Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Wainø Hansen

Senior Strategist

Restructurings making progress

Restructuring negotiations under the G20’s so-called Common Framework process have been challenging and protracted but finally yielded results in 2024. The progress is largely due to the development of mutual trust and experience among stakeholders, including non-traditional official creditors like China, India, and Saudi Arabia, which have accelerated the restructuring process.

Zambia and Ghana have successfully concluded debt restructuring negotiations with bondholder committees this year, both under the Common Framework as well as though other methods. Sri Lanka concluded its restructuring negotiations successfully with the process notably faster than it was for Suriname. Ghana and Sri Lanka are awaiting bondholder votes to secure the necessary majority. Ukraine announced its agreement with bondholders on 22 July, but it has yet to be formally finalized. Remaining countries in default include Lebanon, Venezuela and Ethiopia.

We also note a decline in emerging market sovereign defaults and requests for comprehensive debt relief since the peak in 2021 and 2022; Ghana's request in January 2023 was the last significant instance (index weight close to 1%) noting that Ethiopia defaulted in December 2023 (index weight 0.1%)

Noisy credit spreads

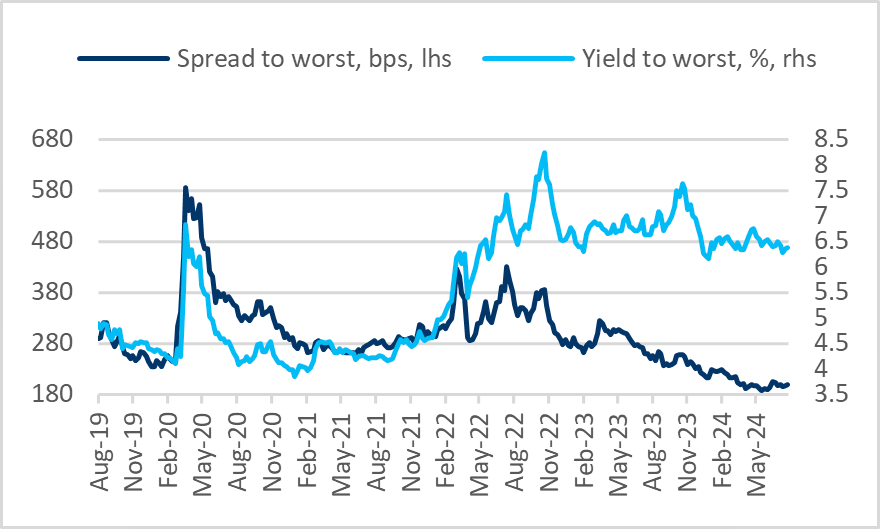

Defaulted bonds in the Emerging Market Bond Index Global Diversified (EMBIGD) have caused significant spread volatility over the past few years.

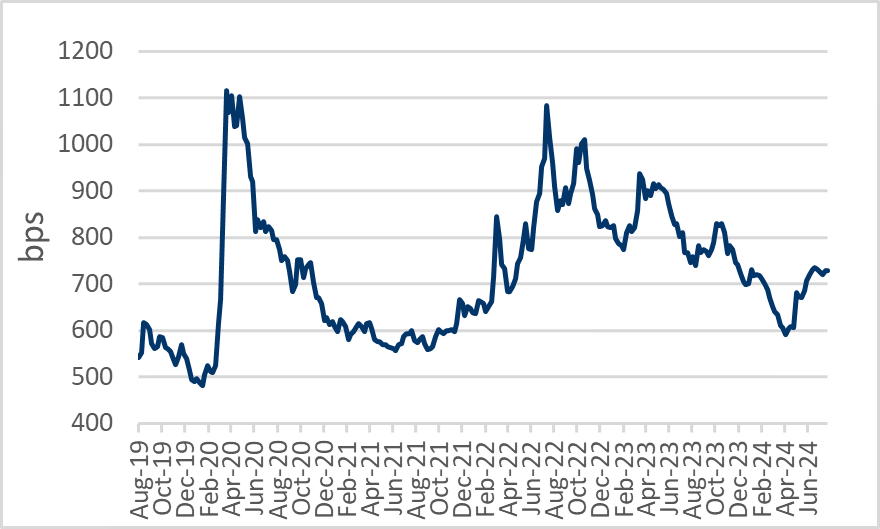

After reaching a peak spread of 1203 basis points in March 2020, the EMBIGD high yield spread narrowed to 556 basis points in June 2021, only to widen again to 1088 basis points in July 2022.

JP Morgan, a prominent index provider for emerging markets hard-currency debt including the flagship EMBIGD, calculates index spreads and yields under the assumption that all payments originally listed in bond prospectuses will be made on time. Hence, benchmark yields and spreads can be misleading, a point we address below.

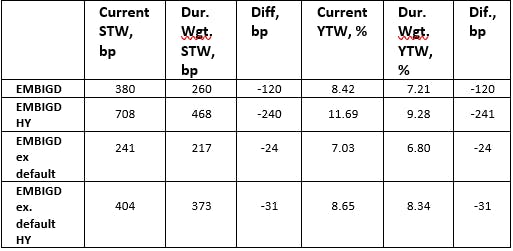

Also, JP Morgan will launch duration-weighted EMBI spread and yield calculations in Q1 2025, running concurrently with the current 'Superbond' method until it is completely phased out at the end of 2025. This will result in a significant decrease in index yields and spreads, as per JP Morgan’s calculations issued earlier this year.

Venezuela a special case

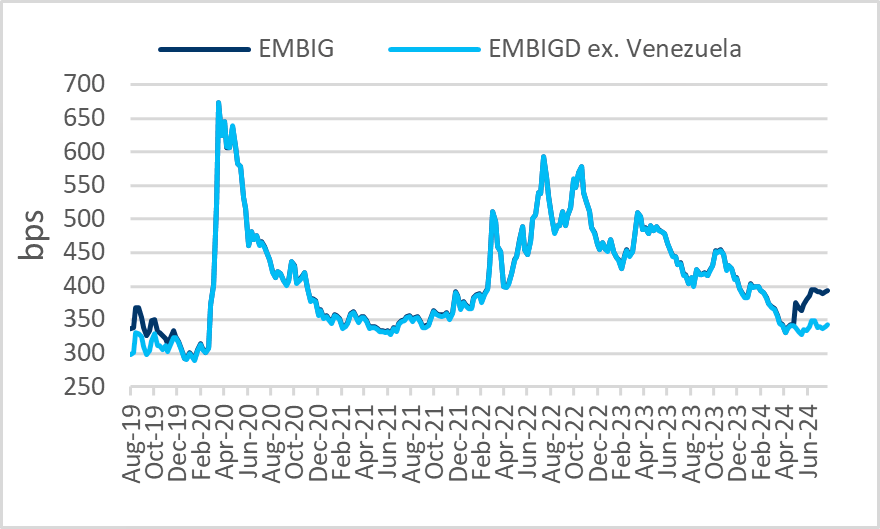

Generally speaking, we consider credit spreads at the index level to be relatively rich, noting that one should not be dazzled by the re-entry of Venezuela into the EMBIGD. Venezuelan Sovereign and Petroleos de Venezuela S.A. bonds completed their three-month phase-in to the EMBIGD benchmarks on June 28, 2024. Following this final installment, Venezuela's index weight was 62 basis points, primarily accounting for the EMBIGD spread widening from 341 basis points on April 29 to 391 basis points on June 28.

Restructured bonds entering the index

Moving forward, the high yield spread will remain volatile as restructured bonds from Zambia, Ghana, Sri Lanka, and Ukraine enter the index at significantly lower spreads compared to their defaulted bonds.

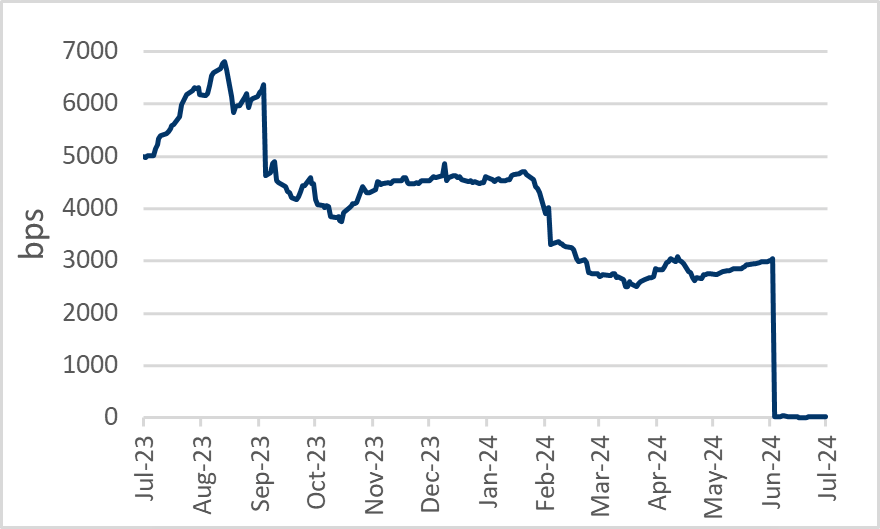

For instance, Zambia’s EMBIGD spread has already experienced a substantial compression from approximately 3000 basis points in late June 2024 to just 12 basis points in mid-July, although this is highly misleading. The reason for this artificially low spread is that Zambia’s restructured B bonds are modelled based on a scenario with a 0.5% coupon and a maturity date in 2053. However, the restructured B bonds include an "upside case" with a potential coupon step-up from 0.5% to 7.5%, a 6.00% payment in kind, and a maturity shift to 2035 if a specified adjustment event occurs.

As a result, since the market anticipates that an adjustment will occur and prices the B bonds accordingly, we have the 12-basis-points spread level as of July 12 based on the index providers’ assumption of a 2053 maturity date. Consequently, Zambia has single-handedly reduced the headline EMBIGD spread by approximately 10 basis points during the two weeks prior to July 12.

It goes without saying that should value-recovery instruments become more prevalent in restructuring deals, the headline EMBIGD spreads may become increasingly opaque.

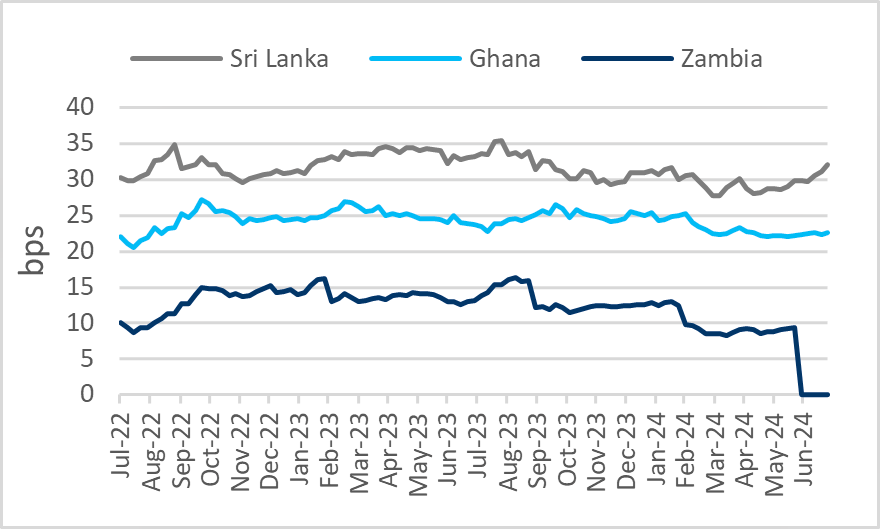

The chart below illustrates the daily spread contribution to the headline EMBIGD spread from Sri Lanka, Ghana, and Zambia, calculated as spread multiplied by floating index weight. As of July 12, these three sovereigns combined contributed more than 50 basis points of the EMBIGD’s 389-basis-points spread. (Note the compression of Zambia’s spread contribution as the restructured B-bond enter the index)

EMBIGD YTM with a pinch of salt

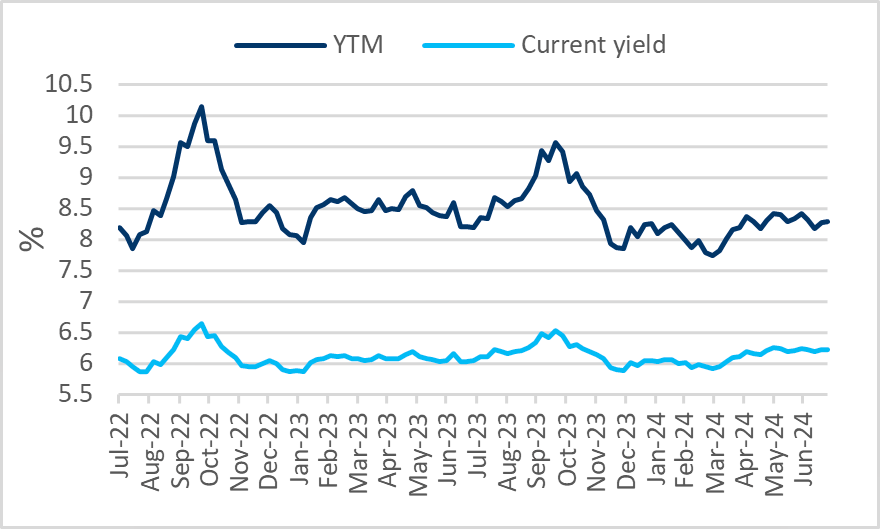

Similar to how the high-yield/high-risk segment of the EMBIGD generates noise in the headline spread, the yield to maturity (YTM) of the index can also be misleading due to the impact of defaulted and distressed pricing. Current yield may provide a more accurate measure of the index yield, as YTM assumes that bonds will mature at par, which is clearly not the case for bonds already in default and undergoing restructuring.

However, as restructured bonds enter the index, its YTM should converge toward the current yield, providing a more accurate representation of both the spread and YTM. Although spreads and YTM may appear less attractive following the entry of restructured bonds, at least investors can have greater confidence that coupons will be paid.

Alternatively, to avoid the noisy high-yield/high-risk segment, investors should examine the EMBIGD excluding CCC-rated bonds spread and YTM, or the EMBIGD excluding defaulted bonds, to gain a clearer understanding of the relative value and the "true" spread and YTM.

Why invest in EM sovereign dollar debt?

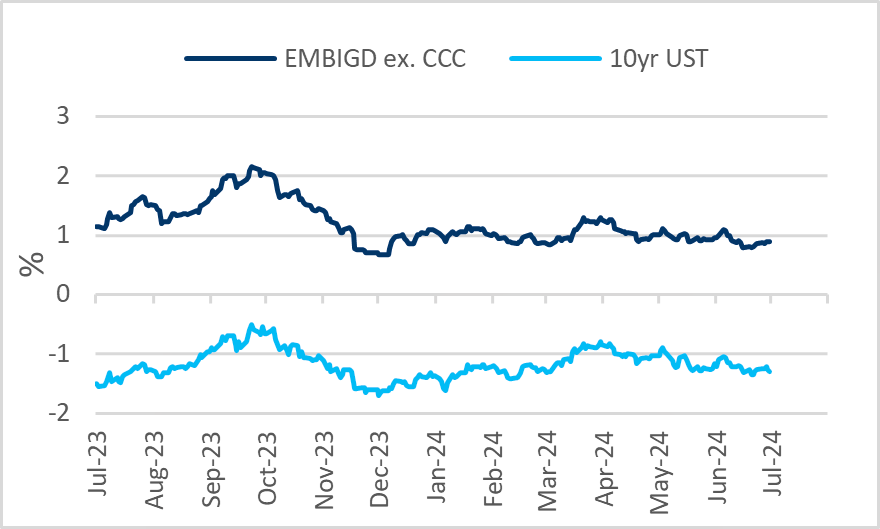

Despite spreads screening tight in a historical context, the duration exposure of the EMBIGD (6.59) combined with the YTM of the index excluding CCC bonds still provides investors with a positive all-in carry over the upper bound of the U.S. Fed funds rate. This contrasts with the duration exposure via 10-year U.S. Treasury notes (7.88), which are currently yielding around 4.20%. (as of July 26, 2024)

One might also consider that the term premium for 10-year U.S. Treasury bonds arguably is nonexistent, leaving investors without compensation for fiscal risks, including a U.S. debt-to-GDP ratio increasing from approximately 99% currently to 122% by 2034, per projections by the non-partisan U.S. Congressional Budget Office. For reference, the IMF has aggregate EM-debt-to-GDP at 69.4% in 2024.

Moreover, we believe the positive carry of the EMBIGD (even if excluding CCC-rated bonds) offers better protection against a potential Trump policy-induced bear steepening of the U.S. Treasury yield curve than duration exposure to U.S. Treasury bonds.

In our view, investing in EM sovereign dollar debt thus presents an opportunity for investors seeking better returns and risk management in the current economic environment.

IMPORTANT

There will be significant differences between a client portfolio’s investments and the index. Indices may or may not reflect the reinvestment of dividends; interest or capital gains and the indices are not subject to any of the incentive allocation, management fees or expenses to which a client portfolio may be subject. It should not be assumed that the client portfolio will invest in any specific securities that comprise the index, nor should it be understood to mean that there is a correlation between a client portfolio’s returns and the indices. Nor can one assume that correlations to the indices based on historical returns will persist in the future. The Index is included for informational purposes only.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Managment A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438.. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2025 Global Evolution - All rights reserved