Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Witold Bahrke

Senior Macro and Allocation Strategist

A short Q4 2025 outlook

§ MACRO: Taking stock on three key themes for 2025

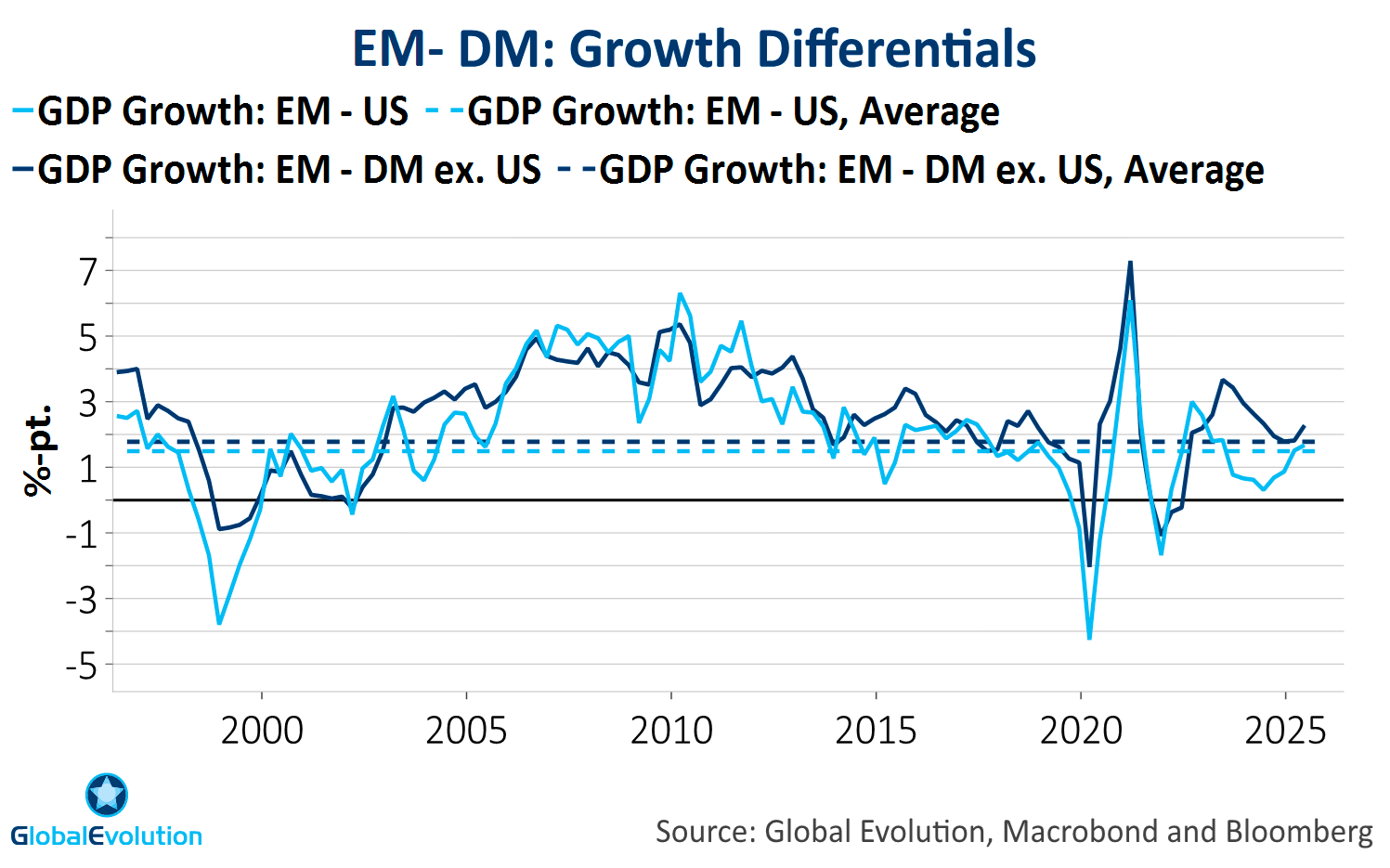

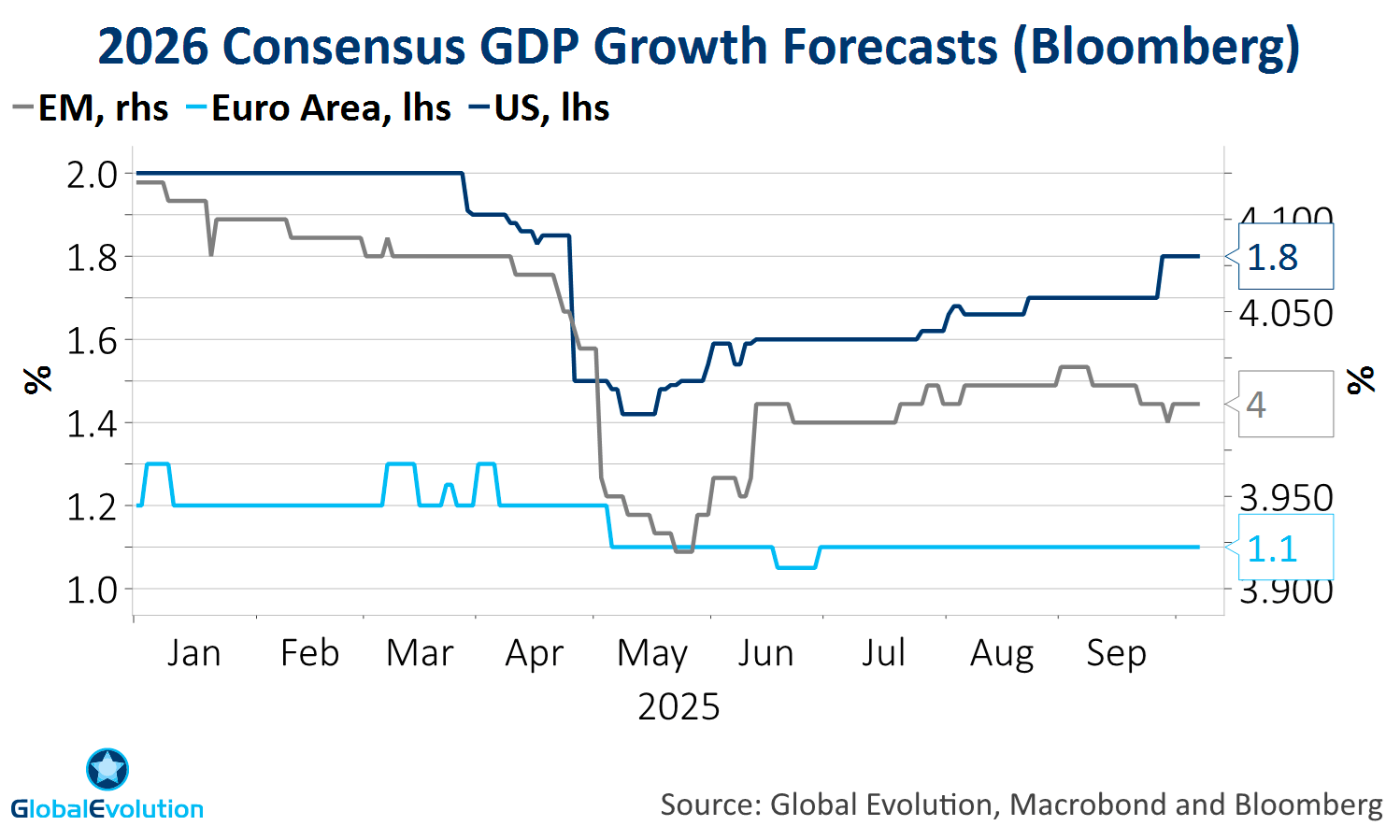

Peak US exceptionalism: Pausing. Reduced policy uncertainty, resilient growth, reduced fiscal concerns due to tariff revenues and an AI investment boom means US growth estimates are being lifted. Chinese momentum disappoints as fiscal stimulus remains measured → EM-DM (ex. US) growth gap should widen, EM – US more sideways (RHS).

Peak policy uncertainty: On track. Trade uncertainty is high, but falling. US effective tariff rate most likely settles below its recession threshold. Trump’s pressure on Fed should be about to peak as he’s underperforming on inflation in the eyes of voters (no.1 concern).

Peak growth pessimism: For now, mostly a DM story as China’s stimulus cycle slows. US recession probability falls as monetary conditions ease, oil price is low and labour lags.

Two-sided RISKS: Overheating/stagflation & recessionary reflexivity (US job market).

§ MARKETS: Solid 12M returns - shifting down into year-end

Don’t extrapolate: Monetary easing and peak policy uncertainty supports EMD, but growth rebalancing takes a breather → positive, but lower EMD returns towards year-end.

Rethink the narrative (I): Tactically moving hard currency to overweight form neutral as support for EM FX from peak US exceptionalism fades and USD weakness is consensus.

Rethink the narrative (II): Structural shifts (higher inflation, level-shift higher in geopolitical uncertainty, higher fiscal leverage) create a more uncertain investment environment. These shifts are driven out of DM, not EM → EMD performed because of elevated uncertainty, not despite of it. Longer-term, these shifts should benefit local currency debt, in particular.

It’s the supply side, stupid: Normally, gauging the business cycle is all about the demand side – not so much this time around → assessing the business cycle is much more two-dimensional than usual – uncertainties abound!

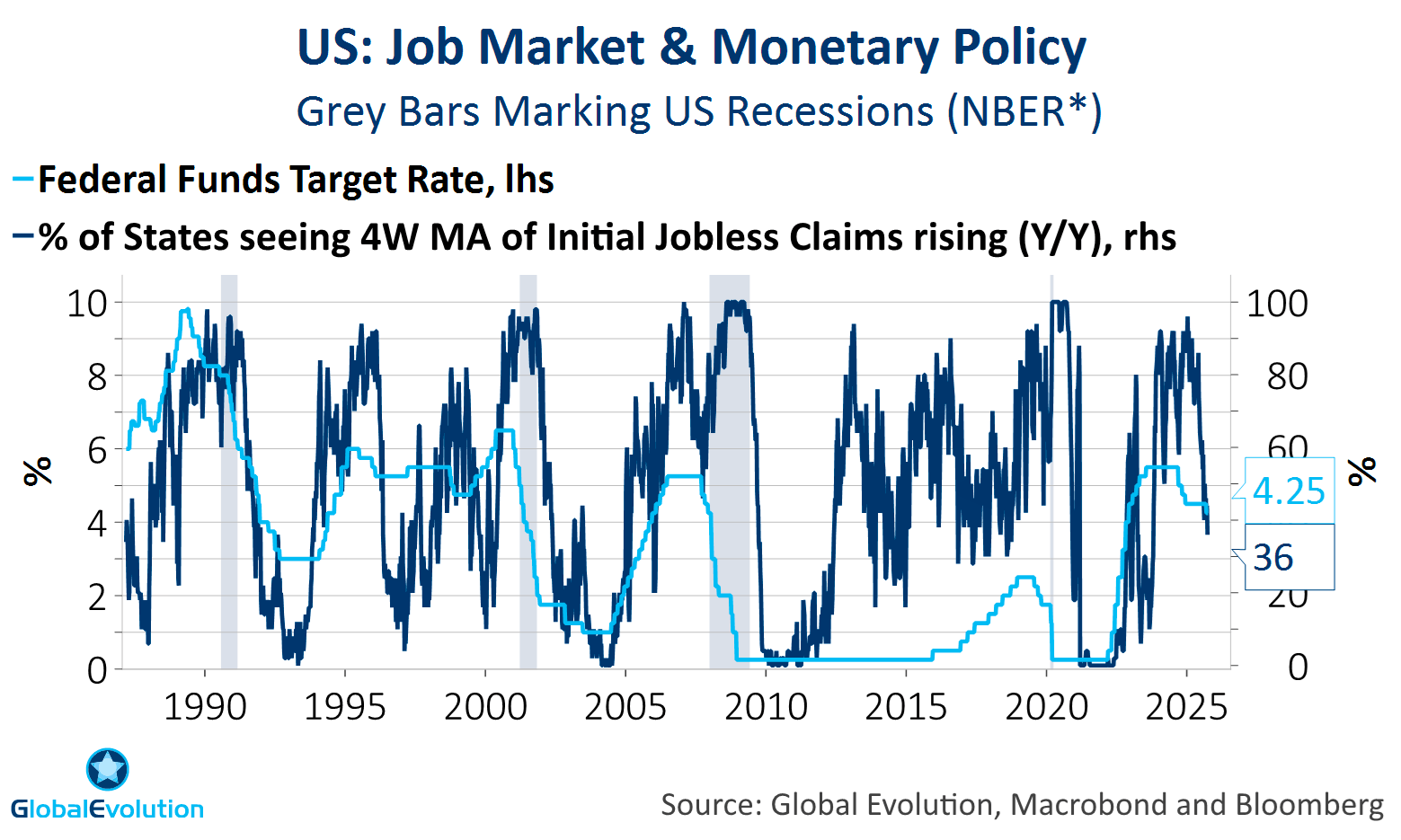

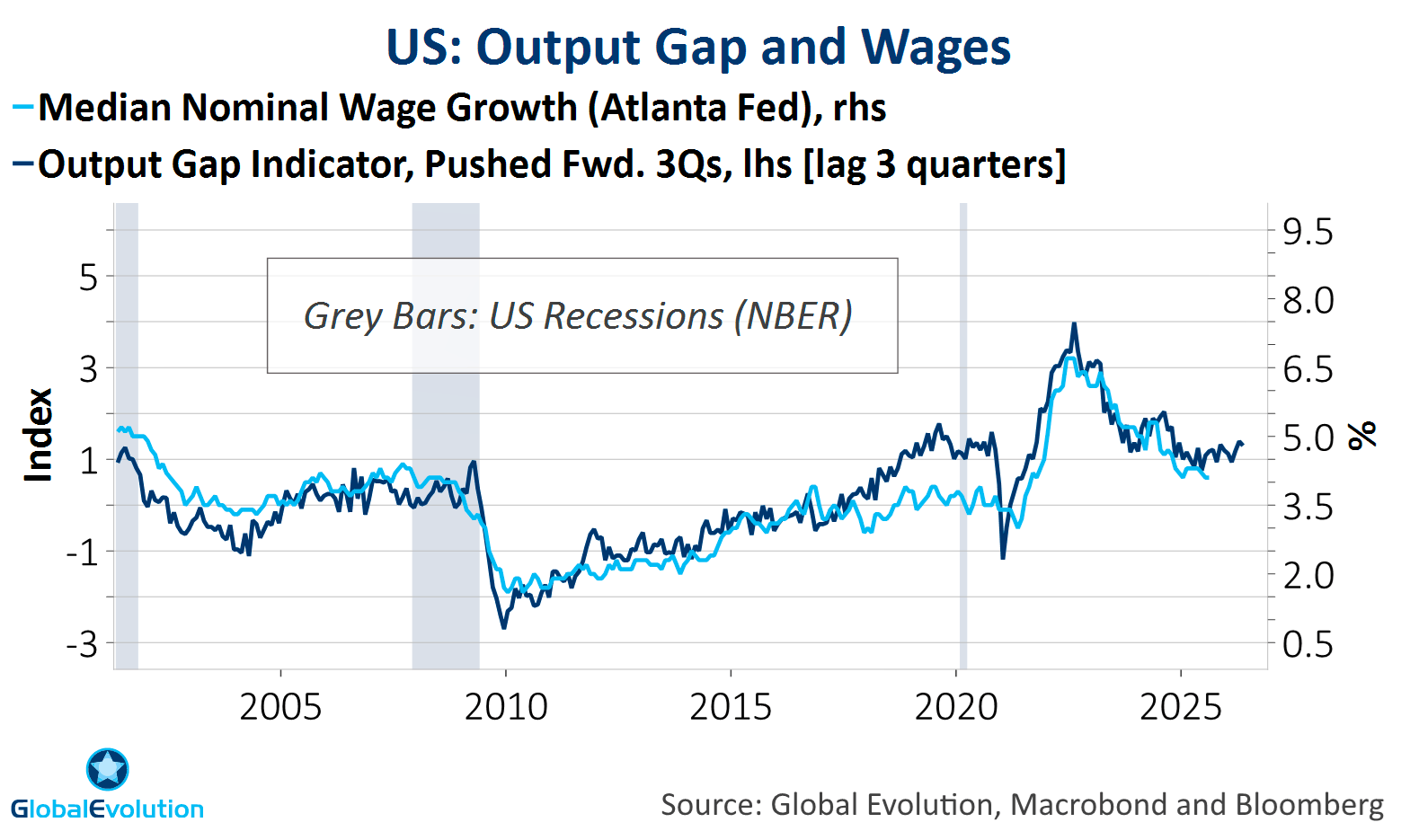

Mid-cycle upturn: Rather than extrapolating US labour market weakness into “recessionary reflexivity”, the latter might be as weak as it gets (LHS) as the economy exits a mid-cycle soft-patch. This rhymes with a stabilization of the outputgap (RHS).

Implications: Growth concerns are overblown…and monetary easing momentum is approaching a peak.

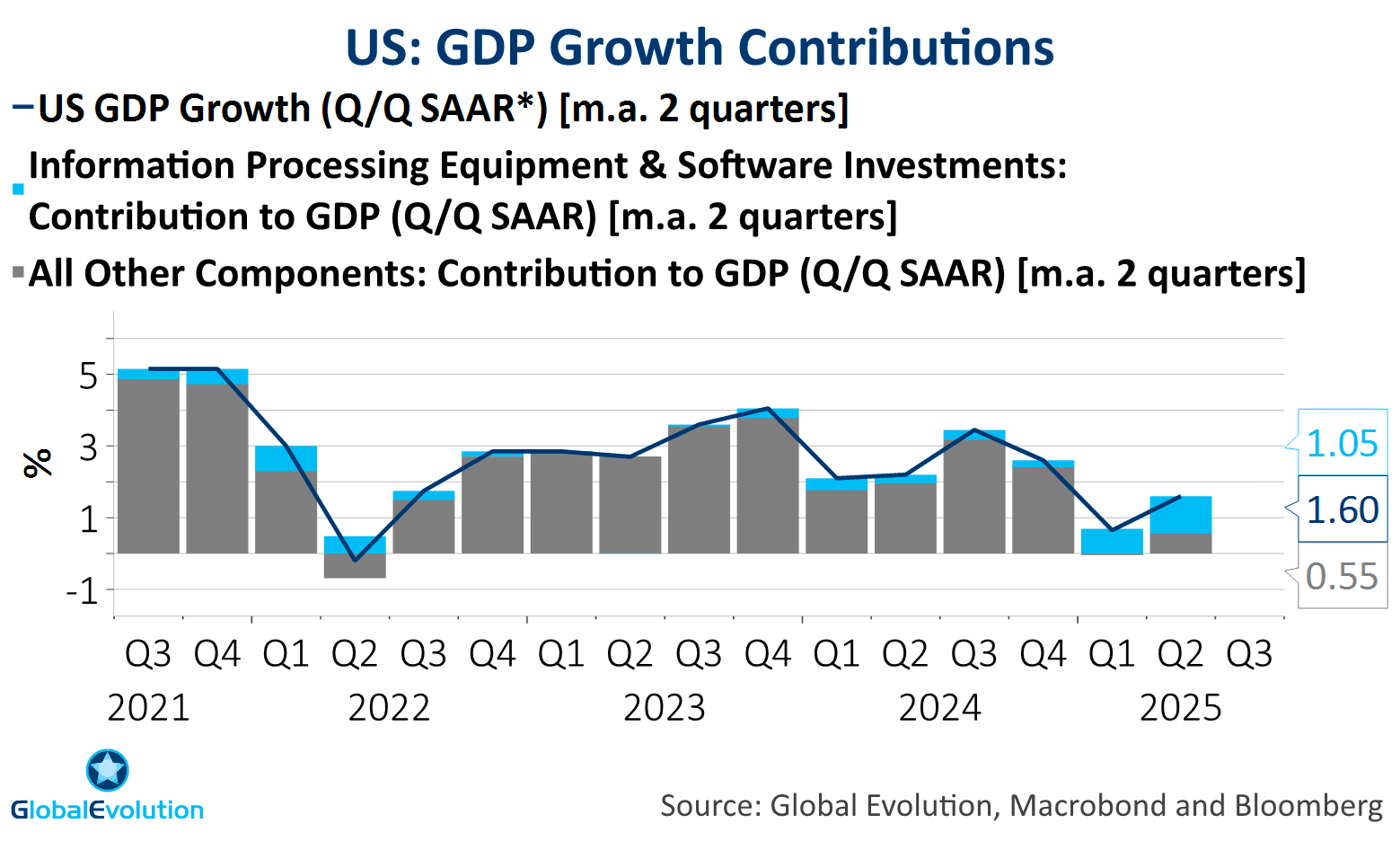

A little bit of US exceptionalism repeating: An AI investment boom has contributed significantly to H1 growth (RHS), US consumers are so far unimpressed by tariffs and US GDP estimates are being revised higher (RHS).

Atlanta Fed’s Nowcast model indicates 3-4% GDP growth (AR**).

**) AR: Annual rate

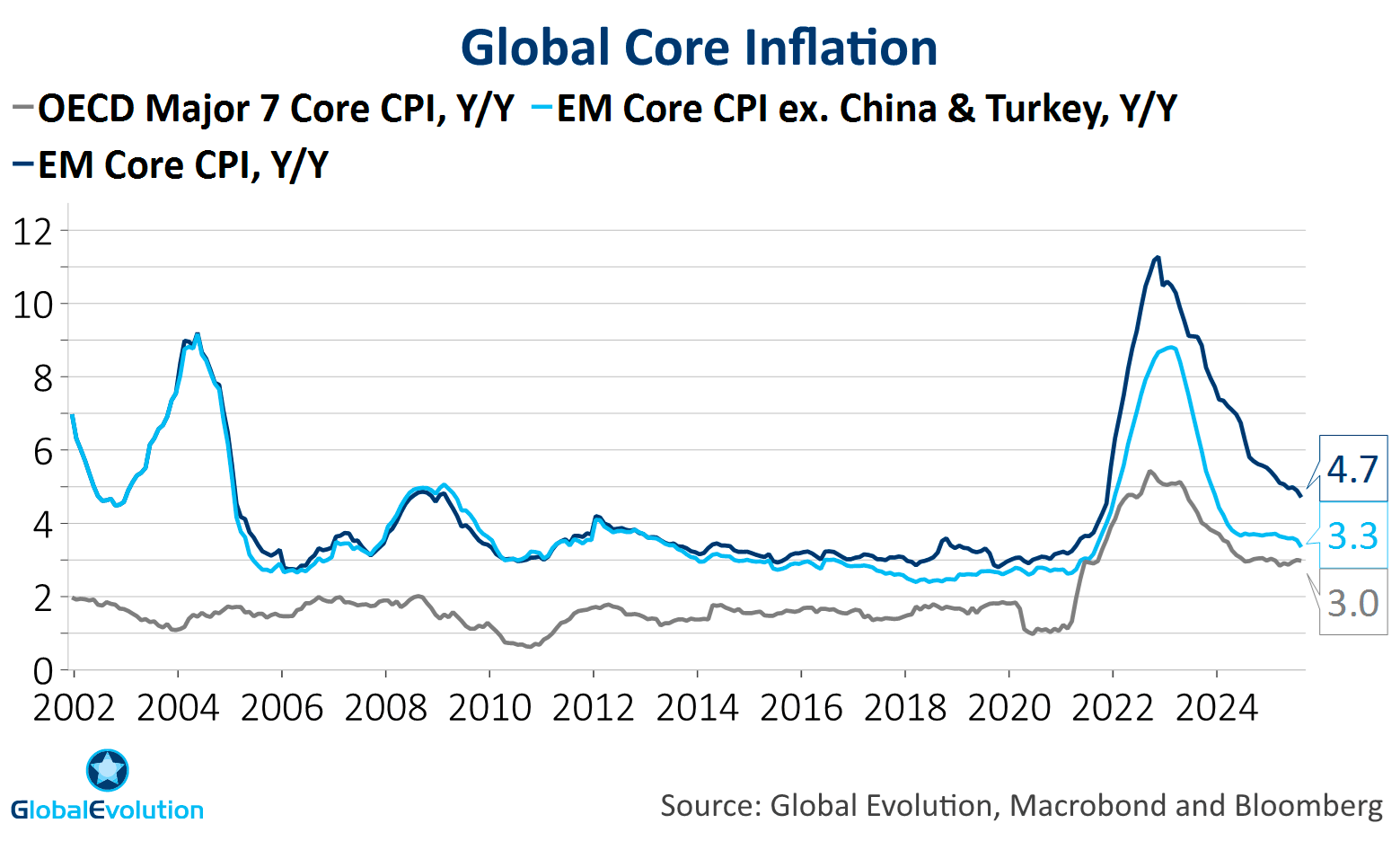

EM inflation continues to drift lower, while DM inflation is stagnating (EA) and accelerating in the US (LHS).

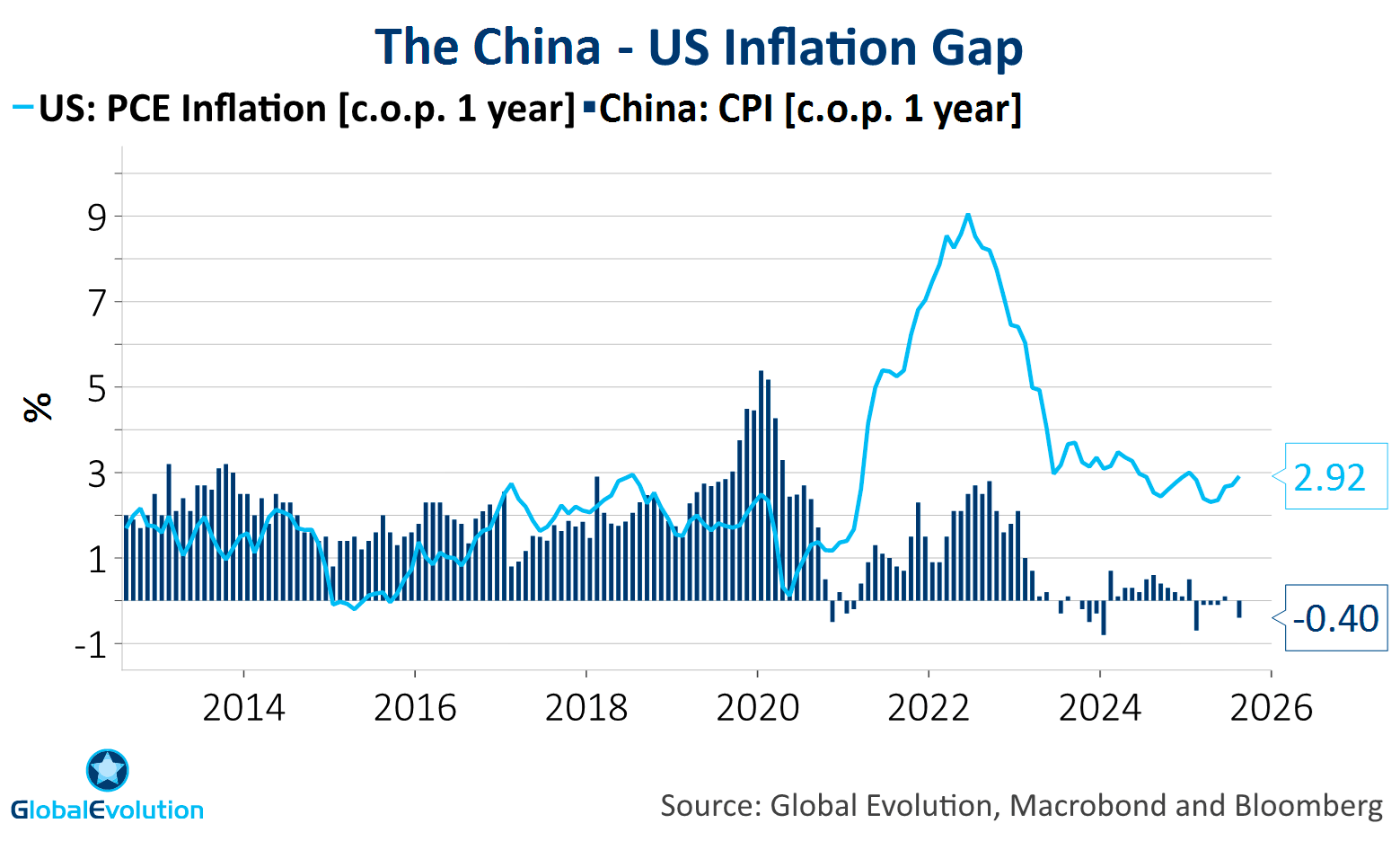

Disruptive divergence: Re-flation in the US, deflation in China (RHS)

→ As long as China is in deflation, it will be difficult to get consumption going.

→ China’s size relative to the US economy in current USD/market exchange rate terms (63%) is the same as it was in 2015.

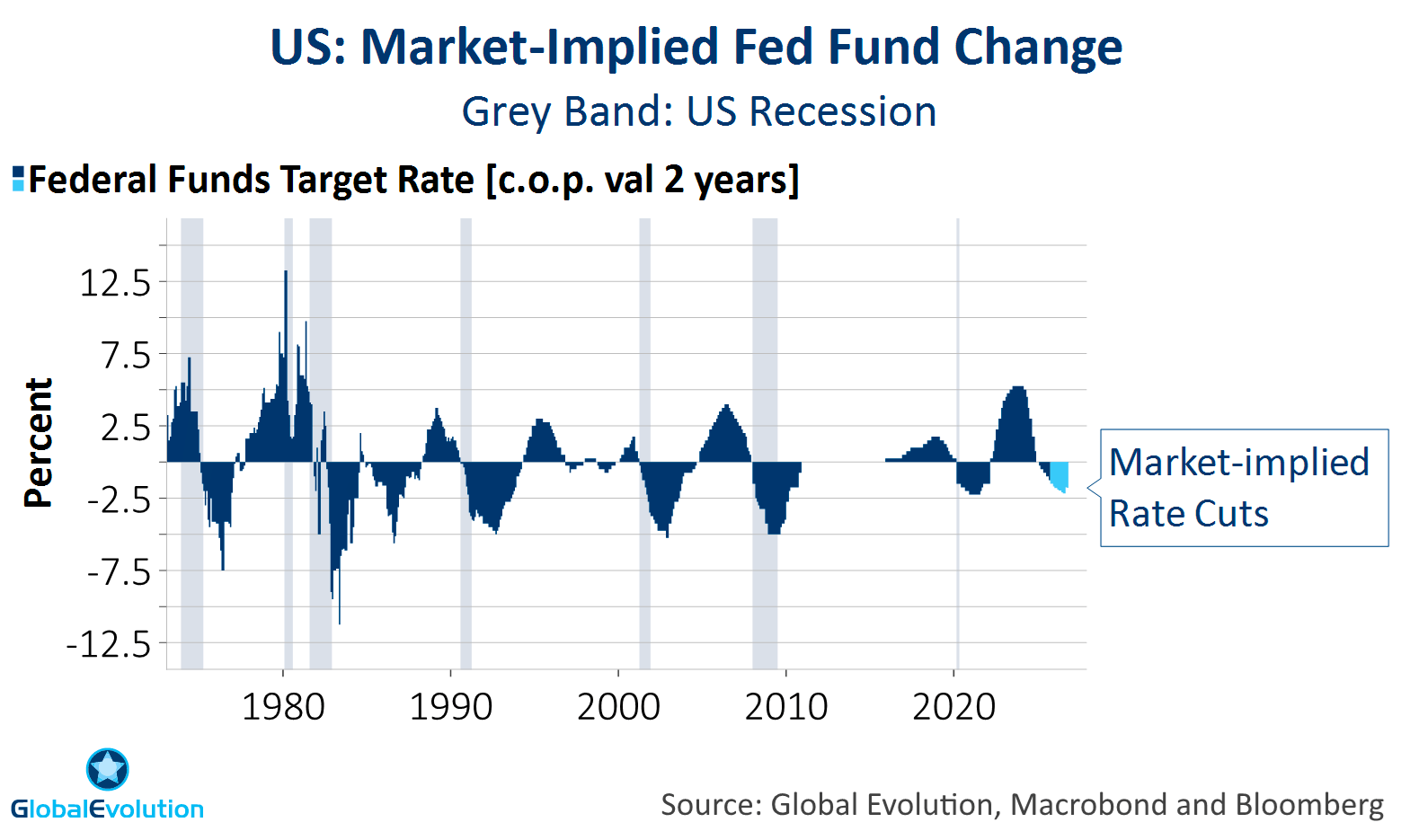

Amid US labour market weakness, Fed’s not done with its “insurance cuts”.

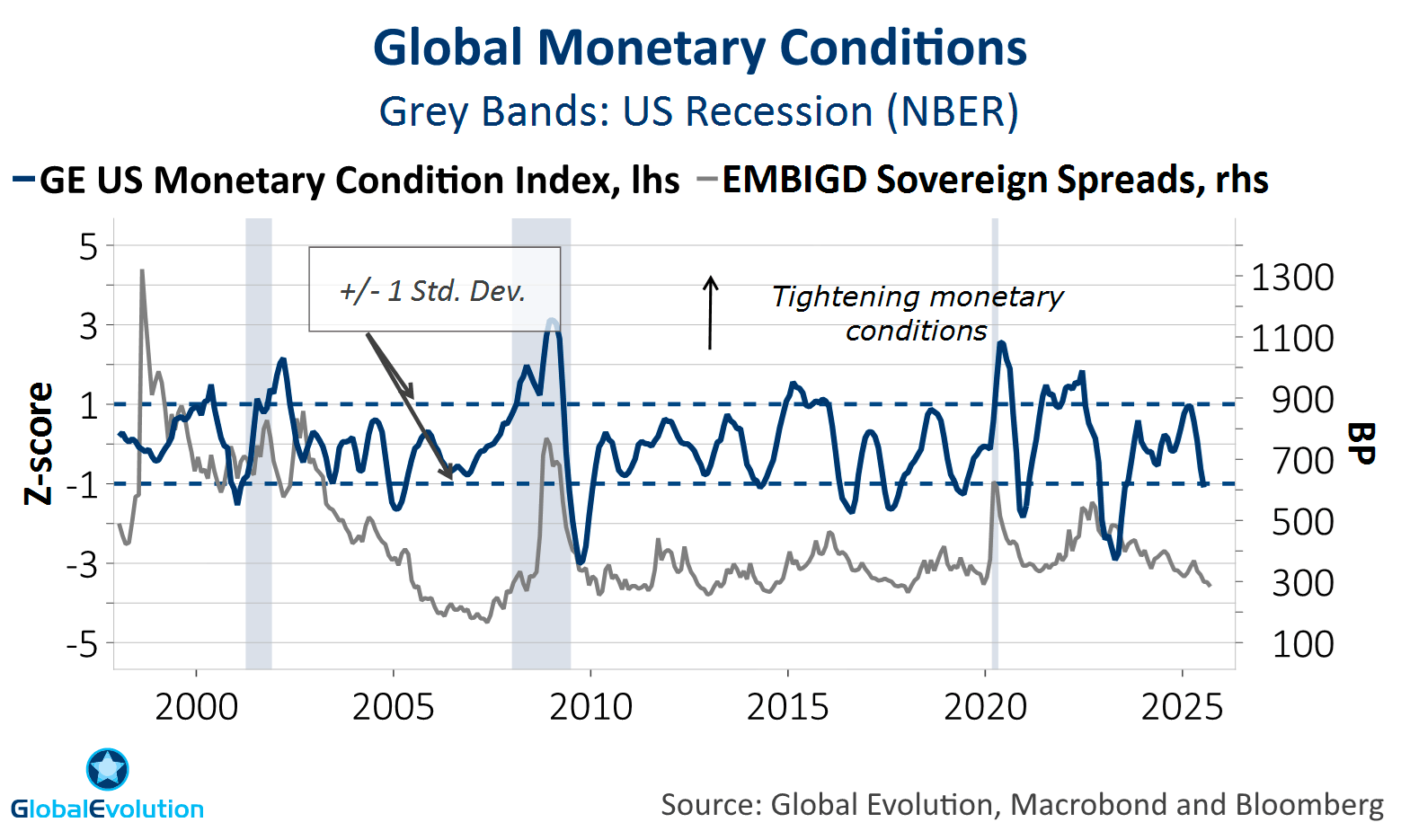

However, the market seems to have priced too many cuts. Current pricing is more reflective of a recessionary backdrop (LHS), which we don’t see. Monetary conditions are easing (RHS), but the pace of easing (impulse) is peaking.

Fed independence under threat: Acc. to YouGov Sep. survey*, inflation is the single biggest issue for US voters. Trump scores the poorest on inflation ahead of Mid-terms → beyond pure rhetoric we believe, White House pressure on the Fed should subside in 2026.

*) See link here.

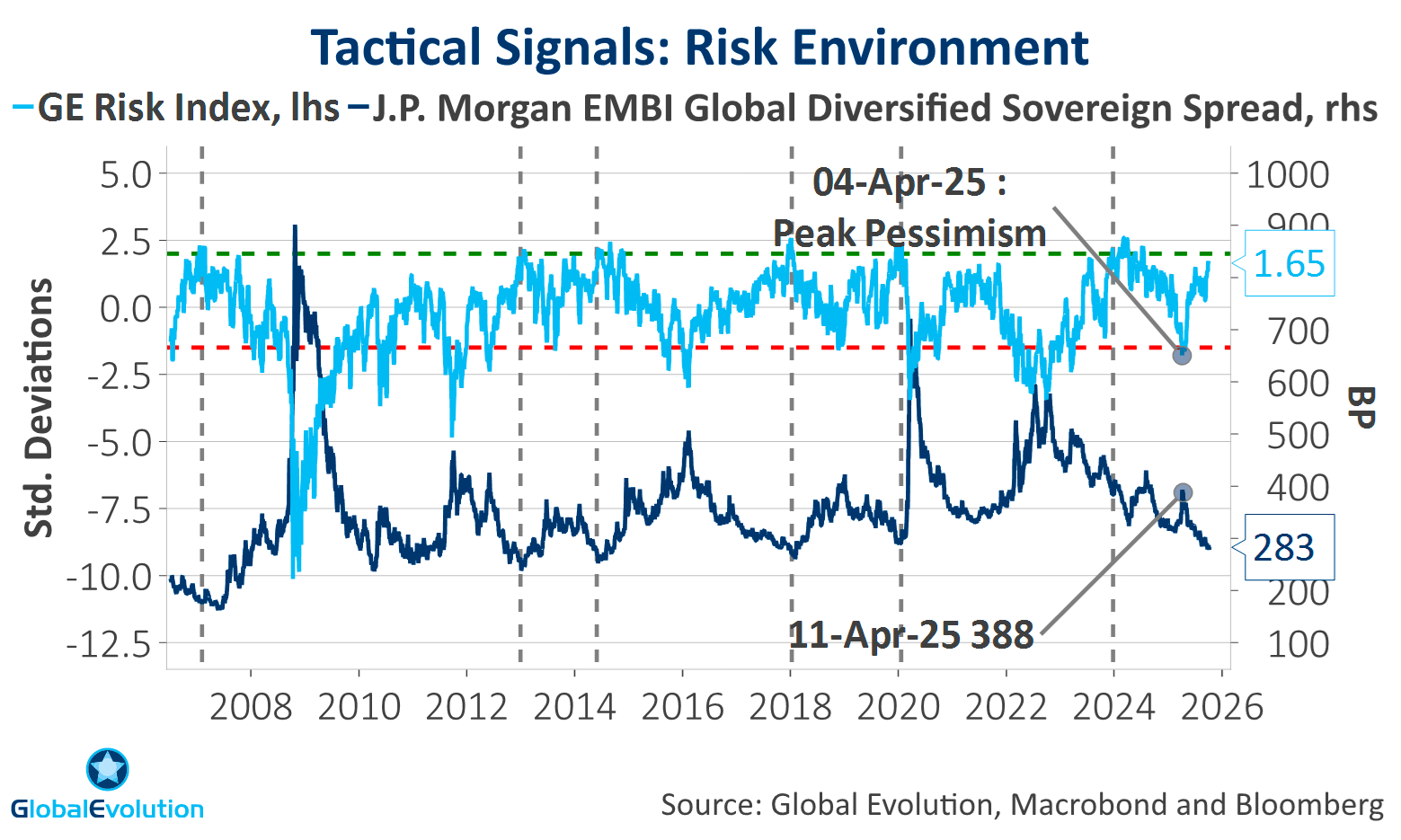

In April, our contrarian GE Risk Index triggered a positive signal for risk assets and for credit risk, in particular (peak pessimism, LHS).

Tactical signals point to limited risk of spread widening overshadowing carry as the main return driver for hard currency debt.

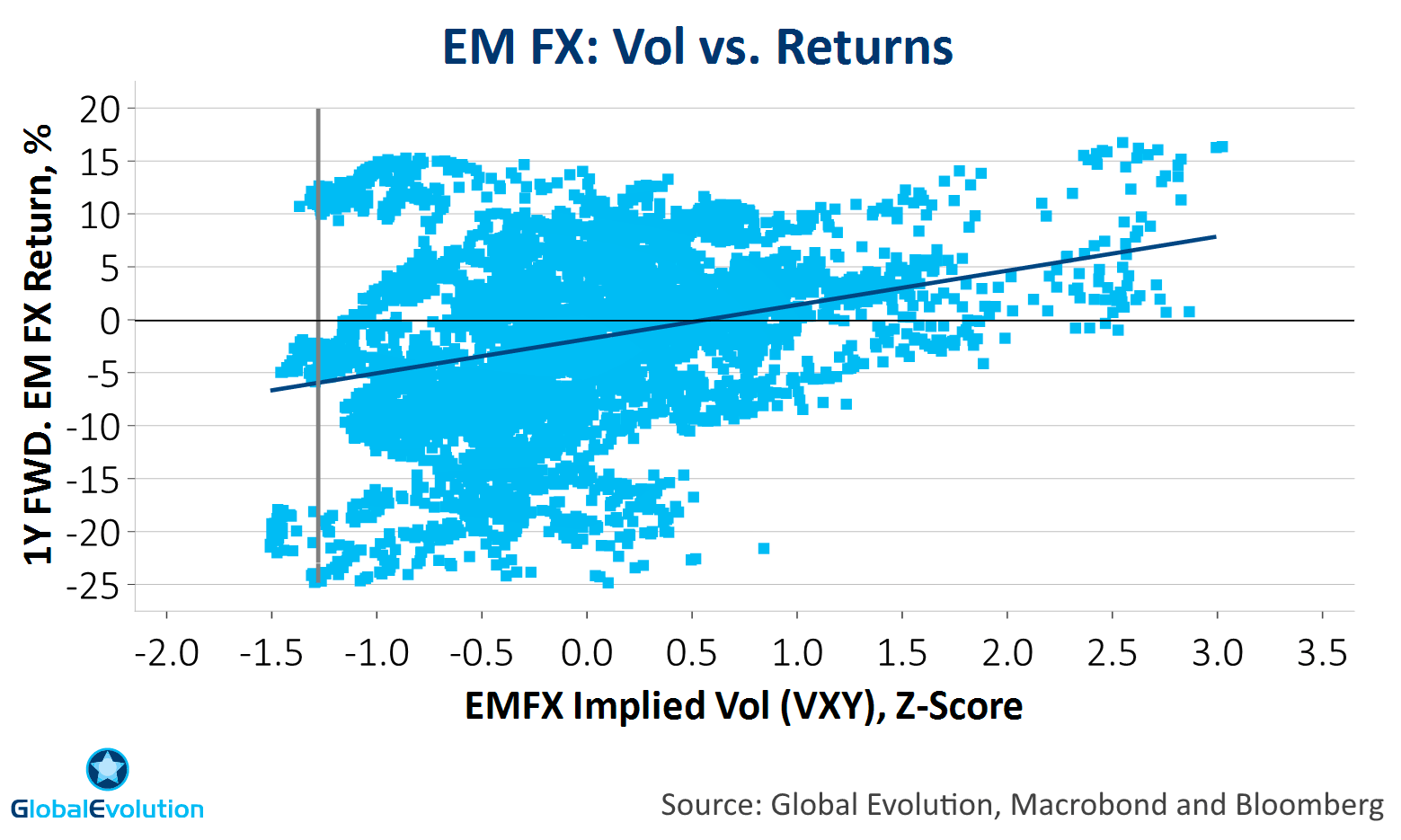

“Peak US exceptionalism” pausing, implied vol is historically low (RHS) → tactical downside risks to EM FX.

Rethink the narrative (I): While we believe local currency EMD will outperform longer term, we prefer hard currency EMD into year-end.

What to watch out for: Should the GE Risk Index surpass +2 std. dev., some spread widening in subsequent months has to be expected.

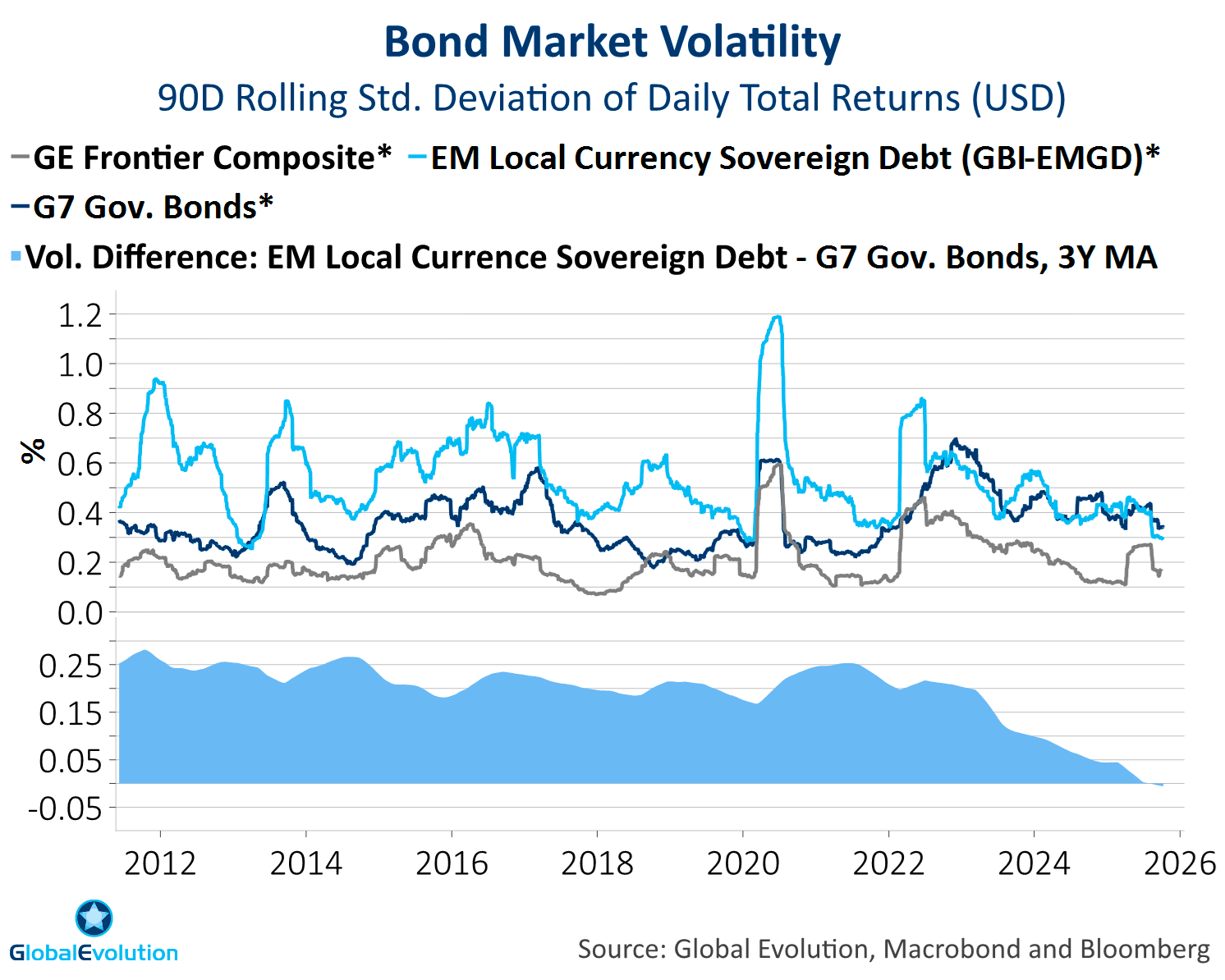

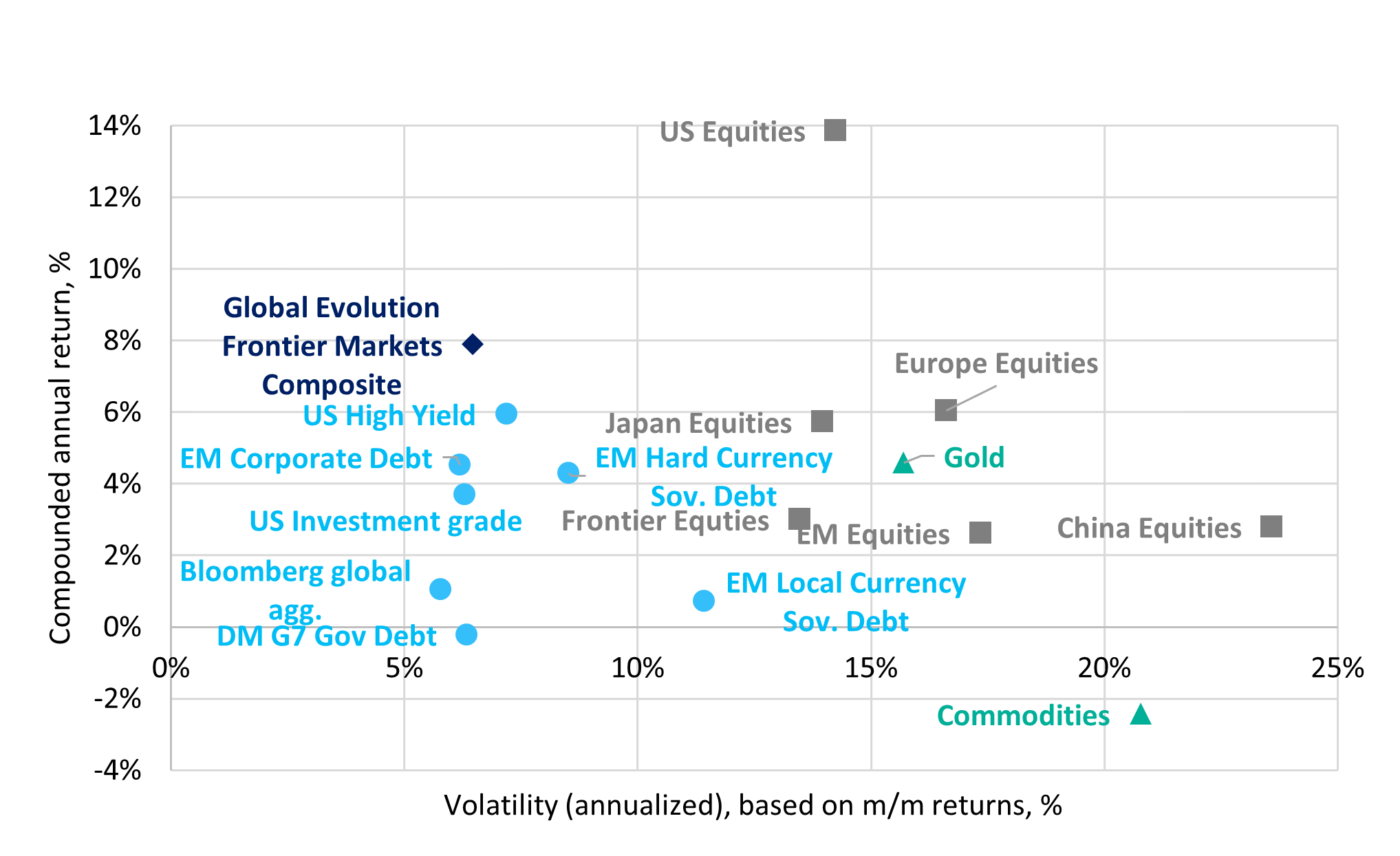

Rethink the narrative (II): Structural regime shifts (higher inflation, higher geopolitical uncertainty, fiscal largesse) are EM- driven

→ Impacting DM vol more than EM vol (LHS), improving the relative risk/reward of EM debt.

Upside potential: In particular, we expected EM Local Currency Debt to move north-west in the RHS diagram on the coming years.

Prepared by Global Evolution as of Sep. 29, 2025. Performance is calculated in USD, gross of fees. Performance is calculated in USD, gross of fees. Past performance is not indicative of future results. Strategy inception: Dec. 15, 2010. Please see the “GIPS Performance & Disclosure” for Frontier Markets Composite at the end of this document. . The data above is supplemental to the data contained therein and information on fees are present. All composite performance presented after December 31, 2024 is subject to final annual revision and re-calculation where the result will be adjusted due to changes in management fees, performance fee, custody fees and administration fees or non-material errors in pricing. Please see definitions page at the end of this document for clarification of indices.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Danish FSA (Finanstilsynet). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Management A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438.. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

This communication may contain aggregate peer analysis data has been obtained from eVestment Alliance LLC and its affiliated entities (collectively, "eVestment"). eVestment reserves all rights, including to ownership and distribution. eVestment collects information directly from investment management firms and other sources believed to be reliable; however, eVestment does not guarantee or warrant the accuracy, timeliness, or completeness of the information provided and is not responsible for any errors or omissions. Performance results may be provided with additional disclosures available on eVestment’s systems and other important considerations such as fees that may be applicable. Not for general distribution. * All categories not necessarily included; Totals may not equal 100%. Copyright 2013‐2024 eVestment Alliance, LLC. Returns less than a year are not annualized.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Legal Disclaimer ©2025 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved