Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Witold Bahrke

Senior Macro and Allocation Strategist

Summer doldrums - what happened?

Until recently, markets have weathered negative news remarkably well. Over the last few days, however, the negative newsflow seems to have reached a critical mass, triggering a spike in volatility and a sell-off in risk assets. The market impact is widespread, but centers around areas such as Japanese currencies and equities as well as US tech stocks. What has changed, causing this shift in the market mood? We see four key reasons for the recent sell-off:

Payrolls report fueling a recession narrative: The US job market report for July has been weak, but not awful. Monthly job growth stood at 114 thousand, potentially held down by bad weather. However, Sahm’s famous recession rule was triggered as the 3-month moving average of US unemployment rate has now risen by 0.5%-pt. above its 12-month low[1]. This has historically been a strong recession indicator and rhymes with our long-held expectation of a mild recession in the US, starting within the next 6-9 months.

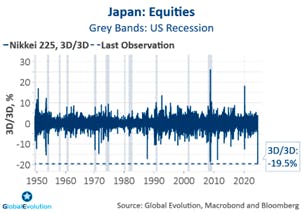

Policy divergence: Historically, where the Fed goes, other central banks follow – but not so much this time around. The Bank of Japan recently hiked rates and signaled further hikes, while Fed chair Powell put a rate cut on the table for the September meeting. Policy divergence always has the potential to create market disruptions. In Japan’s case, the impact is widespread as Japan traditionally is a provider of liquidity through yen-funded carry trades. Higher Japanese rates implies that these carry trades (e.g. borrow in Yen and investing in higher-yielding EM bonds) have become less profitable and are now being unwound to some degree. Further, a strong Yen is hurting Japanese exporters, contributing to a historic decline in Japanese equities (see figure 1).

Poor Liquidity: Summer and August, in particular, is often a period of poor market liquidity, amplifying any potential market move. On top, short-term Dollar liquidity has taken a turn for the worse. US bank’s reserves at the Fed – a crude measure of Dollar liquidity provision to the wider financial sector - last week showed the first year-over-year decline since August 2023[2].

Positioning unwinds: The abovementioned policy divergence has been exacerbated by the unwind of big short positions in the Japanese Yen, further pulling the rug from under Yen-based carry positions. In the equity space, negative earnings news combined with crowded positioning have triggered a big sell-off in tech equities. Tech stocks have been darlings of the equity investor community, which naturally increases the vulnerability to any negative news amid very crowded positioning and elevated valuations.

Road ahead: Mild recession, but not panic stations

The market narrative has shifted at record speed from being dominated by goldilocks hopes to recession anxiety . Our long-held view has been that the US is heading for a mild recession, triggered by the lagged impact of past interest rate hikes and a reversing fiscal impulse on GDP growth. In other words, the signals from the US labor market must be taken seriously. Consequently, the medium-term market direction is one of lower core yields and wider credit spreads. All being said, we do not think this is panic stations and would caution against extrapolating recent market moves.

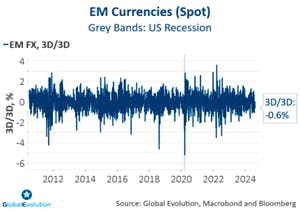

First, the market rout is not broad-based enough to create a panic-mode that risk feeding on itself. Case in point, while tech stocks are beaten up, the equal weighted S&P 500 index is has been performing much better. In the EM space, some classic carry currencies like the Mexican Peso are suffering big losses. However, the decline in broad EM FX is nothing out of the ordinary (see figure 2). The Euro – despite its procyclicality - is actually up versus the Dollar over the past few days. If panic reigned and investors were seriously worried about the global economy, the Euro should also depreciate.

This brings us to our second point: The real economy. While we have expected a mild recession for some time, there’s nothing on the data front suggesting it’s time to run for the hills as a severe recession is not on the cards. Take the recent US job report. Unemployment is suggesting a recession ahead. But a job growth of more than 100.000 per month is signaling a gradual slowdown, not a sudden stand-still. In addition, inflation has cooled somewhat in the US, finally allowing the Fed to cut interest rates at a relatively early stage of the slowdown. Markets are pricing 125 basis points of Fed rate cuts over the coming three meetings at the current juncture and a better than equal probability of an emergency cut in the very near-term. This seems a bit overdone. However, a cutting cycle is likely to start in September, in itself limiting the downside risk to the global business cycle.

The EMD perspective

In other words, there are good reasons not to extrapolate the recent short-term market moves. Nevertheless, the cyclical backdrop is weakening. We therefore believe a defensive bias in our overall EMD asset allocation and within our main strategies is warranted. In the blended EMD asset allocation strategy, we have been overweight higher-rated segments like EM corporate debt for some time, We have held an underweight position in EM currency risk throughout the year. Within Global Evolution’s local currency strategy, we prefer relatively defensive currencies within the high yielding segments like the Peruvian Sol, while being underweight e.g. Mexican Peso. In hard currency space, we have reduced our exposure to low-rated credit. Frontier markets as such have a relatively low beta given a large domestic investor share compared to the other main segments of EM debt, limiting the vulnerability to current market hick-ups.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“Global Evolution DK”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). Global Evolution DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

Global Evolution DK has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under the Firm Reference Number 954331.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), an SEC registered investment advisor. Registration with the SEC does not infer any specific qualifications Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is an wholly-owned subsidiary of Global Evolution Asset Management A/S (“Global Evolution DK”). Global Evolution DK is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Global Evolution is affiliated with Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker dealer, Conning Asset Management Limited, Conning Asia Pacific Limited and Octagon Credit Investors, LLC are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has offices in Boston, Cologne, Hartford, Hong Kong, London, New York, and Tokyo.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. Conning, Inc. is also registered with the National Futures Association and Korea’s Financial Services Commission. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316), Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this website constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2025 Global Evolution - All rights reserved