Dear visitor

You tried to access but this page is only available for

You tried to access but this page is only available for

Witold Bahrke

Senior Macro and Allocation Strategist

Taking stock: Is Trump 2.0 priced?

US voters have made their choice. The nation’s politics will undergo a seismic shift in 2025 as Republicans won the trifecta of White House, Senate and House of Representatives. From an EM debt (EMD) investor perspective, we believe the most important consequences will be more restrictive trade and immigration policies, while fiscal policy is set to remain loose (as per our election roadmap).

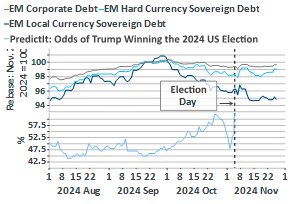

Financial markets, and EMD in particular, have repriced accordingly. In fact – and admittedly with a tiny bit of hindsight - markets already started pricing in a Trump victory in the second half of September when his odds of winning the election began to rise in earnest (see figure 1). Since then, EM currencies have sold off by roughly 5 percent and 10-year US Treasury yields climbed from 3.75 percent to almost 4.50 at their post-election peak. In total-return terms, EM fixed income unsurprisingly saw losses with local currency bonds particularly hard hit, suffering a drawdown of more than 5 percent since September 20.

Still, the drawdown in local currency EMD almost exactly matches what we envisioned under such an election outcome. This begs the question of whether Trump 2.0 is already priced into local currency EM sovereign bonds. History offers scant evidence of this kind of political shift, but in light of the marketreaction, we lean toward a ‘yes’ – at least from a short-term pricing perspective.

Policy direction set - destination unknown

Medium term, it almost goes without saying that politics and policies will decide whether value has emerged in parts of EMD. The underlying assumption is that the global economy remains robust and a recession will be avoided. When assessing the path forward of US politics, there’s little doubt about its direction over the coming four years; it’s widely expected by market participants that trade and immigration policies will become more restrictive. Therefore, it will be the destination, i.e., how restrictive US policies will end up being, that defines whether we have medium-term buying opportunity in segments that have sold off the most.

It might take a while for investors to identify the destination of fiscal and immigration policy. Trade policies, on the other hand, might change soon after Trump’s January 20 inauguration as the president has considerable discretion over tariffs. Economically speaking, the impact on inflation will be felt rather quickly. Among the three key policy areas identified in our election roadmap, trade restrictions are also likely to have the greatest impact on the rest of the world.

The other key policy areas are also important but are more relevant when looking beyond the tactical horizon. The economic impact will likely take longer to play out. Meaningful fiscal policy adjustments, for instance, require budget reconciliation, i.e., backing from Congress, and are not immune to filibustering[1] due to a slim Republican majority in the Senate. In the same vein, reduced employment growth due to immigration curbs or even outright deportation will lower growth and lift inflation over the medium term rather than have any significant short-term impact on the key macro variables. This is not to say that markets won’t make attempts to price in fiscal and immigration policies. Still, trade policy might be a clearer signpost for the destination US politics under Trump 2.0.

How hard will Trump’s tariffs hit the global economy? On the campaign trail, he warned about 10% extra tariffs on imported products and up to 60% on Chinese goods. However, it is our belief that the bark is worse than the bite. There are good reasons to believe Trump’s trade policies will be less harmful to the rest of the world than what was postulated during his campaign.

Trump’s tariff conundrum

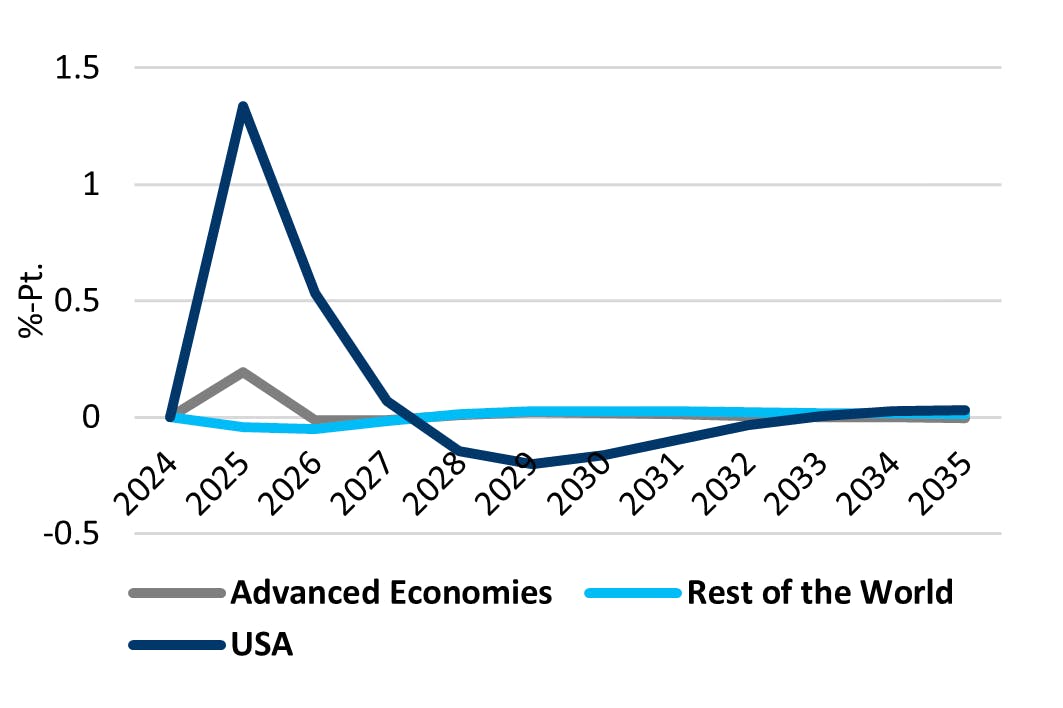

Why is that? First and foremost, Trumps policies are inherently inconsistent with his mandate from voters to reduce inflation. Figure 2 illustrates how inflation could increase as a consequence of 10% extra tariffs on imported goods, including the realistic assumption of retaliation from other countries. According to the calculations from the Peterson Institute of International Economics, US inflation will be boosted by more than 1 percentage point in 2025. We consider this scenario not to be far-fetched as it does not even include the 60% tariffs on Chinese imports Trump aired during his election campaign.

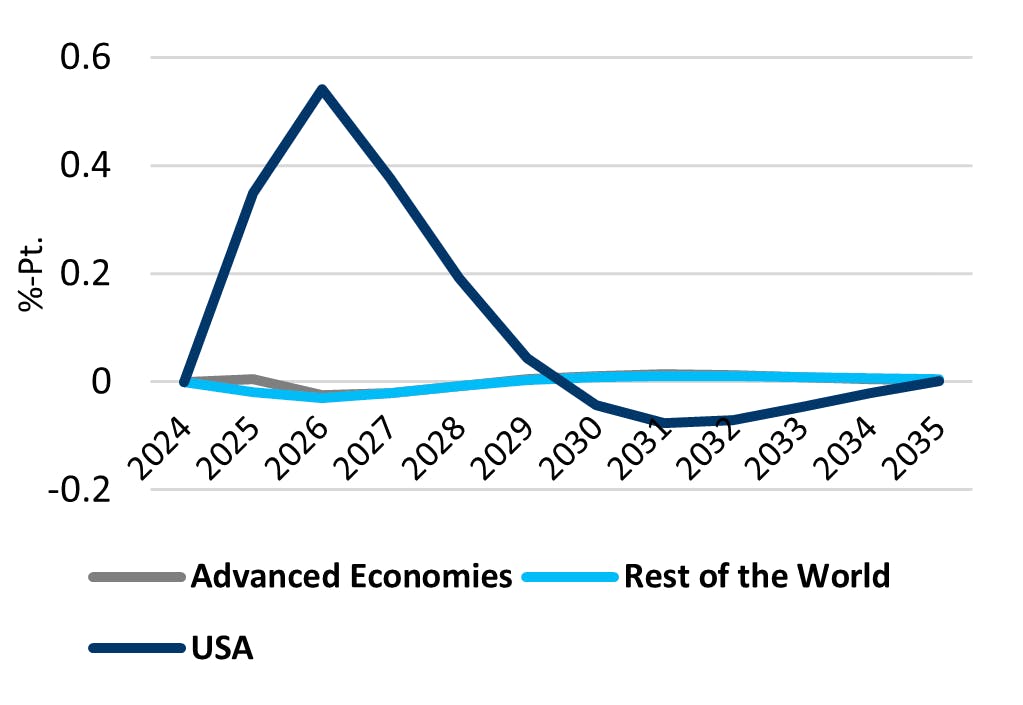

The picture would have looked even worse if immigration policies were added to the mix. While less important from a short-term perspective, immigration has a crucial role to play in defining the medium-term path of inflation. As illustrated in figure 3, the initial impact of deportation of unauthorized immigrants is muted, but it has longevity. This contrasts with the inflationary impact of tariff policy, which according to the model calculation is more hefty but also more short-lived as it approaches zero from 2027 onwards.

The simulations highlight inconsistencies between Trump’s tariff push and his mandate from voters to curb inflation. To solve this conundrum, in our opinion trade restrictions will in all likelihood turn out to be less severe than feared. Therefore, we believe 10% across the board tariffs and 60% tariffs on Chinese goods are unlikely to see the light of day during Trump 2.0. By the way, a more benign tariff scenario would be perfectly in line with Team Trump’s ambition to use tariffs as a negotiation tool. So qualitatively, there’s little doubt that the new US government moves in the direction indicated during the election campaign. Quantitatively, we have strong doubts that things will become as bad as postulated.

How to navigate the post-election landscape

If our analysis is right, value has emerged in the realm of EM fixed income but at the same time uncertainty and volatility will remain high. So how to position portfolios for the opportunities and challenges of such a post-election investment landscape?

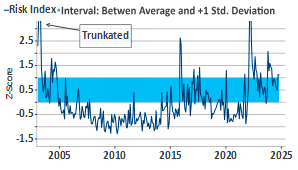

Firstly, the election-related market action has created attractive entry points in parts of EMD. This is especially the case with very limited recession risks in the coming quarters. More concretely, we believe a buying opportunity has emerged in local currency EM debt. As depicted in figure 1 and explained above, this segment faced the biggest drawdown and the initial “red sweep” shock is likely priced in. Combined with our expectation that trade headwinds from Trump’s protectionist policies will turn out to be less harmful than feared, local currency EMD stands out to be the main winner of reduced uncertainty in the aftermath of the US election. If Trump’s first-term presidential period serves as a blueprint, geopolitical noise and headline risk will remain elevated during his presidency. This should result in geopolitical risk indices (please see figure 4) to settle above their historical average, but avoiding extreme readings as we saw in 2015 or 2022. Under Trump 2.0, we expect geopolitical risks to fluctuate in the lower part of the light blue band shown below in figure 4.

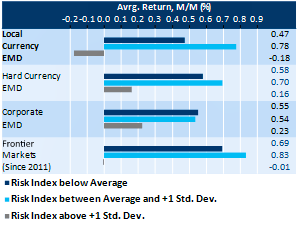

In such regimes of high - but not extreme - readings of geopolitical risks, local currency EM sovereign bonds have actually outperformed the other main segments of the EMD universe with the notable exception of Frontier debt (see figure 5). From a valuation perspective, local currency EM sovereign bonds are close to their fundamental fair value. Hard currency EM sovereign bonds meanwhile still appear expensive relative to fundamentals and their own history.

Within the local currency universe, Latin American and Eastern European countries look particularly attractive. The former have a relatively low correlation to core yields, reducing vulnerabilities to lingering inflation risks. The latter are closely correlated with the euro which seems oversold at current levels.

Secondly, investors should emphasize flexibility. Elevated uncertainty about the ultimate destination of US politics and lingering inflation risks should result in more frequent swings in the asset return cycle. It is hard to argue that Trump’s policies won’t add to a deteriorating growth/inflation trade-off over the coming years. Fiscal policy will stay lose and labour supply is under pressure from immigration curbs in the context of a US economy that already runs very close to full capacity.

The consequence is a shortening of the monetary easing cycles as inflation remains very responsive to any kind of stimulus, be it fiscal or monetary. Shorter monetary cycles should be reflected in shorter market cycles. Together with persistently high geopolitical uncertainty, such a tactical market environment calls for a dynamic asset allocation overlay in EM fixed income portfolios. The ability to actively allocate between the various EMD segments in blended strategies should reduce drawdown risk and volatility.

[1] “A filibuster is a political procedure in which one or more members of a legislative body prolong debate on proposed legislation so as to delay or entirely prevent a decision.” Source: Wikipedia

Disclaimer & Important Disclosures

Global Evolution Asset Management A/S (“Global Evolution DK”) is incorporated in Denmark and authorized and regulated by the Finanstilsynets of Denmark (the “Danish FSA”). Global Evolution DK is located at Buen 11, 2nd Floor, Kolding 6000, Denmark.

Global Evolution DK has a United Kingdom branch (“Global Evolution Asset Management A/S (London Branch)”) located at Level 8, 24 Monument Street, London, EC3R 8AJ, United Kingdom. This branch is authorized and regulated by the Financial Conduct Authority under the Firm Reference Number 954331.

In the United States, investment advisory services are offered through Global Evolution USA, LLC (‘Global Evolution USA”), an SEC registered investment advisor. Registration with the SEC does not infer any specific qualifications Global Evolution USA is located at: 250 Park Avenue, 15th floor, New York, NY. Global Evolution USA is an wholly-owned subsidiary of Global Evolution Asset Management A/S (“Global Evolution DK”). Global Evolution DK is exempt from SEC registration as a “participating affiliate” of Global Evolution USA as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use investment advisory resources of non-U.S. investment adviser affiliates subject to the regulatory supervision of the U.S. registered investment adviser. Registration with the SEC does not imply any level of skill or expertise. Prior to making any investment, an investor should read all disclosure and other documents associated with such investment including Global Evolution’s Form ADV which can be found at https://adviserinfo.sec.gov.

In Singapore, Global Evolution Fund Management Singapore Pte. Ltd has a Capital Markets Services license issued by the Monetary Authority of Singapore for fund management activities. It is located at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Global Evolution is affiliated with Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker dealer, Conning Asset Management Limited, Conning Asia Pacific Limited and Octagon Credit Investors, LLC are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has offices in Boston, Cologne, Hartford, Hong Kong, London, New York, and Tokyo.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940 and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. Conning, Inc. is also registered with the National Futures Association and Korea’s Financial Services Commission. Conning Investment Products, Inc. is also registered with the Ontario Securities Commission. Conning Asset Management Limited is authorised and regulated by the United Kingdom's Financial Conduct Authority (FCA#189316), Conning Asia Pacific Limited is regulated by Hong Kong’s Securities and Futures Commission for Types 1, 4 and 9 regulated activities

This publication is for informational purposes and is not intended as an offer to purchase any security. Nothing contained in this website constitutes or forms part of any offer to sell or buy an investment, or any solicitation of such an offer in any jurisdiction in which such offer or solicitation would be unlawful.

All investments entail risk and you could lose all or a substantial amount of your investment. Past performance is not indicative of future results which may differ materially from past performance. The strategies presented herein invest in foreign securities which involve volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging and frontier markets. Derivatives may involve certain costs and risks such as liquidity, interest rate, market and credit.

This communication may contain Index data from J.P. Morgan or data derived from such Index data. Index data information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

While reasonable care has been taken to ensure that the information herein is factually correct, Global Evolution makes no representation or guarantee as to its accuracy or completeness. The information herein is subject to change without notice. Certain information contained herein has been provided by third party sources which are believed to be reliable, but accuracy and completeness cannot be guaranteed. Global Evolution does not guarantee the accuracy of information obtained from third party/other sources.

The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This document does not constitute investment advice. The contents of this document represent Global Evolution's general views on certain matters, and is not based upon, and does not consider, the specific circumstance of any investor.

Legal Disclaimer ©2024 Global Evolution.

This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Global Evolution, as applicable.

Copyright © 2026 Global Evolution - All rights reserved