Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Michael Nguyen

Lead of Quantitative Research

Witold Bahrke

Senior Macro and Allocation Strategist

US Election: High uncertainty, high impact

Trump or Harris? Either way, a change is coming in the White House with profound near-term impact on financial markets. EM fixed income will be no exception. Understandably, the market narrative is increasingly being dominated by the US which increasingly looks like a coin toss. Trump and Harris are running neck-and-neck in national polls. Betting markets[1] have swung in favour of a Trump victory. It is beyond our competence to make any qualified guess on the election result. Rather, the aim is to help EM bond investors navigating through the fog of political uncertainty over the coming weeks and months. We provide an election roadmap mapping the most relevant outcomes, key transmission channels worth monitoring and how it filters through to EMD returns.

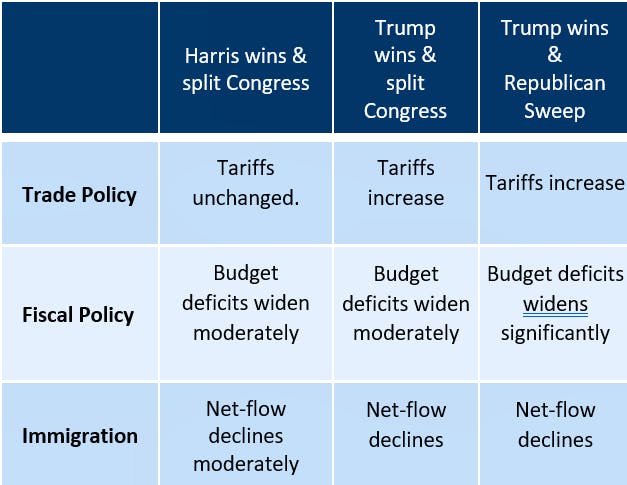

So how will the different election outcomes impact EM fixed income? To start with, let’s first have a look at what we believe are the most likely election results to consider. Especially from a fiscal perspective, the composition of the Congress is equally relevant as the presidential race, itself. For simplicity, we focus on three election outcomes on Nov. 5. and what they mean for EMD returns over a tactical horizon:

Harris wins, Congress is split between Republicans, Democrats

Trump wins, Congress is split between Republicans and Democrats

Trump wins, Republican majority in both the House of Representatives and the Senate (“Republican sweep”)

A Democratic sweep has been left out of the analysis. At the time of writing, there seems to be a high hurdle for Democrats to win both the race to the White House, the Senate (highest hurdle) and the House of Representatives. Betting markets attach a 43% probability to a Republican sweep, whereas a Democratic sweep carries a 14% probability according to Polymarket (see footnote). Consequently, we choose to limit our analysis to the three scenarios listed above.

Mapping election scenarios & transmission channels

In order to assess the market impact and how EM bond returns are likely to respond, three policy areas are particularly important in shaping market participant’s perception of the various election outcomes. It almost goes without saying that other areas like e.g. energy policy or international security policy could impact markets as well. However, the policy areas below should by far be most impactful from an EMD perspective. A word of caution is warranted, though: at this point in time, very little is known in terms of concrete measures or initiatives from both candidates within these areas. Consequently, this report delivers an assessment of what policies markets expect from each candidate rather than a subjective view of what the candidates end up actually implementing. After all, the former will define the short-term market reaction to any given election outcome, which is the focus of this report.

Trade policy: Neither Harris nor Trump are doves when it comes to trade. But whereas Harris is set to stick to the status quo, Trump has flagged his ambition to raise tariffs substantially if he comes to power with a universal tariff of 10% and up to 60% for selected Chinese imports, see also our previous note on Trump’s trade policy here. Also, Trump intends to use tariffs as a negotiation tool according to his aides. Altogether, trade policy is set to become more protectionist and a greater source of volatility under a Trump presidency, even without taking 2nd round effects in the shape of other countries tit-for-tat reaction into account. A Trump victory should therefore strengthen the US Dollar as it would limit US demand for products from the rest of the world. In addition, higher tariffs will increase inflation risks in the US, contributing to upward pressure on US yields. While not completely derailing the Fed’s rate cutting cycle, Trump’s trade policy has the potential to at least reduce the amount of rate cuts. Both Dollar strength and upside risk to US rates imply tighter monetary conditions than under a Harris-led White House. Add to this a negative real economic impact from a reduced EM exports to the US, it becomes a safe bet that a Trump presidency could be seen as negative from an EMD perspective. A Harris victory, on the other hand, would most likely imply a continuation of current policies, implying a more neutral impact from trade policy on EM bonds. Given the large degree of presidential power when it comes to trade policy, the composition of the Congress matters less than e.g. in a fiscal context.

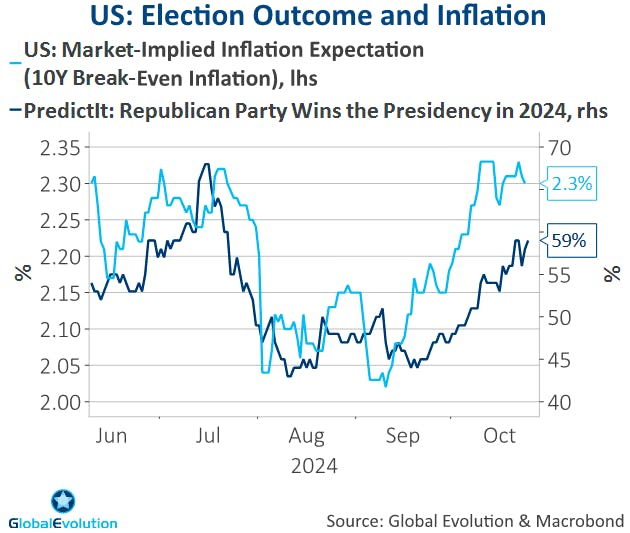

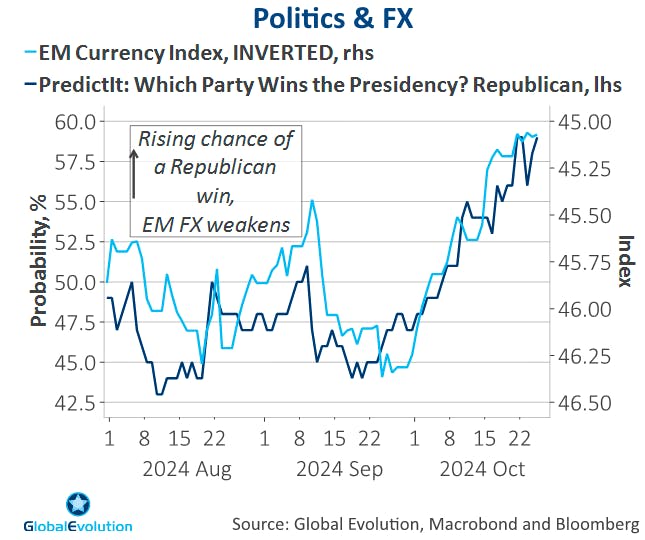

Fiscal policy: Neither candidate is likely to turn his back on the fiscal largesse of the post pandemic years. In other words, the risk to the budget deficit, currently running around 6% of GDP, remains biased to the upside. The main question therefore becomes who will be more expansionary. The key question from a fiscal perspective is whether Congress will be split between Democrats and Republicans or controlled by one party, only. The President’s room for fiscal maneuver is limited without the backing from Congress. Under a split congress, there will be little difference between fiscal trajectories as Congress would be able to block meaningful fiscal initiatives. High deficits would prevail together with reoccurring periods of uncertainty and liquidity bottlenecks around debt ceiling negotiations. All else being equal, any election outcome with a split congress should be seen as neutral from a market perspective. A Republican sweep scenario, on the other hand, would change the fiscal trajectory substantially. Trump would get green light to open the fiscal floodgates through tax cuts. Deficits are likely to rise. Fiscal concerns and inflation risk would drive US interest rates higher, potentially surpassing previous cycle highs. Some of these dynamics are already unfolding (see chart below).

While the US Dollar would be biased stronger, the appreciation potential should be limited by debt sustainability concerns. The net result would be reinvigorated monetary headwinds globally, hurting EM assets. While we have so far ignored a democratic sweep scenario, it would most likely look similar from a fiscal perspective, causing US yields to climb, as well. The USD appreciation should be less pronounced, though, as the fiscal expansion primarily would come in the shape of higher expenses and less via tax reductions, benefitting US assets less than a Republican sweep.

Immigration: While both fiscal and trade policy aspects have the potential to impact markets immediately, immigration is a long-term factor. There is an ongoing debate about how much immigration has boosted labour supply in the US, but a significant positive impact is beyond much doubt. Given Trumps ambition to strongly curb immigration, the net-flow of immigrants is expected to decrease substantially if Republicans take the White House. This would limit US labour force growth, creating an upside risk to wage inflation amid an already tight labour market. From an immigration standpoint, a Trump victory is therefore seen as the most inflationary outcome. This adds to the monetary tightening triggered by Trump’s trade policies.

Both candidates push an inflationary agenda. However, a Trump presidency should be seen as more inflationary and creates higher demand for US assets amid his appetite for lower corporate taxes. Another key difference is that inflation risks stemming from Trumps agenda are driven by supply side dynamics (immigration, tariffs), whereas Harris agenda tilts inflation risks towards the demand side. So, a Trump victory’s impact on inflation would be viewed as more long-lasting, pulling growth potential lower, as well. The following table summarizes market’s interpretation of election outcomes in terms of trade policy, fiscal policy and immigration.

Cut to the chase: 3 key take-aways

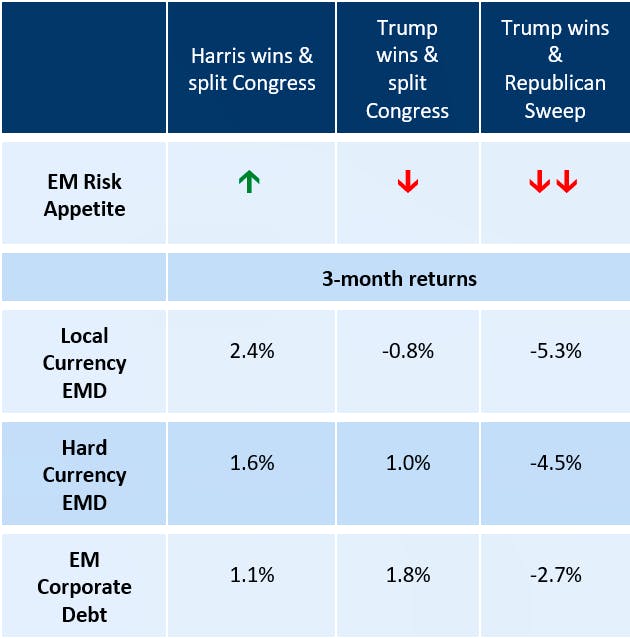

How do these policy scenarios translate into EMD returns? We take a two-step approach to address this question. First, we assess the impact on the US Dollar and US 10-year yields. These two metrics should give a good sense of how overall EM risk appetite will react. In the second step, the changes in these price metrics are used as input to our entropy pooling model, which identifies similar US rate and Dollar environments. Attaching higher weights to these episodes, the model generates modified return expectations for the main EM fixed income segments, shown in the table below.

Three conclusions stand out. Firstly, a Republican sweep would be the most negative short-term scenario for EM bonds, resulting in negative returns across the board, see table above. Significant headwinds from higher US yields on the back of fiscal deficit concerns would have a negative impact on hard currency EM bonds. At the same time, a stronger US Dollar driven by US protectionism and tax cuts benefits US corporate earnings (at least as a first-round effect) would undermine local currency EM debt returns. While we largely ignore the Democratic sweep scenario, it would trigger expectations of a fiscal expansion, driving US yields higher and EMD returns into negative territory. However, protectionism would be less of a concern, resulting in milder EM bond drawdowns than a Republican sweep.

Secondly, EM fixed income should thrive if Harris wins the White House race. By-and-large markets would view such a scenario as the status quo of key policies prevailing. Tariffs should be kept largely unchanged and budget deficits widen only marginally as a split congress would limit Harris’ fiscal wiggle-room. Add to this that the market already has priced a large chunk of the so-called “Trump trade”, EM bond investors should expect some relief.

Thirdly, both kind of Trump victories (split congress and Republican sweep) favour EM hard currency bonds over local currency bonds, with US Dollar strength being the common feature. Fiscal expansion and higher tariffs create inflation risks and upward pressure on US yields. Fed’s rate cutting cycle would be short-lived. Corporate tax cuts and deregulation causes US assets to be sought after, creating Dollar demand. Vice-versa, local currency EMD is set to outperform if Harris wins the presidential election, as tariffs are expected to be kept largely unchanged and corporate taxes could increase, limiting Dollar upside.

How to position: Buy the rumour, sell the fact?

Having mapped election scenarios, policy transmission channels as well as quantified their market impact, a key question to ask is what scenario markets are pricing at the current juncture. US yields have been rising, the US Dollar is on a tear (see chart below), EM bond returns are in the red in October. Comparing with our estimates of the short-term market impact of the main election scenarios, this suggests that the market is pricing a scenario somewhere between a Trump victory with a split congress and a Republican Sweep. The upshot is that a Harris victory would bring short-term relief to EM bonds.

So, markets seem to front run a Trump victory, potentially triggering a “buy the rumour, sell the fact” dynamic in the immediate aftermath of the election. A Trump win - somewhat counterintuitively - could therefore lead to a decline in yields and the US Dollar in the immediate aftermath of the election. The risk to the estimated returns in the two Trump victory scenarios is probably to the upside. Finally – absent the non-negligible scenario of a contested election – the sheer fact that uncertainty decreases after Nov. 5th could also cause the initial market reaction to tilt more positively than indicated by the above table.

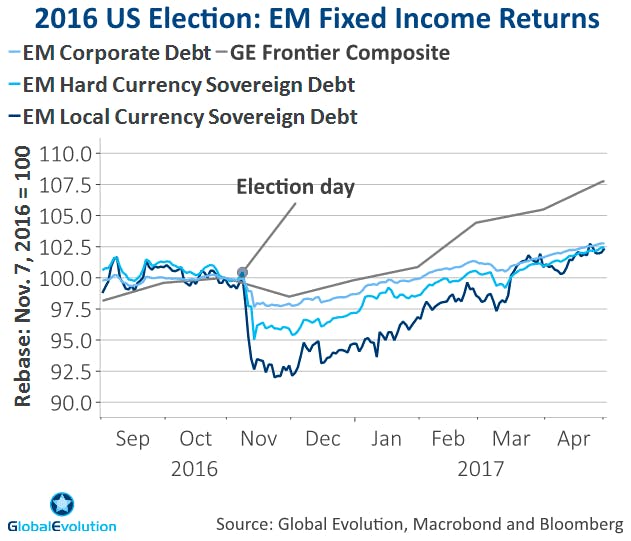

So how to position amid overwhelming election uncertainty? The optimal allocation is obviously highly dependent on the subjective probabilities attached to each election scenario. At this stage we resist the temptation of guessing election results, moving our EMD asset allocation between hard, local and corporate debt closer to neutral. All being said, outside the main EMD segments, Frontier Markets provides a somewhat overlooked diversification opportunity. In fact, Frontier Markets should perform well under most election scenarios, shielding against political risks. Frontier Markets are less correlated with global risk factors compared to the main EM bond indices. Case in point, the initial drawdown around the 2016 US election relatively muted in Frontier Markets (chart below). Even during periods of rising rates, the asset class has shown outstanding risk-reward prospects, significantly outperforming other fixed income segments. In other words, particularly in a sweep scenario, EM Frontier Markets should be well positioned to cope with rising US yields.

When the fog lifts

Finally, it is worth recalling the 2016 election. Although the reaction in Emerging Market fixed income was negative in the immediate aftermath of the election, the subsequent months turned out to be positive for Emerging Market bonds. Hence, we emphasize that the above analysis centers around the short-term impact of the election (3 months). Longer-term, global macro fundamentals will be the dominant driver of EMD returns. As we see recession odds decline and monetary conditions ease, these fundamentals provide fertile ground for EM fixed income and a come-back of EM local currency bonds once the fog around the US elections has lifted. Ultimately, culminating election uncertainty might therefore provide an attractive entry point for EM bond investors.

[1] See .e.g. Polymarket | Balance of Power: 2024 Election and 2024 Presidential Election Predictions & Odds | Who will be the next president? Betting markets are being used to show where results are trending but are not indicative of actual results.

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“GEAM”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). GEAM DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

GEAM has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under FCA # 954331. In Canada, while GEAM has no physical place of business, it has filed to claim the international dealer exemption and international adviser exemption in Alberta, British Columbia, Ontario, Quebec and Saskatchewan.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), a Securities and Exchange Commission (“SEC”) registered investment advisor. Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is a wholly owned subsidiary of Global Evolution Financial ApS, the holding company of GEAM. Portfolio management and investment advisory services are provided to GE USA clients by GEAM. GEAM is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd (“Global Evolution Singapore”) has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

GEAM, Global Evolution USA, and Global Evolution Singapore, together with their holding companies, Global Evolution Financial Aps and Global Evolution Holding Aps, make up the Global Evolution group affiliates (“Global Evolution”).

Global Evolution, Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, and Pearlmark Real Estate, L.L.C. and its subsidiaries are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. Conning has investment centers in Asia, Europe and North America.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, PREP Investment Advisers, L.L.C. and Global Evolution USA, LLC are registered with the SEC under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities.

Conning, Inc. is also registered with the National Futures Association. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is Authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316); Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities; Global Evolution Asset Managment A/S is regulated by Finanstilsynet (the Danish FSA) (FSA #8193); Global Evolution Asset Management A/S (London Branch) is regulated by the United Kingdom's Financial Conduct Authority (FCA# 954331); Global Evolution Asset Management A/S, Luxembourg branch, registered with the Luxembourg Company Register as the Luxembourg branch(es) of Global Evolution Asset Management A/S under the reference B287058. It is also registered with the CSSF under the license number S00009438. Conning primarily provides asset management services for third-party assets.

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this communication constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk, and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, and credit.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved