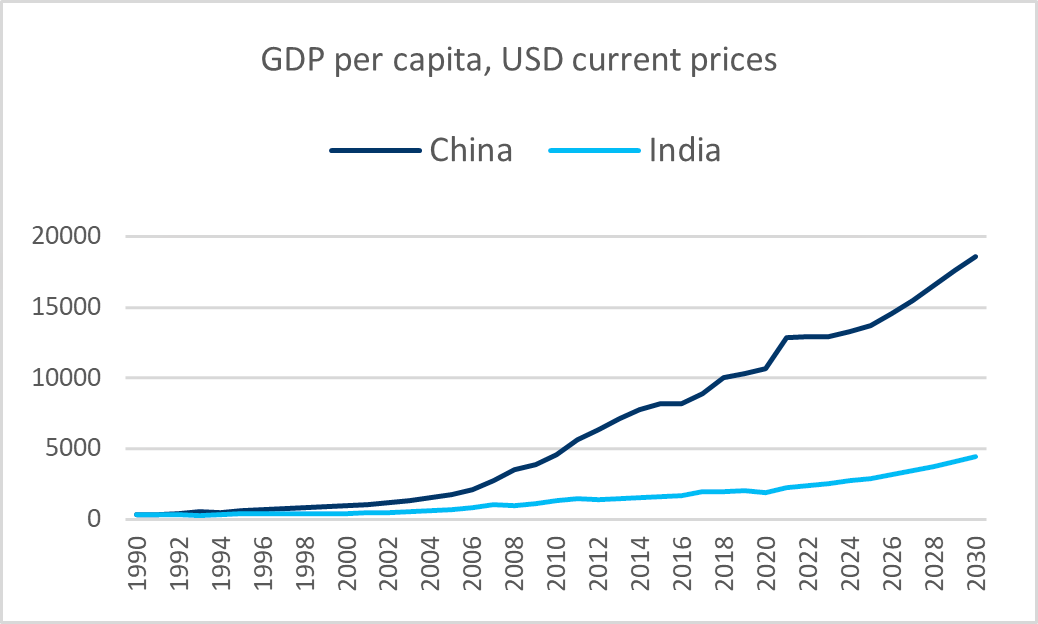

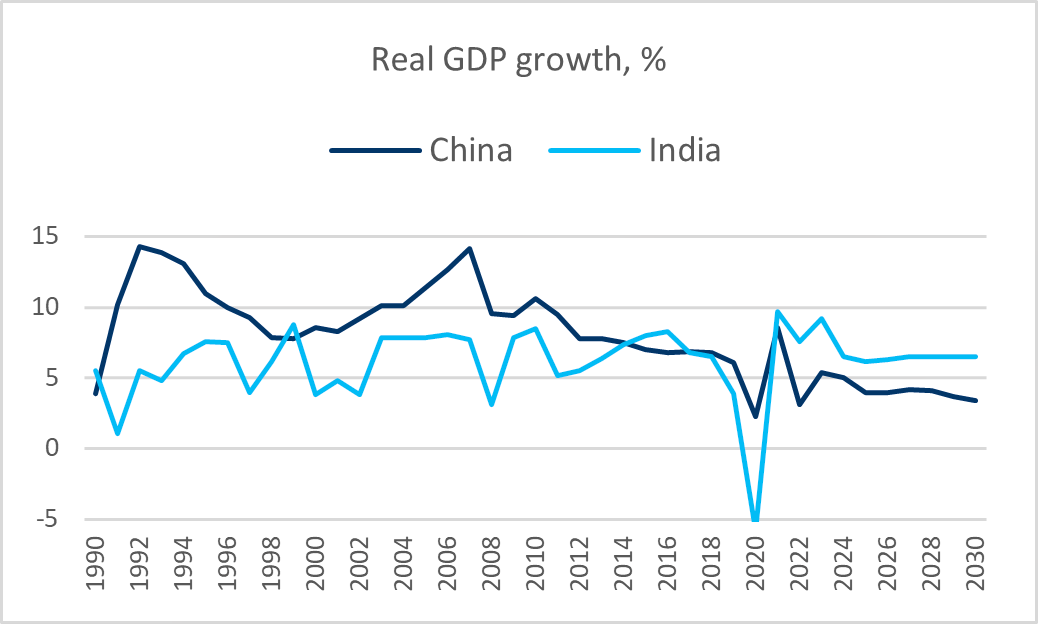

India and China are both heavyweights in terms of population and economy, but while their populations are roughly the same size, China is clearly dominant economically. Measured by nominal GDP and GDP per capita, China has significantly outpaced India since the 2000s, when China first joined the World Trade Organization (in 2001) and subsequently benefited from the Western world’s industrial outsourcing.

India has not, in the same way as China, managed to raise its GDP per capita, but there are clear signs that the coming years will lead to a gradual convergence in terms of economic scale. Since 2020, the Indian economy has, in fact, begun to grow faster than the Chinese economy.

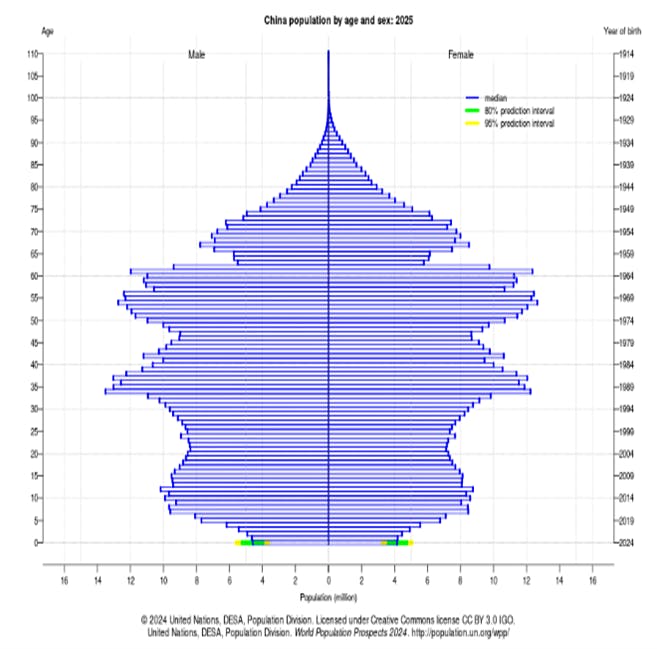

In addition, India benefits from a more favorable and productive demographic composition, which in the long term we believe should support the Indian economy relative to China’s, where an aging and less productive population will increasingly leave its mark on the economic data.

India’s trade deficit a present challenge

At present, India’s biggest challenge is likely the country’s trade deficit—both globally and with China—a problem that will only worsen if its exports to the U.S. continue to face American tariffs.

Regarding trade with China, the Indian embassy in China has expressed concern that although bilateral trade has grown exponentially, it has also resulted in India’s largest trade deficit with a single country, amounting to USD 99.2 billion in 2024.

Over the past five years, India’s primary exports to China have consisted of iron ore, light naphtha, p-xylene, shrimp, and castor oil. However, this has been far outpaced by a rising volume of imports from China, including machinery, electronics, personal computers, monolithic integrated circuits, parts of telephonic/telegraphic equipment, lithium-ion batteries, and fertilizers.

The growth in bilateral investments has lagged far behind the growth in trade. While both India and China have targets for attracting investments from the rest of the world, China’s direct investments in India between 2015 and 2023 amounted to a total of USD 3.2 billion, including a modest USD 60.3 million in 2023. By comparison, India’s direct investments in China from April 2000 to March 2025 amounted to a modest USD 2.5 billion, equivalent to an average of USD 100 million per year.

As mentioned above, these are issues that Prime Minister Modi is expected to address during his upcoming visit to China.

U.S. Foreign and Trade Policy: Potential implications

U.S. foreign and trade policy appears highly interlinked, with President Trump employing tariffs as a “multi-purpose instrument” for a wide range of objectives, from judicial interventions (e.g., Brazil) to facilitating peace negotiations (e.g., Ukraine-Russia, India-Pakistan, Thailand-Cambodia). Last but not least, the Trump administration views tariffs as a means to generate revenue and to protect as well as create American jobs.

The current U.S. approach toward India carries significant financial and strategic risks. While the Trump administration has unequivocally affirmed the non-negotiable status of the dollar as the global reserve currency, the potential for financial repression remains a looming concern. Policies that push India closer to China and the Shanghai Cooperation Organization (SCO) risk incentivizing these countries to seek alternatives to the dollar and coordinate on shaping a parallel global order, including enhanced regional trade and military cooperation.

From a U.S. strategic perspective, managing China’s ambitions in the South China Sea (including Taiwan) and beyond would be substantially easier if India maintains a position of relative neutrality while remaining favorably disposed toward the West. The coming weeks will be critical. Will India’s Premier minister Modi turn his back on the US and will U.S. administration recognize the strategic importance of India in this context.

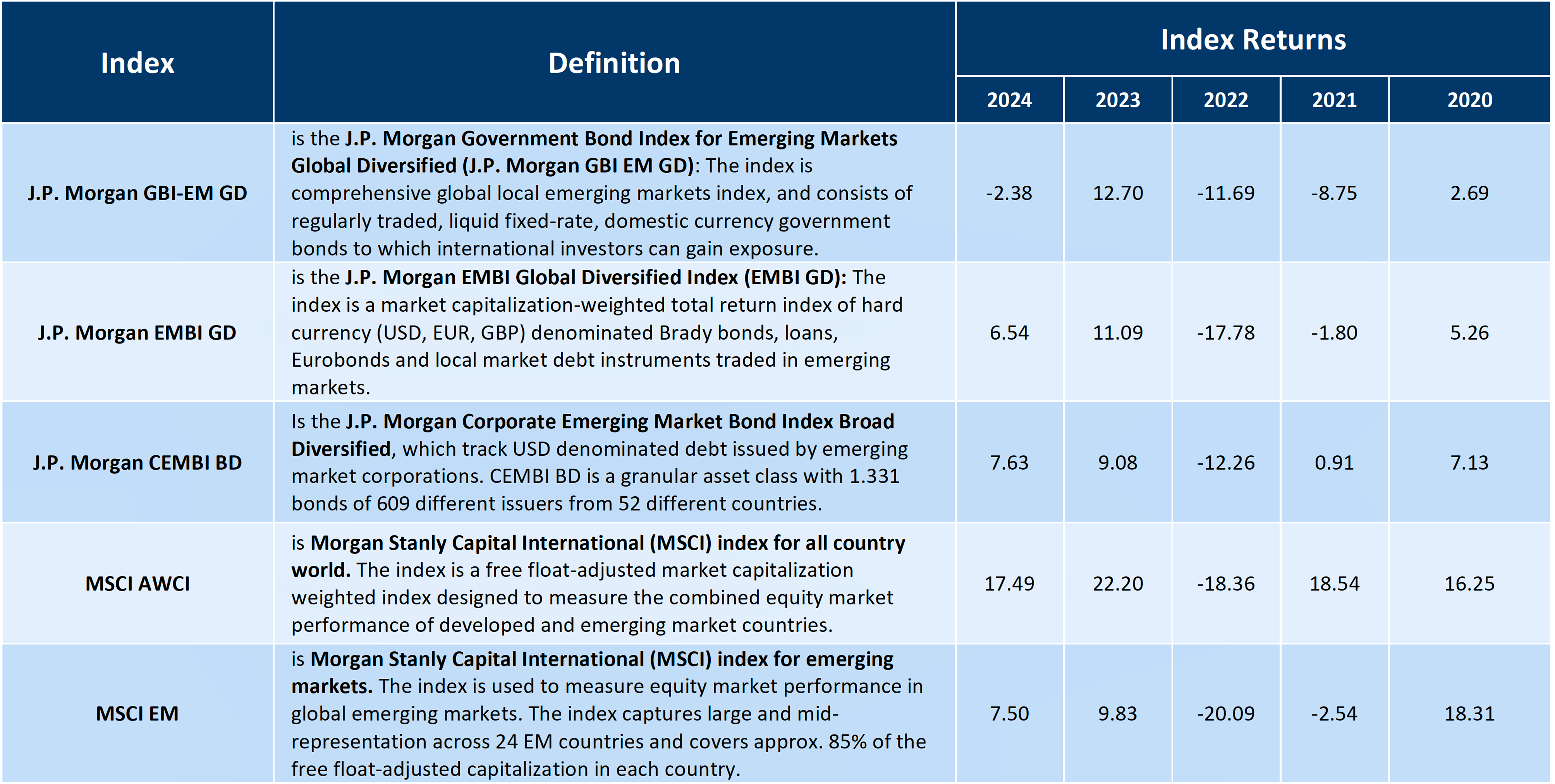

India and China in Benchmarks

From a global investment perspective, India and China are hard to ignore. In JP Morgan’s local currency debt index, the GBI EM Global Diversified, India and China each account for 10%, whereas their country weights in JP Morgan’s sovereign dollar debt index, the EMBI Global Diversified, are more modest at 0.78% and 3.49%, respectively. In JP Morgan’s corporate dollar debt index, the CEMBI Broad Diversified, India has an index weight of 3.99%, while China’s weight is 6.30%.

Turning to equities, India’s and China’s weights in the MSCI All Country World Index are approximately 1.75% and 2.55%, respectively, while their weights in the MSCI Emerging Markets Index are approximately 16.40% and 24.30%, respectively.

[2] The SCO was founded in 2001 and today includes China, India, Pakistan, Iran, Russia, Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan, and Belarus—countries that can hardly be described as “best of friends” of the United States. In addition, there is a list of dialogue partners and observers, including Egypt, Turkey, the UAE, and Saudi Arabia. In many cases, these are the same countries that appear on the BRICS membership list or have expressed interest in joining BRICS.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Managment A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438.. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Legal Disclaimer ©2025 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved