Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Wainø Hansen

Senior Strategist

Trump is making headlines

The US presidential election draws nearer. Former President Donald Trump has proven unbeatable in the preliminary Republican caucuses/primaries, and a recent poll conducted by Ipsos/Reuters shows his progress, from a tie with current US President Joe Biden in early January to a lead of 40% against 34%.

Not surprisingly, Trump has become emboldened, and his well-known bombastic rhetoric has strengthened. He has announced a universal 10% import tariff and is considering imposing a tariff of 60% on American imports from China.

In other words, a trade war is looming.

Head of states, take notice

Leaders of the affected countries remember all too well Trump's aggressive attitude and determination when he imposed tariffs on Chinese and EU imports during his 2017-2021 presidency. Therefore, it is no surprise that the EU, in a timely show of caution, has begun drafting trade plans in response to possible tariffs.

It is not only a Trump victory that can trigger import restrictions on Chinese goods. The Biden administration has recently warned Chinese officials that price dumping their goods on the international market will be met with anti-dumping measures. Meanwhile, EU Competition Commissioner Margrethe Vestager said that the trade bloc is ready to use trade restrictions against unfair Chinese practices.

Foreign policy sea change

If Trump is re-elected president, global trade and supply chains might face significant challenges, but there could also be a notable shift in foreign policy.

Trump's comments regarding Taiwan have raised uncertainty about continued American support for an independent Taiwan if China flexes its military muscles. Similarly, the presence of the US Navy as a counterbalance to China in the South China Sea is also uncertain. Taiwanese officials have expressed concern, and in Japan, sources in the foreign ministry also indicate their serious concern about Trump possibly favoring a security agreement with China over support for Taiwan, as such a move would undermine recent efforts by the G7 to contain China.

Turning our attention to Europe and the Middle East, a Trump victory would also create renewed uncertainty about American engagement in those regions.

Trump opposes continued American support for Ukraine, stating that the war must come to an end, and he will ensure it happens. NATO headquarters in Brussels also expressed concerns when Trump, in a recent speech to loyal voters, almost encouraged Russia to attack NATO member countries that do not meet the commitment to spend at least 2% of GDP on defense.

Saudi Arabia had initiated negotiations with the US for a defense deal and the establishment of diplomatic relations between Israel and Saudi Arabia before Hamas's attack on Israel on October 7, 2023. However, as the Saudis announced in January 2024, they are ready to resume negotiations toward a political declaration from Israel about the establishment of a Palestinian state rather than anything more binding. We think the goal is to adopt such a defense agreement while Biden is still in office.

Trump's statements on the war between Israel and Hamas have generally supported Israel, and he has signaled a much tougher stance on Iran.

Current tariffs

Throughout his time in office, President Biden has predominantly upheld import tariffs on goods manufactured in China. Additionally, he has intensified the already tense relationship with China by imposing restrictions on Chinese technology firms operating within the US and limiting American semiconductor exports. These actions stem from concerns regarding China's technological progress and its potential ramifications for US national security.

The Trump administration imposed tariffs on USD 380bn worth of imports (based on 2018 value). The average import tariff on Chinese goods today is 12%, ranging from 25% on imports worth about USD 150 billion, 7.5% on imports worth about USD 100 billion, to 2-3% on the remaining imports (according to the non-partisan nonprofit Tax Foundation).

In this light, Trump's thoughts on increasing the import tariff on all Chinese goods to 60% are incredibly drastic. Calculations by Oxford Economics, sponsored by the US-China Business Council, estimate that such an escalation could cost the US economy USD 1.6 trillion and 700,000 jobs.

Add to this Trump's thoughts on a universal import tariff of 10%; if implemented, it would be a nine-fold increase on the amount of goods subject to import tariffs compared to Trump's first term.

Trump's rhetoric is bombastic and well-received among a non-critical voter base. He has persistently argued that import tariffs bring production and jobs back to the US and that Chinese companies, because of the tariffs, pay billions of dollars to the US Treasury. The latter is a claim that meets little opposition among loyal Trump supporters but is flatly rejected by both Republican and Democratic economists, who point out that tariffs are primarily paid by American households and businesses.

Is it feasible?

Trump is a businessman, and everything is negotiable. We doubt that a 60% import tariff on all Chinese goods is feasible and see it rather as a negotiation offer to China's President Xi.

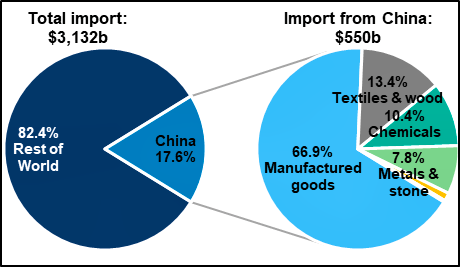

In 2022, Chinese exports to the US amounted to USD 550 billion, equivalent to 17.6% of total American imports. Manufactured goods accounted for the vast majority (66.9%), followed by textiles and wood (13.40%), chemicals (10.4%), and metals/stone (7.8%).

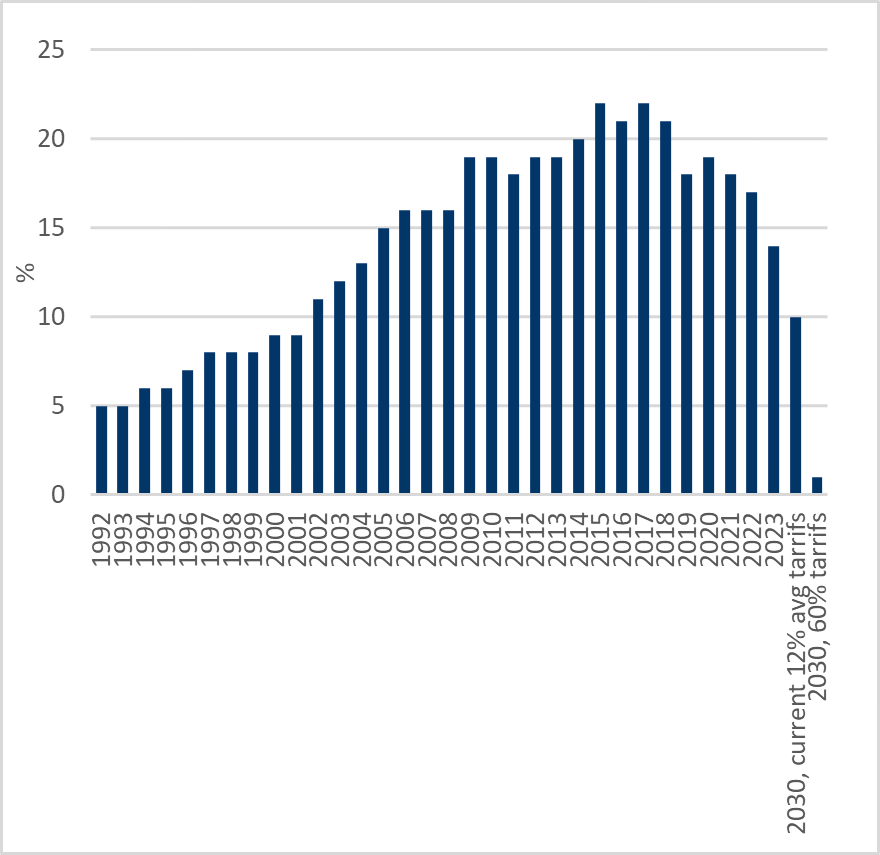

The share of Chinese goods in total American imports peaked at 22% in 2015-2017 and has since steadily declined under the influence of import tariffs and supply chain reorganization in the wake of the COVID-19 pandemic.

Calculations by Bloomberg Economics suggest that the share of Chinese goods in American imports will further decrease to 10% in 2030 if current tariffs are maintained. An increase in tariffs on Chinese goods to 60% will trigger a dramatic drop to just 1%.

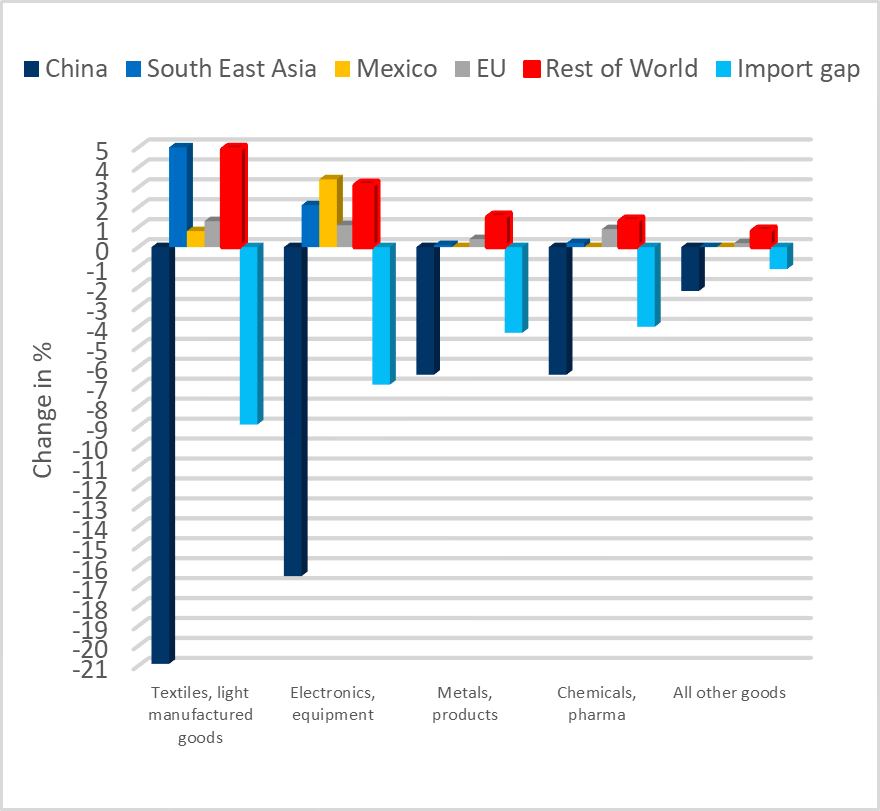

If these estimates prove correct, a 60% import tariff on Chinese goods will force American importers to seek alternatives.

Once more, we question the feasibility of a 60% import tariff on all Chinese goods. However, even a lesser increase could still have significant repercussions on Chinese export volumes to the US. While this will be more costly for US importers, the alternative countries will benefit from increased exports to the US.

Various countries are emerging as alternative manufacturing hubs to China, including:

Vietnam - Rising in importance, especially in textiles, electronics, and footwear, due to lower labor costs.

Mexico - Proximity to the US and favorable trade agreements like USMCA make it attractive for industries like automotive and electronics.

India - With a diverse economy, it aims to increase exports to the US in sectors like IT, pharmaceuticals, textiles, and automotive components.

Taiwan - Known for its semiconductor industry, it could become crucial in supplying more critical electronic components to the US. However, manufacturing capabilities may already be operating at full capacity.

Malaysia - Well-established in electronics, it could expand its role in supplying various goods to the US.

Bangladesh - Major exporter of textiles and garments, increasing its presence in the global apparel market.

Thailand - Diverse manufacturing sector with potential in automotive, electronics, and machinery.

Indonesia - Growing economy, particularly in textiles and electronics, poised for increased exports to the US.

However, their ability to replace China depends on factors like competitiveness, infrastructure, trade policies, and geopolitical stability. Hence, there is a significant risk that the US will face an unmet import need which, if necessary, must be replaced by domestic production.

Green transition and concentration risk

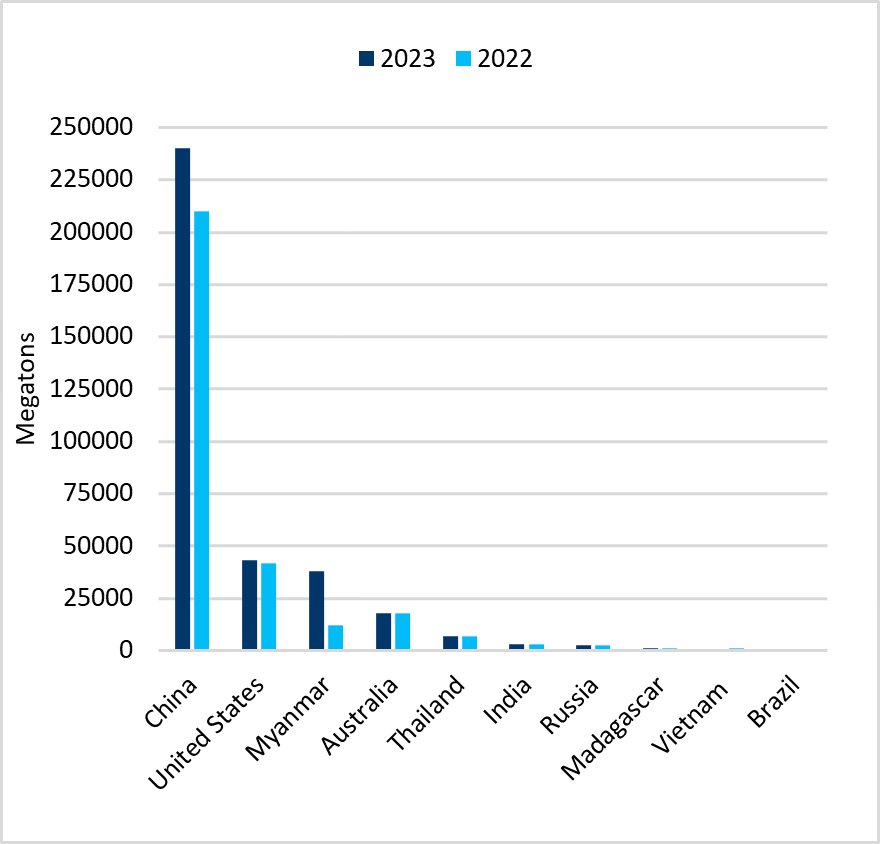

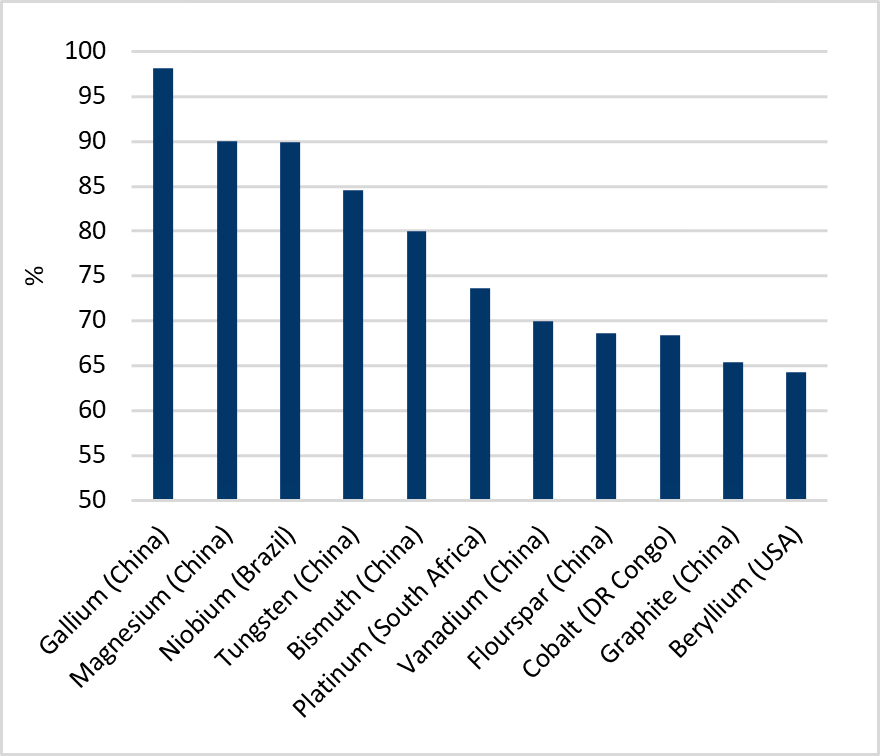

Regarding the green transition, China is currently a significant source of rare earth metals and their processing, as well as critical minerals. Rare earth metals denote a group of 17 chemical elements crucial in several key technologies, including battery electrodes, alloys, magnets, and lasers. Critical minerals including copper, lithium, nickel, and cobalt are vital ingredients in numerous, rapidly expanding clean-energy technologies, ranging from wind turbines and electricity networks to electric vehicles. The demand for these minerals is surging as clean-energy transitions accelerate.

In October 2023, China introduced export restrictions on graphite, a key input in battery production. If a US-China trade war escalates, China could impose additional restrictions on this and other items.

The concentration of rare metals and critical minerals in countries that are hardly considered "best of friends" by the West is a factor that concerns politicians, both in the US and EU.

In this light, it is not surprising that the US and the EU are considering cooperation that would merge the EU's "critical materials club"[1] concept with the Biden administration's "Minerals Security Partnership"[2]. Several potential rare metal projects have already been identified, but the development of new mines and/or processing plants is a lengthy and expensive endeavor, especially if they are to be located in the EU or the US.

In efforts to reduce the geopolitical concentration risk of China's dominance in global rare earth mining, we believe that the US and EU will increasingly encourage and financially support new domestic extraction as well as extraction in Africa and Latin America.

In Africa, rare metal/critical mineral extraction is primarily in countries such as South Africa, Malawi, Kenya, Namibia, DRC, Mozambique, Tanzania, Zambia, and Burundi. In Latin America, Brazil, Argentina, Chile, and Peru are key players with the potential for increased output.

Emerging markets currencies

The Chinese currency will undoubtedly come under pressure if Trump continues his positive momentum in the polls and his bombastic rhetoric aimed at China.

From spring until autumn 2018, the Chinese currency weakened by 10% against the US dollar as a direct consequence of the import tariffs imposed by the Trump administration. In addition to the Chinese currency, it was primarily currencies with a relatively high beta to global growth that were affected, including the euro.

We expect that an increase in tariffs on Chinese goods imported into the US will have a ripple effect on other Asian currencies, while currencies from other geographical regions will come under pressure either due to their beta to global growth or if Trump follows through on his thoughts on a global import tariff of 10%. We note that US tariffs on imported goods produced globally are estimated at 3-4%, covering only 12% of total US imports. A 10% import tariff targeting all US imports would be a significant escalation.

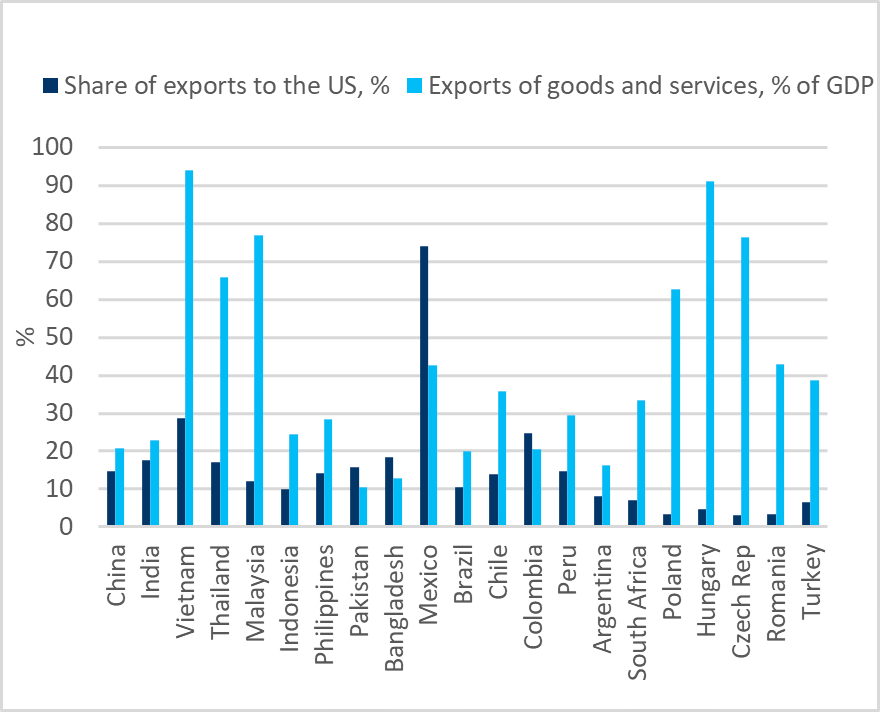

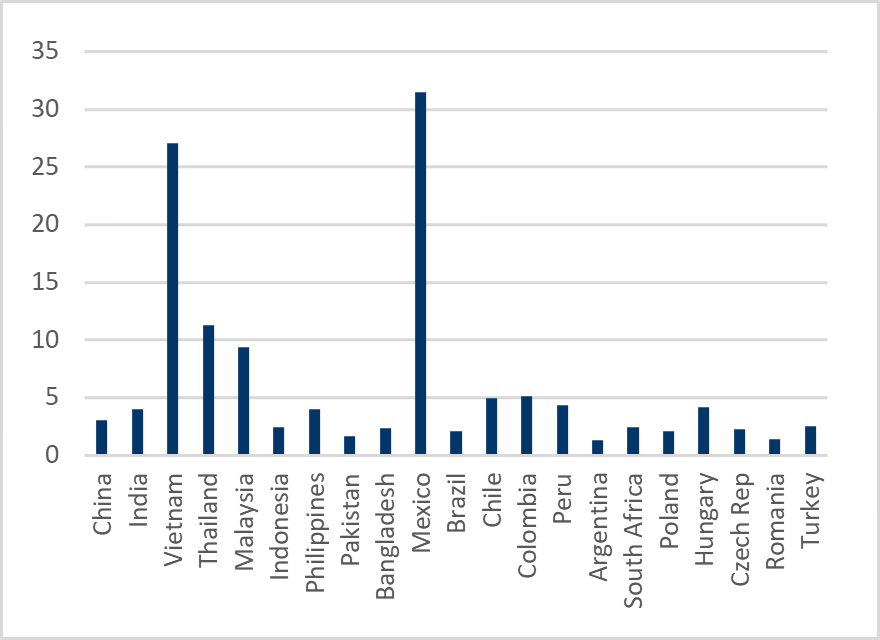

Also, the extent to which a given currency can come under pressure depends on the country's current exports to the US and the prospect of potentially taking over some of China's US exports (i.e., substitution).

The chart below shows a range of selected countries' export exposure to the US as a percentage of its total exports, but also the ratio of exports to its GDP.

The sensitivity of a country’s US exports is quantified by multiplying its size of US exports relative to total exports by the share of exports relative to GDP.

The chart above shows that Vietnam and Mexico stand out with a relatively high export exposure. At the same time, it is relevant to emphasize that a relatively low export exposure in the CE-4 countries could be misleading, as the countries, through their exports to the Eurozone and the euro's high beta to global growth, make the CE-4 currencies vulnerable to a weakening of EUR/USD.

Importantly, the potentially negative currency reaction triggered by a relatively large export exposure to the US can be countered wholly or partially if the country benefits from reorganized supply chains, including taking over parts of the previous Chinese exports to the US.

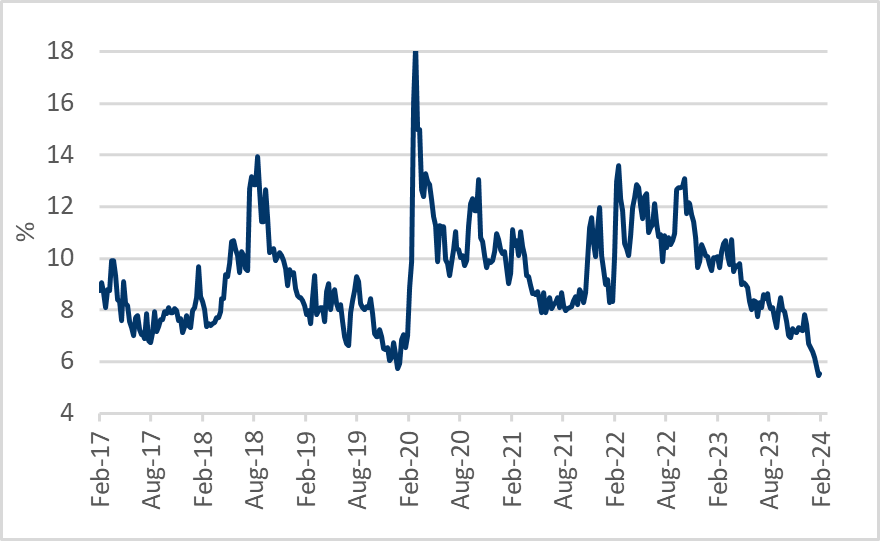

Volatility in emerging markets currencies

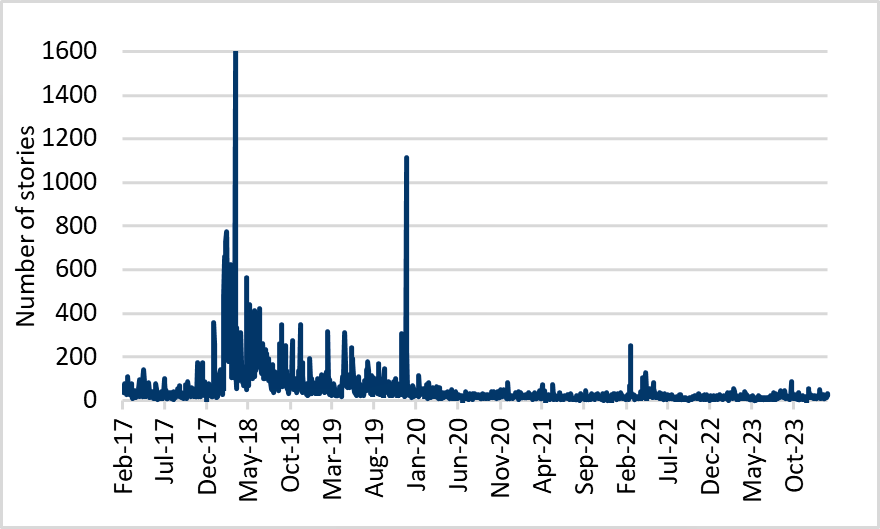

The volatility of emerging markets currencies has fallen to a level last seen in the weeks leading up to the pandemic in early 2020 and is significantly lower than the volatility that prevailed in 2018 when the US-China trade war made headlines.

The current low volatility environment could be explained by a mix of factors including enhanced current account positions, timely monetary tightening that successfully helped bring down inflation, and prudent foreign exchange management. In the context of low volatility, relative-value carry trades have maintained their attractiveness but low volatility also risks complacency.

The inflation gap could narrow

De-globalization efforts, including the implementation of new US import tariffs, are expected to result in higher inflation (all else being equal), but China's surplus manufacturing slack resulting from declining exports may prompt the country to engage in price dumping in markets outside the US. Should this occur, China is expected to continue exporting disinflation, with emerging economies and the EU (assuming no new import tariffs) being the main beneficiaries. This could potentially narrow the inflation differential between developed and emerging economies, thereby supporting the case for long duration in emerging markets local fixed income.

EUR/USD

In February 2024, we revised our 12-month expectation for EUR/USD from 1.12 to a more negative 1.05. The downgrade follows still-robust US job figures, higher than expected US inflation figures, and a resulting higher pricing of the path for the Fed's monetary easing in the coming 12 months.

We believe that a US recession is the most likely outcome in the next 12 months. Additionally, the risk of a global trade war has increased with Trump's recent progress in the polls. Concurrently, a victory for Trump would raise questions about US engagement in geopolitical conflicts in Asia, the Middle East, and Europe.

For the EU/Eurozone it means that member states must allocate more resources to defense with negative consequences for business and consumer confidence and ultimately growth.

All of this is reflected in our portfolio considerations, where the allocation to local bond markets favors high-yield countries and currencies outside of Asia, while the allocation in blended mandates has local bonds and currencies as underweight.

Our Frontier strategy is well-positioned to mitigate the repercussions of a US-China trade war. Frontier markets tend to be more responsive to unique developments than global news, and they are not a primary target for import tariffs, particularly as they supply crucial minerals and rare earth metals that China controls (and may limit its export of).

Much can happen before November 5, 2024, and it is unlikely to be dull. While increased economic and geopolitical uncertainty may lead to increased volatility and risk aversion, it will also lead to new investment opportunities. We approach the challenge confidently.

Disclaimer & Important Disclosures

Global Evolution Fondsmæglerselskab A/S (“Global Evolution DK”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). Global Evolution DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

Global Evolution DK has a United Kingdom branch (“Global Evolution Fondsmæglerselskab A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under the Firm Reference Number 954331.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), an SEC registered investment advisor. Registration with the SEC does not infer any specific qualifications Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is an wholly-owned subsidiary of Global Evolution Fondsmæglerselskab A/S (“Global Evolution DK”). Global Evolution DK is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Global Evolution is affiliated with Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker dealer, Conning Asset Management Limited, Conning Asia Pacific Limited and Octagon Credit Investors, LLC are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has offices in Boston, Cologne, Hartford, Hong Kong, London, New York, and Tokyo.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. Conning, Inc. is also registered with the National Futures Association and Korea’s Financial Services Commission. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316), Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this website constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2025 Global Evolution - All rights reserved